OAO GAZPROMNOTES TO THE IAS CONSOLIDATED FINANCIAL STATEMENTS(In millions of Russian Roubles in terms of the equivalent purchasing power of the Rouble asof 31 December 2001)Principal associated undertakings% of share capital held31 DecemberAssociated undertaking Country Nature of operations 2001 2000Agrochemical Azot Russia Sale of agricultural chemicals 46 –AEB Hungary Banking 26 26Armrosgazprom Armenia Gas distribution and transportation 45 –BSPC Netherlands Construction and gas transportation 50 50EuRoPol GAZ S.A. Poland Gas distribution and transportation 48 48Gas undWarenhandeslgesellschaftGmbH Austria Gas distribution 50 50Gasym Oy Finland Gas distribution and transportation 25 25Moldovagaz Moldova Gas distribution and transportation 50 50Latvias Gaze Latvia Gas distribution and transportation 25 25Overgaz Inc. Bulgaria Gas distribution 50 50Panrusgaz Hungary Gas distribution 31 31Prometheus Gas Greece Construction 50 50Sibur-Tyumen Russia Refining investments 42 –Slovrusgaz Slovakia Gas distribution 50 50Stella Vitae Lithuania Gas distribution and transportation 30 30Turusgaz Turkey Gas distribution 45 45WINGAS GmbH Germany Gas distribution and transportation 35 35Dividends received from associated undertakings were RR 716 and RR 772 for the years ended31 December 2001 and 2000, respectively.12 OTHER LONG-TERM INVESTMENTS31 December2001 2000South Pars project (net of provision for impairment of RR 1,770and nil as of 31 December 2001 and 2000, respectively) 16,996 13,833Other joint ventures (net of provision for impairment of RR14,889 and RR 15,408 as of 31 December 2001 and 2000, respectively) 1,814 2,269Available-for-sale investments (net of provision for impairment of RR 12,136and RR 6,712 as of 31 December 2001 and 2000, respectively) 13,697 15,46032,507 31,562South Pars is a joint venture with Total South Pars and Parsi International Ltd. established in 1997to provide services to National Iranian Oil <strong>Company</strong> in relation to development of South Pars oil and gasfield in Iran. Under the terms of agreement OAO <strong>Gazprom</strong> has a 30% interest in the joint venture.Management have assessed the recoverable amount of the Group's investment in the South Pars jointventure based on the present value of expected future cash flows and applying a discount rate of 16%.As a result, a RR 1,770 impairment has been recognised and recorded within operating expenses inthe consolidated statements of operations for the year ended 31 December 2001. The impairment isprimarily due to revised timing of cash inflows and outflows associated with the joint venture.Available for sale investments include the Group's 14.3% interest in ZAO Media-Most. Theinterest in ZAO Media-Most was acquired in 1999 via the settlement of ZAO Media-Most's debt to theF-62

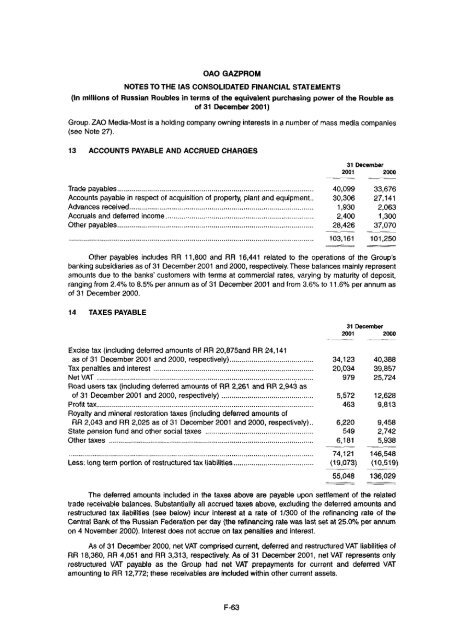

OAO GAZPROMNOTES TO THE IAS CONSOLIDATED FINANCIAL STATEMENTS(In millions of Russian Roubles in terms of the equivalent purchasing power of the Rouble asof 31 December 2001)Group. ZAO Media-Most is a holding company owning interests in a number of mass media companies(see Note 27).13 ACCOUNTS PAYABLE AND ACCRUED CHARGES31 December2001 2000Trade payables 40,099 33,676Accounts payable in respect of acquisition of property, plant and equipment 30,306 27,141Advances received 1,930 2,063Accruals and deferred income 2,400 1,300Other payables 28,426 37,070103,161 101,250Other payables includes RR 11,800 and RR 16,441 related to the operations of the Group'sbanking subsidiaries as of 31 December 2001 and 2000, respectively. These balances mainly representamounts due to the banks' customers with terms at commercial rates, varying by maturity of deposit,ranging from 2.4% to 8.5% per annum as of 31 December 2001 and from 3.6% to 11.6% per annum asof 31 December 2000.14 TAXES PAYABLE31 December2001 2000Excise tax (including deferred amounts of RR 20,875and RR 24,141as of 31 December 2001 and 2000, respectively) 34,123 40,388Tax penalties and interest 20,034 39,857Net VAT 979 25,724Road users tax (including deferred amounts of RR 2,261 and RR 2,943 asof 31 December 2001 and 2000, respectively) 5,572 12,628Profit tax 463 9,813Royalty and mineral restoration taxes (including deferred amounts ofRR 2,043 and RR 2,025 as of 31 December 2001 and 2000, respectively) 6,220 9,458State pension fund and other social taxes 549 2,742Other taxes 6,181 5,93874,121 146,548Less: long term portion of restructured tax liabilities (19,073) (10,519)55,048 136,029The deferred amounts included in the taxes above are payable upon settlement of the relatedtrade receivable balances. Substantially all accrued taxes above, excluding the deferred amounts andrestructured tax liabilities (see below) incur interest at a rate of 1/300 of the refinancing rate of theCentral Bank of the Russian Federation per day (the refinancing rate was last set at 25.0% per annumon 4 November 2000). Interest does not accrue on tax penalties and interest.As of 31 December 2000, net VAT comprised current, deferred and restructured VAT liabilities ofRR 18,360, RR 4,051 and RR 3,313, respectively. As of 31 December 2001, net VAT represents onlyrestructured VAT payable as the Group had net VAT prepayments for current and deferred VATamounting to RR 12,772; these receivables are included within other current assets.F-63

- Page 1:

OFFERING CIRCULARJOINT-STOCKCOMPANY

- Page 4 and 5:

classifications and methodologies,

- Page 6 and 7:

INVESTMENT CONSIDERATIONSAn investm

- Page 8 and 9:

Relationship with the GovernmentThe

- Page 10 and 11:

elation to its assets and operation

- Page 12 and 13:

Ethnic and religious differences in

- Page 14 and 15:

TRANSACTION SUMMARYThe transaction

- Page 16 and 17:

SELECTED FINANCIAL INFORMATIONThe s

- Page 18 and 19:

CAPITALISATIONThe following table s

- Page 20 and 21:

OAO GAZPROMPrivatisation and Format

- Page 22 and 23:

Gazprom Shares. The Presidential De

- Page 24 and 25:

Gazprom's main subsidiaries were, a

- Page 26 and 27:

Management StructureIn accordance w

- Page 28 and 29:

The current membership of Gazprom's

- Page 30 and 31:

1999 2000 2001(mtoe, except for per

- Page 32 and 33:

Central and Eastern EuropeGazprom e

- Page 34 and 35:

U.S.$43 million and from those cust

- Page 36 and 37:

Country% OFEUROPEANNATURALGAS SUPPL

- Page 38 and 39:

As at 31 December 2000, proved and

- Page 40 and 41:

The following table sets out, as at

- Page 42 and 43:

een put on stream at the Astrakhans

- Page 44 and 45:

Orenburg Helium Plant. This is Russ

- Page 46 and 47:

The following table sets forth some

- Page 48 and 49:

Gazprom provides the independent su

- Page 50 and 51:

INTERNATIONAL PROJECTS AND ALLIANCE

- Page 52 and 53:

major natural gas distributor in ea

- Page 54 and 55:

Other foreign associate undertaking

- Page 56 and 57:

Gazprom has developed and continues

- Page 58 and 59:

LOAN AGREEMENTThe following is the

- Page 60 and 61:

"Notes" means the U.S.$500,000,000

- Page 62 and 63:

"Subsidiary" means, with respect to

- Page 64 and 65:

5 Repayment and Prepayment5.1 Repay

- Page 66 and 67:

the amount of any such payment and

- Page 68 and 69:

necessary to compensate the Bank fo

- Page 70 and 71:

9.1.15 In any proceedings taken in

- Page 72 and 73:

10.6 Payment of Taxes and Other Cla

- Page 74 and 75:

ankruptcy law, or (iii) a bankruptc

- Page 76 and 77:

execution of this Agreement and all

- Page 78 and 79:

14.8 Contracts (Rights of Third Par

- Page 80 and 81:

TERMS AND CONDITIONS OF THE NOTESTh

- Page 82 and 83:

Under the Trust Deed, the obligatio

- Page 84 and 85:

Payments of interest shall be made

- Page 86 and 87:

The Trustee may agree, without the

- Page 88 and 89:

SUMMARY OF PROVISIONS RELATING TO T

- Page 90 and 91:

circumstances, if the disposal proc

- Page 92 and 93:

SALOMON BROTHERS AGThe Bank is lice

- Page 94 and 95:

GENERAL INFORMATION1. The Notes rep

- Page 96 and 97:

force is being formed to gradually

- Page 98 and 99:

to address these pressures. First,

- Page 100 and 101:

Balance of PaymentsThe following ta

- Page 102 and 103:

understanding that it would serve a

- Page 104 and 105:

GeneralAPPENDIX B - PART 1 - OVERVI

- Page 106 and 107:

most important recent piece of legi

- Page 108 and 109:

integrated objects managed on a cen

- Page 110 and 111:

• price regulation - setting pric

- Page 112 and 113:

APPENDIX B — PART II — EXTRACT

- Page 114 and 115:

APPENDIX C - GLOSSARY OF TERMS"Acco

- Page 116 and 117:

"State Gas Concern Gazprom"the Stat

- Page 118 and 119:

OAO GAZPROMIAS CONSOLIDATED FINANCI

- Page 120 and 121:

OAO GAZPROMIAS CONSOLIDATED BALANCE

- Page 122 and 123:

OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 124 and 125:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 126 and 127:

OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 128 and 129: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 130 and 131: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 132 and 133: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 134 and 135: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 136 and 137: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 138 and 139: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 140 and 141: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 142 and 143: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 144 and 145: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 146 and 147: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 148 and 149: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 150 and 151: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 152 and 153: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 154 and 155: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 156 and 157: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 158 and 159: PRlCEWATERHOUSECOOPERSZAO Pricewate

- Page 160 and 161: OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 162 and 163: OAO GAZPROMIAS CONSOLIDATED STATEME

- Page 164 and 165: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 166 and 167: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 168 and 169: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 170 and 171: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 172 and 173: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 174 and 175: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 176 and 177: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 180 and 181: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 182 and 183: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 184 and 185: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 186 and 187: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 188 and 189: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 190 and 191: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 192 and 193: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 194 and 195: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 196 and 197: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 198 and 199: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 200 and 201: OAO GAZPROMNOTES TO THE IAS CONSOLI

- Page 202 and 203: OAO GAZPROMINVESTOR RELATIONSThe Co

- Page 204 and 205: LEGAL ADVISERSTo the CompanyAs to R

- Page 206: printed by eprintfinancial.comtel: