C Si Ni Cr V Ti Ta Sc Li Sr Zr Fe Cu Zn Sn B Al Ce U Mn Mo Nb Sb

C Si Ni Cr V Ti Ta Sc Li Sr Zr Fe Cu Zn Sn B Al Ce U Mn Mo Nb Sb

C Si Ni Cr V Ti Ta Sc Li Sr Zr Fe Cu Zn Sn B Al Ce U Mn Mo Nb Sb

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

period over which the obligation is to be settled. The<br />

expectation used for 2010 was 8.0% (2009: 8.25%) for the<br />

US plans.<br />

Assumptions regarding future mortality are based on<br />

published statistics and the RP-2000 Combined Healthy<br />

<strong>Mo</strong>rtality table. The valuation was prepared on a goingplan<br />

basis. The valuation was based on members in<br />

the Plan as of the valuation date and did not take future<br />

members into account. No provision has been made<br />

for contingent liabilities with respect to non-vested<br />

terminated members who may be reemployed. No<br />

provisions for future expenses were made.<br />

Medical cost trend rates are not applicable to these plans.<br />

The best estimate of contributions to be paid to the plans<br />

for the year ending December 31, 2011 is $1,446.<br />

European plans<br />

LSM plans<br />

The Company sponsors the LSM 2006 Pension Plan and<br />

the LSM Additional Pension Plan, which are defined<br />

benefit arrangements. LSM’s defined benefit pension<br />

plans cover all eligible employees in the UK.<br />

Benefits under these plans are based on years of service<br />

and the employee’s compensation. Benefits are paid either<br />

from plan assets or, in certain instances, directly by LSM.<br />

Substantially all plan assets are invested in listed stocks<br />

and bonds. The expected return on bonds is determined<br />

by reference to UK long dated gilt and bond yields at the<br />

reporting date. The expected rate of return on equities<br />

have been determined by setting an appropriate risk<br />

premium above gilt/bond yields having regard to market<br />

conditions at the reporting date. The expected long-term<br />

return on cash is equal to bank base rates at the<br />

reporting date.<br />

The expected long-term rates of return on plan assets are<br />

as follows:<br />

2010 2009<br />

% per annum % per annum<br />

Equities 8.50 9.60<br />

Bonds 4.15–5.50 3.90–6.70<br />

Cash 2.00 2.00<br />

Other 3.90 3.90<br />

Overall for LSM plans 6.30 7.41<br />

The actual return on plan assets for the year ending<br />

December 31, 2010 was 21.5% (2009: 13.3%) for the<br />

primary and 4.1% (2009: 11.7%) for the additional defined<br />

benefit plan.<br />

114 Notes to Consolidated Financial Statements<br />

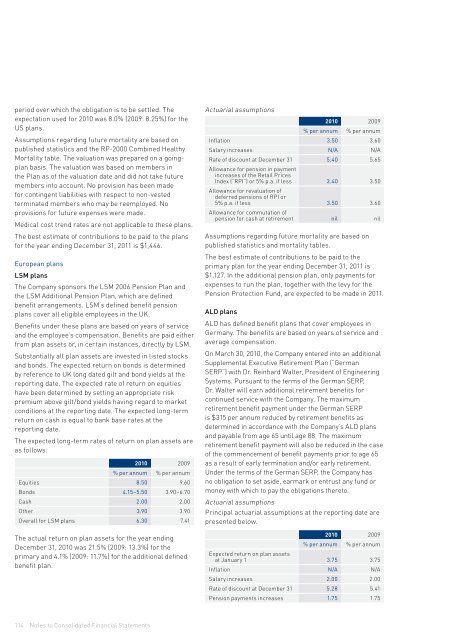

Actuarial assumptions<br />

2010 2009<br />

% per annum % per annum<br />

Inflation 3.50 3.60<br />

Salary increases N/A N/A<br />

Rate of discount at December 31<br />

<strong>Al</strong>lowance for pension in payment<br />

increases of the Retail Prices<br />

5.40 5.65<br />

Index (“RPI”) or 5% p.a. if less<br />

<strong>Al</strong>lowance for revaluation of<br />

deferred pensions of RPI or<br />

3.40 3.50<br />

5% p.a. if less<br />

<strong>Al</strong>lowance for commutation of<br />

3.50 3.60<br />

pension for cash at retirement nil nil<br />

Assumptions regarding future mortality are based on<br />

published statistics and mortality tables.<br />

The best estimate of contributions to be paid to the<br />

primary plan for the year ending December 31, 2011 is<br />

$1,127. In the additional pension plan, only payments for<br />

expenses to run the plan, together with the levy for the<br />

Pension Protection Fund, are expected to be made in 2011.<br />

ALD plans<br />

ALD has defined benefit plans that cover employees in<br />

Germany. The benefits are based on years of service and<br />

average compensation.<br />

On March 30, 2010, the Company entered into an additional<br />

Supplemental Executive Retirement Plan (“German<br />

SERP”) with Dr. Reinhard Walter, President of Engineering<br />

Systems. Pursuant to the terms of the German SERP,<br />

Dr. Walter will earn additional retirement benefits for<br />

continued service with the Company. The maximum<br />

retirement benefit payment under the German SERP<br />

is $315 per annum reduced by retirement benefits as<br />

determined in accordance with the Company’s ALD plans<br />

and payable from age 65 until age 88. The maximum<br />

retirement benefit payment will also be reduced in the case<br />

of the commencement of benefit payments prior to age 65<br />

as a result of early termination and/or early retirement.<br />

Under the terms of the German SERP, the Company has<br />

no obligation to set aside, earmark or entrust any fund or<br />

money with which to pay the obligations thereto.<br />

Actuarial assumptions<br />

Principal actuarial assumptions at the reporting date are<br />

presented below.<br />

2010 2009<br />

% per annum % per annum<br />

Expected return on plan assets<br />

at January 1 3.75 3.75<br />

Inflation N/A N/A<br />

Salary increases 2.00 2.00<br />

Rate of discount at December 31 5.28 5.41<br />

Pension payments increases 1.75 1.75