Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

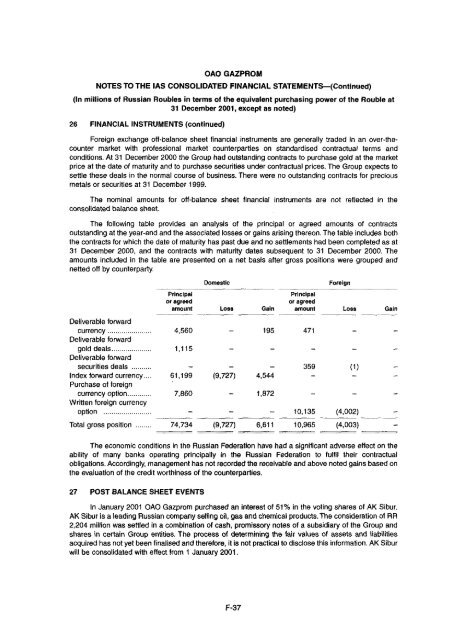

OAO GAZPROMNOTES TO THE IAS CONSOLIDATED FINANCIAL STATEMENTS—(Continued)(In millions of Russian Roubles in terms of the equivalent purchasing power of the Rouble at31 December 2001, except as noted)26 FINANCIAL INSTRUMENTS (continued)Foreign exchange off-balance sheet financial instruments are generally traded in an over-thecountermarket with professional market counterparties on standardised contractual terms andconditions. At 31 December 2000 the Group had outstanding contracts to purchase gold at the marketprice at the date of maturity and to purchase securities under contractual prices. The Group expects tosettle these deals in the normal course of business. There were no outstanding contracts for preciousmetals or securities at 31 December 1999.The nominal amounts for off-balance sheet financial instruments are not reflected in theconsolidated balance sheet.The following table provides an analysis of the principal or agreed amounts of contractsoutstanding at the year-end and the associated losses or gains arising thereon. The table includes boththe contracts for which the date of maturity has past due and no settlements had been completed as at31 December 2000, and the contracts with maturity dates subsequent to 31 December 2000. Theamounts included in the table are presented on a net basis after gross positions were grouped andnetted off by counterparty.DomesticForeignPrincipalPrincipalor agreedor agreedamount Loss Gain amount Loss GainDeliverable forwardcurrency 4,560 – 195 471 – –Deliverable forwardgold deals 1,115 – – – – –Deliverable forwardsecurities deals – – – 359 (1) –Index forward currency 61,199 (9,727) 4,544 – – –Purchase of foreigncurrency option 7,860 – 1,872 – – –Written foreign currencyoption – – – 10,135 (4,002) –Total gross position 74,734 (9,727) 6,611 10,965 (4,003) –The economic conditions in the Russian Federation have had a significant adverse effect on theability of many banks operating principally in the Russian Federation to fulfil their contractualobligations. Accordingly, management has not recorded the receivable and above noted gains based onthe evaluation of the credit worthiness of the counterparties.27 POST BALANCE SHEET EVENTSIn January 2001 OAO <strong>Gazprom</strong> purchased an interest of 51% in the voting shares of AK Sibur.AK Sibur is a leading Russian company selling oil, gas and chemical products. The consideration of RR2,204 million was settled in a combination of cash, promissory notes of a subsidiary of the Group andshares in certain Group entities. The process of determining the fair values of assets and liabilitiesacquired has not yet been finalised and therefore, it is not practical to disclose this information. AK Siburwill be consolidated with effect from 1 January 2001.F-37