Bio- and regenera- tive Medicine as an important growth Market

Bio- and regenera- tive Medicine as an important growth Market

Bio- and regenera- tive Medicine as an important growth Market

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18 HHL RESEARCH REPORT 2012 finAnCE, ACCOunTing And CORPORATE gOvERnAnCE 19<br />

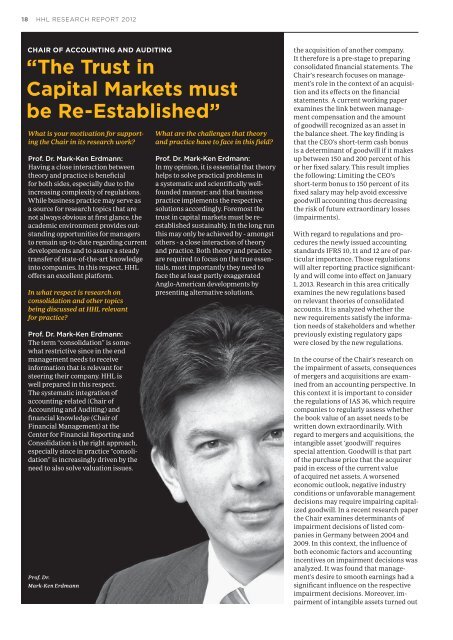

cHair oF accounting <strong><strong>an</strong>d</strong> auditing<br />

“the trust in<br />

capital <strong>Market</strong>s must<br />

be re-estab lished”<br />

What is your motivation for supporting<br />

the Chair in its research work?<br />

Prof. Dr. Mark-Ken erdm<strong>an</strong>n:<br />

Having a close interaction between<br />

theory <strong><strong>an</strong>d</strong> practice is beneficial<br />

for both sides, especially due to the<br />

incre<strong>as</strong>ing complexity of regulations .<br />

While business practice may serve <strong>as</strong><br />

a source for research topics that are<br />

not always obvious at first gl<strong>an</strong>ce, the<br />

academic environment provides outst<strong><strong>an</strong>d</strong>ing<br />

opportunities for m<strong>an</strong>agers<br />

to remain up-to-date regarding current<br />

developments <strong><strong>an</strong>d</strong> to <strong>as</strong>sure a steady<br />

tr<strong>an</strong>sfer of state-of-the-art knowledge<br />

into comp<strong>an</strong>ies . In this respect, HHL<br />

offers <strong>an</strong> excellent platform .<br />

In what respect is research on<br />

consolidation <strong><strong>an</strong>d</strong> other topics<br />

being discussed at HHL relev<strong>an</strong>t<br />

for practice?<br />

Prof. Dr. Mark-Ken erdm<strong>an</strong>n:<br />

The term “consolidation” is somewhat<br />

restric<strong>tive</strong> since in the end<br />

m<strong>an</strong>agement needs to receive<br />

information that is relev<strong>an</strong>t for<br />

steering their comp<strong>an</strong>y . HHL is<br />

well prepared in this respect .<br />

The systematic integration of<br />

accounting-related (Chair of<br />

Accounting <strong><strong>an</strong>d</strong> Auditing) <strong><strong>an</strong>d</strong><br />

fin<strong>an</strong>cial knowledge (Chair of<br />

Fin<strong>an</strong>cial M<strong>an</strong>agement) at the<br />

Center for Fin<strong>an</strong>cial Reporting <strong><strong>an</strong>d</strong><br />

Consolidation is the right approach,<br />

especially since in practice “consolidation”<br />

is incre<strong>as</strong>ingly driven by the<br />

need to also solve valuation issues .<br />

Prof. Dr.<br />

Mark-Ken Erdm<strong>an</strong>n<br />

What are the challenges that theory<br />

<strong><strong>an</strong>d</strong> practice have to face in this field?<br />

Prof. Dr. Mark-Ken erdm<strong>an</strong>n:<br />

In my opinion, it is essential that theory<br />

helps to solve practical problems in<br />

a systematic <strong><strong>an</strong>d</strong> scientifically wellfounded<br />

m<strong>an</strong>ner; <strong><strong>an</strong>d</strong> that business<br />

practice implements the respec<strong>tive</strong><br />

solutions accordingly . Foremost the<br />

trust in capital markets must be reestablished<br />

sustainably . In the long run<br />

this may only be achieved by - amongst<br />

others - a close interaction of theory<br />

<strong><strong>an</strong>d</strong> practice . Both theory <strong><strong>an</strong>d</strong> practice<br />

are required to focus on the true essentials,<br />

most import<strong>an</strong>tly they need to<br />

face the at le<strong>as</strong>t partly exaggerated<br />

Anglo-Americ<strong>an</strong> developments by<br />

presenting alterna<strong>tive</strong> solutions .<br />

the acquisition of <strong>an</strong>other comp<strong>an</strong>y .<br />

It therefore is a pre-stage to preparing<br />

consolidated fin<strong>an</strong>cial statements . The<br />

Chair‘s research focuses on m<strong>an</strong>agement’s<br />

role in the context of <strong>an</strong> acquisition<br />

<strong><strong>an</strong>d</strong> its effects on the fin<strong>an</strong>cial<br />

