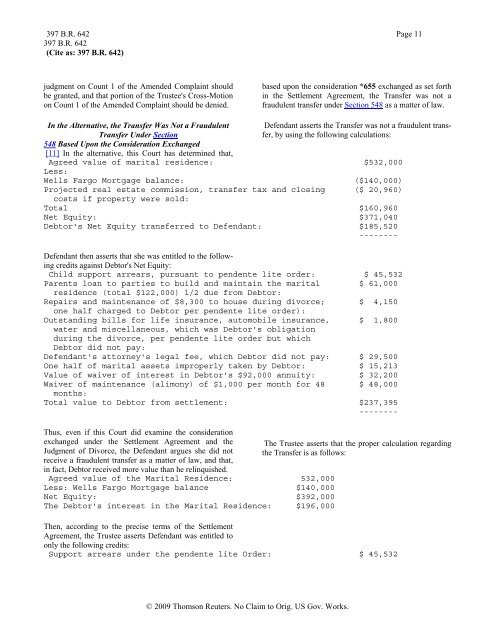

397 B.R. 642 Page 11397 B.R. 642(Cite as: 397 B.R. 642)judgment on Count 1 <strong>of</strong> the Amended Complaint shouldbe granted, and that portion <strong>of</strong> the Trustee's Cross-Motionon Count 1 <strong>of</strong> the Amended Complaint should be denied.based upon the consideration *655 exchanged as set forthin the Settlement Agreement, the Transfer was not afraudulent transfer under Section 548 as a matter <strong>of</strong> law.In the Alternative, the Transfer Was Not a FraudulentTransfer Under Section548 Based Upon the Consideration Exchanged[11] In the alternative, this Court has determined that,Defendant asserts the Transfer was not a fraudulent transfer,by using the following calculations:Agreed value <strong>of</strong> marital residence: $532,000Less:Wells Fargo Mortgage balance: ($140,000)Projected real estate commission, transfer tax and closing ($ 20,960)costs if property were sold:Total $160,960Net Equity: $371,040Debtor's Net Equity transferred to Defendant: $185,520--------Defendant then asserts that she was entitled to the followingcredits against Debtor's Net Equity:Child support arrears, pursuant to pendente lite order: $ 45,532Parents loan to parties to build and maintain the marital $ 61,000residence (total $122,000) l/2 due from Debtor:Repairs and maintenance <strong>of</strong> $8,300 to house during divorce; $ 4,150one half charged to Debtor per pendente lite order):Outstanding bills for life insurance, automobile insurance, $ 1,800water and miscellaneous, which was Debtor's obligationduring the divorce, per pendente lite order but whichDebtor did not pay:Defendant's attorney's legal fee, which Debtor did not pay: $ 29,500One half <strong>of</strong> marital assets improperly taken by Debtor: $ 15,213Value <strong>of</strong> waiver <strong>of</strong> interest in Debtor's $92,000 annuity: $ 32,200Waiver <strong>of</strong> maintenance (alimony) <strong>of</strong> $1,000 per month for 48 $ 48,000months:Total value to Debtor from settlement: $237,395--------Thus, even if this Court did examine the considerationexchanged under the Settlement Agreement and theJudgment <strong>of</strong> Divorce, the Defendant argues she did notreceive a fraudulent transfer as a matter <strong>of</strong> law, and that,in fact, Debtor received more value than he relinquished.Agreed value <strong>of</strong> the Marital Residence: 532,000Less: Wells Fargo Mortgage balance $140,000Net Equity: $392,000The Debtor's interest in the Marital Residence: $196,000The Trustee asserts that the proper calculation regardingthe Transfer is as follows:Then, according to the precise terms <strong>of</strong> the SettlementAgreement, the Trustee asserts Defendant was entitled toonly the following credits:Support arrears under the pendente lite Order: $ 45,532© 2009 Thomson Reuters. No Claim to Orig. US Gov. Works.

397 B.R. 642 Page 12397 B.R. 642(Cite as: 397 B.R. 642)Her right to receive child support and maintenance through $ 30,000September 16, 2004:Her interest in Debtor's annuity: $ 32,200Debtor's total remaining equity interest (if "loan" from $ 88,268 ORDefendant's parents is properly characterized as a gift):--------Debtor's total remaining equity interest (if "loan" is $ 27,268incorrectly deemed a loan):-------------------------------------------------------------------------------Thus, argues the Trustee, the Transfer was without fairconsideration as Debtor was still owed, at a minimum,$27,268 and, as such, the Transfer amounted to a fraudulentconveyance. The Trustee further asserts that the parents'"loan" should be properly characterized as a gift underNew York law, because no documents substantiatedthe parents' loan, there was no interest to be charged, andthere were no agreed payment terms.[12] The Court will separately address each <strong>of</strong> the Trustee'sclaims. First, the Trustee cannot assert that the Defendantcan only claim the consideration stated in the SettlementAgreement as what she surrendered in order toreceive the Transfer, when the Trustee is also seeking tounwind that very agreement. If this Court considered theTrustee's claims at trial, the Court would compare all <strong>of</strong>the consideration given up by the Defendant in order toreceive the Transfer, not just those set out in the preciseterms <strong>of</strong> the Settlement Agreement. Defendant has establishedby competent summary judgment evidence that shemade concessions, and therefore provided value, in excess<strong>of</strong> those detailed in the precise terms <strong>of</strong> the SettlementAgreement.However, even if the Court were to limit Defendant tothe precise terms <strong>of</strong> the Settlement Agreement as the consideration*656 she provided, she still did not receive afraudulent transfer. For fraudulent transfer purposes, if theDefendant's parents made a loan for improvements to theMarital Residence for which the Debtor was liable orwhich encumbered the Marital Residence, the Debtorreceived value under Section 548(a)(2) by the extinguishment<strong>of</strong> that obligation. As noted above, "value" asdefined under Section 548(d)(2), includes satisfaction orsecuring <strong>of</strong> an antecedent debt.The Defendant's Parents Made a Loan to Debtor andDefendantThe only evidence before the Court on whether or not aloan was made by Defendant's parents are the Affidavit <strong>of</strong>Defendant [dkt item 15] and her deposition testimony [dktitem 17]. In her Affidavit, Defendant stated:22. Forgiveness <strong>of</strong> Parental Loan-During our marriage,my parents lent us $122,000 to help us build our maritalresidence and make improvements to it. As part <strong>of</strong> thedivorce settlement, I waived any repayment <strong>of</strong> thesemonies by the debtor on my parents' behalf. The Judgment<strong>of</strong> Divorce states "The plaintiff's waiver <strong>of</strong> his interestin the marital residence is also the result <strong>of</strong> theseparate property claim, which the defendant had as aresult <strong>of</strong> the monies contributed to the purchase <strong>of</strong> thehome and improvements by the defendant's parents."(Exhibit C--Judgment <strong>of</strong> Divorce, page 7, paragraph b)The Judgment <strong>of</strong> Divorce therefore treated this moneyas part <strong>of</strong> the property settlement to which I was entitled,but which I waived.[dkt item 15].In her deposition, Defendant specifically denied that "any<strong>of</strong> this money was meant to be a gift," and she testifiedregarding deposits her parents made to her account andthe use <strong>of</strong> the funds for the home [dkt item 17, Exs. E, F& G].In the Settlement Agreement, Debtor agreed, inter alia,as follows:The Husband's waiver <strong>of</strong> his interest in the marital residenceis also the result <strong>of</strong> the separate property claimswhich the wife had as a result <strong>of</strong> monies contributed tothe purchase <strong>of</strong> the home and its improvements by thewife's parents.[dkt item 15, Ex. A, p. 22].Thus, based on the evidence before the Court, and drawingall proper inferences, the Trustee has failed to create agenuine issue <strong>of</strong> material fact as to whether the parents'loan was a loan or a gift. Therefore, this Court treats thefunds advanced by Defendant's parents as a loan.Even if the parents had not made an enforceable loan,however, Debtor ratified his obligation for these advancesin the Settlement Agreement by acknowledging that De-© 2009 Thomson Reuters. No Claim to Orig. US Gov. Works.

- Page 1 and 2:

Nassau Academy of LawCLE Live Class

- Page 3 and 4:

McKinney's Debtor and Creditor Law

- Page 5 and 6:

McKinney's Debtor and Creditor Law

- Page 7 and 8:

McKinney's Debtor and Creditor Law

- Page 9 and 10:

McKinney's Debtor and Creditor Law

- Page 11 and 12:

McKinney's Debtor and Creditor Law

- Page 13 and 14:

McKinney's Debtor and Creditor Law

- Page 15 and 16:

McKinney's Debtor and Creditor Law

- Page 17 and 18:

McKinney's Debtor and Creditor Law

- Page 19 and 20:

BAKER & HOSTETLER LLP45 Rockefeller

- Page 21 and 22:

usiness of defendant Bernard L. Mad

- Page 23 and 24:

BACKGROUND, THE TRUSTEE, AND STANDI

- Page 25 and 26:

Madoff who received fraudulent tran

- Page 27 and 28:

ased on fictitious profits and for

- Page 29 and 30:

28. BLMIS funds were also used to p

- Page 31 and 32:

Madoff, and her niece, Shana Madoff

- Page 33 and 34:

42. Ruth Madoff was never an employ

- Page 35 and 36:

FIRST CAUSE OF ACTIONTURNOVER AND A

- Page 37 and 38:

66. At the time of each of the Two-

- Page 39 and 40:

Transfers; (b) directing that the S

- Page 41 and 42:

EIGHTH CAUSE OF ACTIONUNDISCOVERED

- Page 43 and 44:

TENTH CAUSE OF ACTIONDISALLOWANCE O

- Page 45 and 46:

111. Mrs. Madoff benefited from the

- Page 47 and 48:

WHEREFORE, the Trustee respectfully

- Page 49 and 50:

2(c)(3): (a) preserving the Subsequ

- Page 51 and 52: 302 B.R. 760 Page 1302 B.R. 760(Cit

- Page 53 and 54: 302 B.R. 760 Page 3302 B.R. 760(Cit

- Page 55 and 56: 302 B.R. 760 Page 5302 B.R. 760(Cit

- Page 57 and 58: 302 B.R. 760 Page 7302 B.R. 760(Cit

- Page 59 and 60: 302 B.R. 760 Page 9302 B.R. 760(Cit

- Page 61 and 62: 302 B.R. 760 Page 11302 B.R. 760(Ci

- Page 63 and 64: 302 B.R. 760 Page 13302 B.R. 760(Ci

- Page 65 and 66: 302 B.R. 760 Page 15302 B.R. 760(Ci

- Page 67 and 68: 302 B.R. 760 Page 17302 B.R. 760(Ci

- Page 69 and 70: 302 B.R. 760 Page 19302 B.R. 760(Ci

- Page 71 and 72: 394 B.R. 721 Page 1394 B.R. 721, 50

- Page 73 and 74: 394 B.R. 721 Page 3394 B.R. 721, 50

- Page 75 and 76: 394 B.R. 721 Page 5394 B.R. 721, 50

- Page 77 and 78: 394 B.R. 721 Page 7394 B.R. 721, 50

- Page 79 and 80: 394 B.R. 721 Page 9394 B.R. 721, 50

- Page 81 and 82: 394 B.R. 721 Page 11394 B.R. 721, 5

- Page 83 and 84: 394 B.R. 721 Page 13394 B.R. 721, 5

- Page 85 and 86: 394 B.R. 721 Page 15394 B.R. 721, 5

- Page 87 and 88: 394 B.R. 721 Page 17394 B.R. 721, 5

- Page 89 and 90: 394 B.R. 721 Page 19394 B.R. 721, 5

- Page 91 and 92: 394 B.R. 721 Page 21394 B.R. 721, 5

- Page 93 and 94: 397 B.R. 642 Page 2397 B.R. 642(Cit

- Page 95 and 96: 397 B.R. 642 Page 4397 B.R. 642(Cit

- Page 97 and 98: 397 B.R. 642 Page 6397 B.R. 642(Cit

- Page 99 and 100: 397 B.R. 642 Page 8397 B.R. 642(Cit

- Page 101: 397 B.R. 642 Page 10397 B.R. 642(Ci

- Page 105 and 106: 397 B.R. 642 Page 14397 B.R. 642(Ci

- Page 107 and 108: 443 F.3d 180 Page 2443 F.3d 180(Cit

- Page 109 and 110: 443 F.3d 180 Page 4443 F.3d 180(Cit

- Page 111 and 112: 443 F.3d 180 Page 6443 F.3d 180(Cit

- Page 113 and 114: 443 F.3d 180 Page 8443 F.3d 180(Cit

- Page 115 and 116: 443 F.3d 180 Page 10443 F.3d 180(Ci

- Page 117 and 118: 443 F.3d 180 Page 12443 F.3d 180(Ci

- Page 119 and 120: Page 2257 A.D.2d 526, 684 N.Y.S.2d

- Page 121 and 122: Page 4257 A.D.2d 526, 684 N.Y.S.2d

- Page 123 and 124: Page 6257 A.D.2d 526, 684 N.Y.S.2d

- Page 125 and 126: 770 N.Y.S.2d 421 Page 22 A.D.3d 780

- Page 127 and 128: Page 14 A.D.3d 495, 773 N.Y.S.2d 71

- Page 129: Page 34 A.D.3d 495, 773 N.Y.S.2d 71

- Page 132 and 133: 780 N.Y.S.2d 409 Page 29 A.D.3d 553

- Page 134 and 135: Page 134 A.D.3d 231, 824 N.Y.S.2d 3

- Page 136 and 137: Page 334 A.D.3d 231, 824 N.Y.S.2d 3

- Page 138 and 139: Page 2991 F.2d 31(Cite as: 991 F.2d

- Page 140 and 141: Page 4991 F.2d 31(Cite as: 991 F.2d

- Page 142 and 143: Page 6991 F.2d 31(Cite as: 991 F.2d

- Page 144 and 145: FRAUDULENT TRANFERENCESRonald M. Te

- Page 146 and 147: Nursing home case_ Transfer of pers

- Page 148 and 149: Sections 548 and 544 work in concer

- Page 150 and 151: U.S. Supreme CourtBFP v. Resolution

- Page 152 and 153:

example, from net 15 to COD; or cha

- Page 154 and 155:

Bankruptcy Code Section§ 548. Frau

- Page 156:

Ron Terenzi is a founding partner a