Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

Open Joint Stock Company Gazprom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

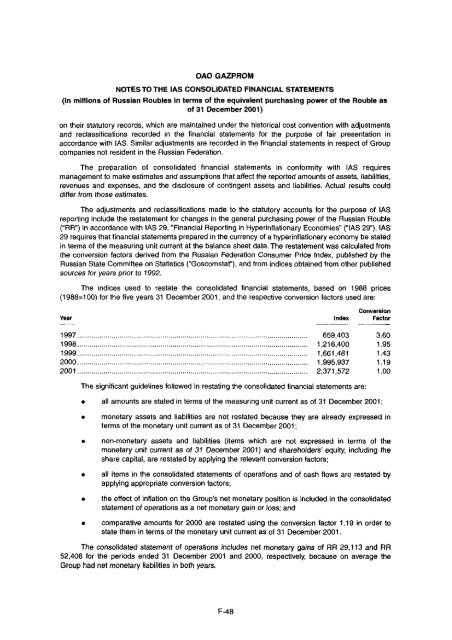

OAO GAZPROMNOTES TO THE IAS CONSOLIDATED FINANCIAL STATEMENTS(In millions of Russian Roubles in terms of the equivalent purchasing power of the Rouble asof 31 December 2001)on their statutory records, which are maintained under the historical cost convention with adjustmentsand reclassifications recorded in the financial statements for the purpose of fair presentation inaccordance with IAS. Similar adjustments are recorded in the financial statements in respect of Groupcompanies not resident in the Russian Federation.The preparation of consolidated financial statements in conformity with IAS requiresmanagement to make estimates and assumptions that affect the reported amounts of assets, liabilities,revenues and expenses, and the disclosure of contingent assets and liabilities. Actual results coulddiffer from those estimates.The adjustments and reclassifications made to the statutory accounts for the purpose of IASreporting include the restatement for changes in the general purchasing power of the Russian Rouble("RR") in accordance with IAS 29, "Financial Reporting in Hyperinflationary Economies" ("IAS 29"). IAS29 requires that financial statements prepared in the currency of a hyperinflationary economy be statedin terms of the measuring unit current at the balance sheet date. The restatement was calculated fromthe conversion factors derived from the Russian Federation Consumer Price Index, published by theRussian State Committee on Statistics ("Goscomstat"), and from indices obtained from other publishedsources for years prior to 1992.The indices used to restate the consolidated financial statements, based on 1988 prices(1988=100) for the five years 31 December 2001, and the respective conversion factors used are:ConversionYear Index Factor1997 659,403 3.601998 1,216,400 1.951999 1,661,481 1.432000 1,995,937 1.192001 2,371,572 1.00The significant guidelines followed in restating the consolidated financial statements are:• all amounts are stated in terms of the measuring unit current as of 31 December 2001;• monetary assets and liabilities are not restated because they are already expressed interms of the monetary unit current as of 31 December 2001;• non-monetary assets and liabilities (items which are not expressed in terms of themonetary unit current as of 31 December 2001) and shareholders' equity, including theshare capital, are restated by applying the relevant conversion factors;• all items in the consolidated statements of operations and of cash flows are restated byapplying appropriate conversion factors;• the effect of inflation on the Group's net monetary position is included in the consolidatedstatement of operations as a net monetary gain or loss; and• comparative amounts for 2000 are restated using the conversion factor 1.19 in order tostate them in terms of the monetary unit current as of 31 December 2001.The consolidated statement of operations includes net monetary gains of RR 29,113 and RR52,406 for the periods ended 31 December 2001 and 2000, respectively, because on average theGroup had net monetary liabilities in both years.F-48