statements . A current working paper<br />

examines the link between m<strong>an</strong>agement<br />

compensation <strong><strong>an</strong>d</strong> the amount<br />

of goodwill recognized <strong>as</strong> <strong>an</strong> <strong>as</strong>set in<br />

the bal<strong>an</strong>ce sheet . The key finding is<br />

that the CEO’s short-term c<strong>as</strong>h bonus<br />

is a determin<strong>an</strong>t of goodwill if it makes<br />

up between 150 <strong><strong>an</strong>d</strong> 200 percent of his<br />

or her fixed salary . This result implies<br />

the following: Limiting the CEO’s<br />

short-term bonus to 150 percent of its<br />

fixed salary may help avoid excessive<br />

goodwill accounting thus decre<strong>as</strong>ing<br />

the risk of future extraordinary losses<br />

(impairments) .<br />

With regard to regulations <strong><strong>an</strong>d</strong> procedures<br />

the newly issued accounting<br />

st<strong><strong>an</strong>d</strong>ards IFRS 10, 11 <strong><strong>an</strong>d</strong> 12 are of particular<br />

import<strong>an</strong>ce . Those regulations<br />

will alter reporting practice signific<strong>an</strong>tly<br />

<strong><strong>an</strong>d</strong> will come into effect on J<strong>an</strong>uary<br />

1, 2013 . Research in this area critically<br />

examines the new regulations b<strong>as</strong>ed<br />

on relev<strong>an</strong>t theories of consolidated<br />

accounts . It is <strong>an</strong>alyzed whether the<br />

new requirements satisfy the information<br />

needs of stakeholders <strong><strong>an</strong>d</strong> whether<br />

previously existing regulatory gaps<br />

were closed by the new regulations .<br />

In the course of the Chair’s research on<br />

the impairment of <strong>as</strong>sets, consequences<br />

of mergers <strong><strong>an</strong>d</strong> acquisitions are examined<br />

from <strong>an</strong> accounting perspec<strong>tive</strong> . In<br />

this context it is import<strong>an</strong>t to consider<br />

the regulations of IAS 36, which require<br />

comp<strong>an</strong>ies to regularly <strong>as</strong>sess whether<br />

the book value of <strong>an</strong> <strong>as</strong>set needs to be<br />

written down extraordinarily . With<br />

regard to mergers <strong><strong>an</strong>d</strong> acquisitions, the<br />

int<strong>an</strong>gible <strong>as</strong>set ‘goodwill’ requires<br />

special attention . Goodwill is that part<br />

of the purch<strong>as</strong>e price that the acquirer<br />

paid in excess of the current value<br />

of acquired net <strong>as</strong>sets . A worsened<br />

economic outlook, nega<strong>tive</strong> industry<br />

conditions or unfavorable m<strong>an</strong>agement<br />

decisions may require impairing capitalized<br />

goodwill . In a recent research paper<br />

the Chair examines determin<strong>an</strong>ts of<br />

impairment decisions of listed comp<strong>an</strong>ies<br />

in Germ<strong>an</strong>y between 2004 <strong><strong>an</strong>d</strong><br />

2009 . In this context, the influence of<br />

both economic factors <strong><strong>an</strong>d</strong> accounting<br />

incen<strong>tive</strong>s on impairment decisions w<strong>as</strong><br />

<strong>an</strong>alyzed . It w<strong>as</strong> found that m<strong>an</strong>agement’s<br />

desire to smooth earnings had a<br />

signific<strong>an</strong>t influence on the respec<strong>tive</strong><br />

impairment decisions . Moreover, impairment<br />

of int<strong>an</strong>gible <strong>as</strong>sets turned out<br />

to be more likely in years in which there<br />

w<strong>as</strong> a ch<strong>an</strong>ge in m<strong>an</strong>agement .<br />

Perform<strong>an</strong>ce<br />

Reporting<br />

The research field of perform<strong>an</strong>ce<br />

reporting focuses on the presentation of<br />

a comp<strong>an</strong>y’s profits <strong><strong>an</strong>d</strong> losses . The<br />

International Accounting St<strong><strong>an</strong>d</strong>ards<br />

Board (IASB) <strong><strong>an</strong>d</strong> the U .S . Fin<strong>an</strong>cial<br />

Accounting St<strong><strong>an</strong>d</strong>ards Board (FASB) aim<br />

to align <strong><strong>an</strong>d</strong> harmonize their respec<strong>tive</strong><br />

accounting st<strong><strong>an</strong>d</strong>ards IAS 1 “Presentation<br />

of Fin<strong>an</strong>cial State ments” <strong><strong>an</strong>d</strong><br />

