- Page 1:

OFFERING CIRCULARJOINT-STOCKCOMPANY

- Page 4 and 5:

classifications and methodologies,

- Page 6 and 7:

INVESTMENT CONSIDERATIONSAn investm

- Page 8 and 9:

Relationship with the GovernmentThe

- Page 10 and 11:

elation to its assets and operation

- Page 12 and 13:

Ethnic and religious differences in

- Page 14 and 15:

TRANSACTION SUMMARYThe transaction

- Page 16 and 17:

SELECTED FINANCIAL INFORMATIONThe s

- Page 18 and 19:

CAPITALISATIONThe following table s

- Page 20 and 21:

OAO GAZPROMPrivatisation and Format

- Page 22 and 23:

Gazprom Shares. The Presidential De

- Page 24 and 25:

Gazprom's main subsidiaries were, a

- Page 26 and 27:

Management StructureIn accordance w

- Page 28 and 29:

The current membership of Gazprom's

- Page 30 and 31:

1999 2000 2001(mtoe, except for per

- Page 32 and 33:

Central and Eastern EuropeGazprom e

- Page 34 and 35:

U.S.$43 million and from those cust

- Page 36 and 37:

Country% OFEUROPEANNATURALGAS SUPPL

- Page 38 and 39:

As at 31 December 2000, proved and

- Page 40 and 41:

The following table sets out, as at

- Page 42 and 43:

een put on stream at the Astrakhans

- Page 44 and 45:

Orenburg Helium Plant. This is Russ

- Page 46 and 47:

The following table sets forth some

- Page 48 and 49:

Gazprom provides the independent su

- Page 50 and 51:

INTERNATIONAL PROJECTS AND ALLIANCE

- Page 52 and 53:

major natural gas distributor in ea

- Page 54 and 55:

Other foreign associate undertaking

- Page 56 and 57:

Gazprom has developed and continues

- Page 58 and 59:

LOAN AGREEMENTThe following is the

- Page 60 and 61:

"Notes" means the U.S.$500,000,000

- Page 62 and 63:

"Subsidiary" means, with respect to

- Page 64 and 65:

5 Repayment and Prepayment5.1 Repay

- Page 66 and 67:

the amount of any such payment and

- Page 68 and 69:

necessary to compensate the Bank fo

- Page 70 and 71:

9.1.15 In any proceedings taken in

- Page 72 and 73:

10.6 Payment of Taxes and Other Cla

- Page 74 and 75:

ankruptcy law, or (iii) a bankruptc

- Page 76 and 77:

execution of this Agreement and all

- Page 78 and 79:

14.8 Contracts (Rights of Third Par

- Page 80 and 81:

TERMS AND CONDITIONS OF THE NOTESTh

- Page 82 and 83:

Under the Trust Deed, the obligatio

- Page 84 and 85:

Payments of interest shall be made

- Page 86 and 87:

The Trustee may agree, without the

- Page 88 and 89:

SUMMARY OF PROVISIONS RELATING TO T

- Page 90 and 91:

circumstances, if the disposal proc

- Page 92 and 93:

SALOMON BROTHERS AGThe Bank is lice

- Page 94 and 95:

GENERAL INFORMATION1. The Notes rep

- Page 96 and 97:

force is being formed to gradually

- Page 98 and 99:

to address these pressures. First,

- Page 100 and 101:

Balance of PaymentsThe following ta

- Page 102 and 103:

understanding that it would serve a

- Page 104 and 105:

GeneralAPPENDIX B - PART 1 - OVERVI

- Page 106 and 107:

most important recent piece of legi

- Page 108 and 109:

integrated objects managed on a cen

- Page 110 and 111:

• price regulation - setting pric

- Page 112 and 113:

APPENDIX B — PART II — EXTRACT

- Page 114 and 115:

APPENDIX C - GLOSSARY OF TERMS"Acco

- Page 116 and 117:

"State Gas Concern Gazprom"the Stat

- Page 118 and 119:

OAO GAZPROMIAS CONSOLIDATED FINANCI

- Page 120 and 121:

OAO GAZPROMIAS CONSOLIDATED BALANCE

- Page 122 and 123:

OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 124 and 125:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 126 and 127:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 128 and 129:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 130 and 131:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 132 and 133:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 134 and 135:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 136 and 137:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 138 and 139:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 140 and 141:

OAO GAZPROMNOTES TO THE IAS CONSOLI

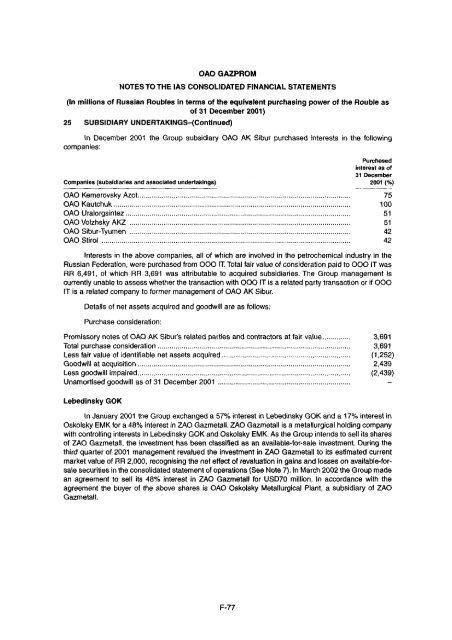

- Page 142 and 143: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 144 and 145: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 146 and 147: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 148 and 149: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 150 and 151: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 152 and 153: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 154 and 155: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 156 and 157: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 158 and 159: PRlCEWATERHOUSECOOPERSZAO Pricewate

- Page 160 and 161: OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 162 and 163: OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 164 and 165: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 166 and 167: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 168 and 169: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 170 and 171: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 172 and 173: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 174 and 175: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 176 and 177: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 178 and 179: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 180 and 181: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 182 and 183: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 184 and 185: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 186 and 187: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 188 and 189: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 190 and 191: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 194 and 195: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 196 and 197: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 198 and 199: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 200 and 201: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 202 and 203: OAO GAZPROMINVESTOR RELATIONSThe Co

- Page 204 and 205: LEGAL ADVISERSTo the CompanyAs to R

- Page 206: printed by eprintfinancial.comtel: