Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

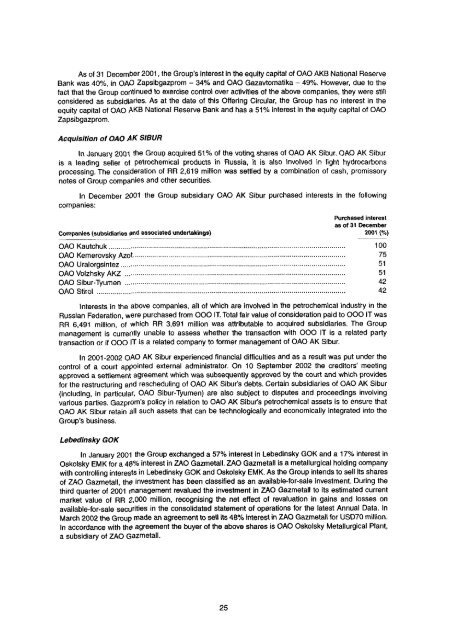

As of 31 December 2001, the Group's interest in the equity capital of OAO AKB National ReserveBank was 40%, in OAO Zapsibgazprom – 34% and OAO Gazavtomatika – 49%. However, due to thefact that the Group continued to exercise control over activities of the above companies, they were stillconsidered as subsidiaries. As at the date of this Offering Circular, the Group has no interest in theequity capital of OAO AKB National Reserve Bank and has a 51% interest in the equity capital of OAOZapsibgazprom.Acquisition of OAO AK SIBURIn January 2001 the Group acquired 51% of the voting, shares of OAO AK Sibur. OAO AK Siburis a leading seller of petrochemical products in Russia, it is also involved in light hydrocarbonsprocessing. The consideration of RR 2,619 million was settled by a combination of cash, promissorynotes of Group companies and other securities.In December 2001 the Group subsidiary OAO AK Sibur purchased interests in the followingcompanies:Purchased interestas of 31 DecemberCompanies (subsidiaries and associated undertakings) 2001 (%)OAO Kautchuk 100OAO Kemerovsky Azot 75OAO Uralorgsintez 51OAO Volzhsky AKZ 51OAO Sibur-Tyumen 42OAO Stirol 42Interests in the above companies, all of which are involved in the petrochemical industry in theRussian Federation, were purchased from OOO IT. Total fair value of consideration paid to OOO IT wasRR 6,491 million, of which RR 3,691 million was attributable to acquired subsidiaries. The Groupmanagement is currently unable to assess whether the transaction with OOO IT is a related partytransaction or if OOO IT is a related company to former management of OAO AK Sibur.In 2001-2002 OAO AK Sibur experienced financial difficulties and as a result was put under thecontrol of a court appointed external administrator. On 10 September 2002 the creditors' meetingapproved a settlement agreement which was subsequently approved by the court and which providesfor the restructuring and rescheduling of OAO AK Sibur's debts. Certain subsidiaries of OAO AK Sibur(including, in particular, OAO Sibur-Tyumen) are also subject to disputes and proceedings involvingvarious parties. <strong>Gazprom</strong>'s policy in relation to OAO AK Sibur's petrochemical assets is to ensure thatOAO AK Sibur retain all such assets that can be technologically and economically integrated into theGroup's business.Lebedinsky GOKIn January 2001 the Group exchanged a 57% interest in Lebedinsky GOK and a 17% interest inOskolsky EMK for a 48% interest in ZAO Gazmetall. ZAO Gazmetall is a metallurgical holding companywith controlling interests in Lebedinsky GOK and Oskolsky EMK. As the Group intends to sell its sharesof ZAO Gazmetall, the investment has been classified as an available-for-sale investment. During thethird quarter of 2001 management revalued the investment in ZAO Gazmetall to its estimated currentmarket value of RR 2,000 million, recognising the net effect of revaluation in gains and losses onavailable-for-sale securities in the consolidated statement of operations for the latest Annual Data. InMarch 2002 the Group made an agreement to sell its 48% interest in ZAO Gazmetall for USD70 million.In accordance with the agreement the buyer of the above shares is OAO Oskolsky Metallurgical Plant,a subsidiary of ZAO Gazmetall.25