SFAS 130 “Reporting Comprehensive<br />

Income” during the course of their Joint<br />

Fin<strong>an</strong>cial Statement Presentation Pro -<br />

ject . The presentation of income <strong><strong>an</strong>d</strong><br />

expenses in international fin<strong>an</strong>cial<br />

statements are to be improved in order<br />

to meet users’ needs more adequately<br />

th<strong>an</strong> before . It is therefore essential to<br />

critically examine the forthcoming<br />

st<strong><strong>an</strong>d</strong>ard, also with regard to potential<br />

m<strong>an</strong>agement discretion .<br />

The Chair’s current research examines<br />

the extent to which Germ<strong>an</strong> comp<strong>an</strong>ies<br />

use discretion in the course of accounting<br />

for pension obligations <strong><strong>an</strong>d</strong> how this<br />

affects the capital market . Discretion<br />

may, among other things, be exercised<br />

when estimating the life expect<strong>an</strong>cy of<br />

eligible employees <strong><strong>an</strong>d</strong> when making <strong>as</strong>sumptions<br />

on the comp<strong>an</strong>y’s employee<br />

structure <strong>as</strong> well <strong>as</strong> salary development .<br />

Accounting for pension obligations is<br />

frequently mentioned in the business<br />

press, especially because these obligations<br />

often make up a signific<strong>an</strong>t share<br />

of a comp<strong>an</strong>y‘s total liabilities .<br />

Glossary<br />

iFrS<br />

International Fin<strong>an</strong>cial Reporting St<strong><strong>an</strong>d</strong>ards (IFRS)<br />

comprise a conceptual framework <strong><strong>an</strong>d</strong> principlesb<strong>as</strong>ed<br />

accounting st<strong><strong>an</strong>d</strong>ards issued by the International<br />

Accounting St<strong><strong>an</strong>d</strong>ards Board (IASB).<br />

It is found that comp<strong>an</strong>ies indeed<br />

make use of the discretion provided by<br />

the accounting st<strong><strong>an</strong>d</strong>ard for pension<br />

obligations . The findings suggest that<br />

comp<strong>an</strong>ies with underfunded pension<br />

obligations use discretion <strong>as</strong> a way to<br />

achieve posi<strong>tive</strong> capital market reactions<br />

(i .e . share price incre<strong>as</strong>es) . In<br />

other words, if a listed comp<strong>an</strong>y h<strong>as</strong><br />

<strong>an</strong> underfunded pension pl<strong>an</strong>, i .e . the<br />

comp<strong>an</strong>y h<strong>as</strong> not saved enough capital<br />

for future pension payments, it aims to<br />

hide this fact in its fin<strong>an</strong>cial statements<br />

by using discretion such that the share<br />

price at le<strong>as</strong>t does not decre<strong>as</strong>e . These<br />

findings are of particular relev<strong>an</strong>ce for<br />

capital market research since it h<strong>as</strong> not<br />

yet been conclusively shown how discretion<br />

in accounting st<strong><strong>an</strong>d</strong>ards affects<br />

stock markets .<br />

St<strong><strong>an</strong>d</strong>ard Setting &<br />

enforcement<br />

The research field of st<strong><strong>an</strong>d</strong>ard setting<br />

<strong><strong>an</strong>d</strong> enforcement deals with the emergence<br />

of accounting regulations (st<strong><strong>an</strong>d</strong>ard<br />

setting) on the one h<strong><strong>an</strong>d</strong> <strong><strong>an</strong>d</strong> the<br />

legal enforcement of accounting st<strong><strong>an</strong>d</strong>ards<br />

on the other .<br />

The dissertation by Dr . Seb<strong>as</strong>ti<strong>an</strong><br />

Hoffm<strong>an</strong>n entitled “Lobbying im<br />

Rahmen der Entstehung von Rechnungslegungsnormen”<br />

(“Lobbying in<br />

the Context of Accounting St<strong><strong>an</strong>d</strong>ard<br />

Setting”), submitted in 2011, is at the<br />

core of the Chair’s research on st<strong><strong>an</strong>d</strong>ard<br />

setting . The nucleus of this dissertation<br />

is a research paper on the work of the<br />

technical staff of the International<br />

Accounting St<strong><strong>an</strong>d</strong>ards Board (IASB) .<br />

It is shown that comments on regulatory<br />

proposals that are sent by comp<strong>an</strong>ies,<br />

account<strong>an</strong>ts, <strong>as</strong>sociations, etc . are<br />

not consistently <strong><strong>an</strong>d</strong> comprehensively<br />

evaluated by the IASB’s staff . In fact,<br />

seemingly critical statements are underweighted<br />

. Hence, the public c<strong>an</strong>not ob -<br />

tain <strong>an</strong> accurate picture of the actual<br />

statements <strong><strong>an</strong>d</strong> the opinions expressed<br />

therein when reading the summary<br />

of comments prepared by the IASB .<br />

Moreover, by weighting the statements<br />

without reservation or further expl<strong>an</strong>ation,<br />

the IASB is at risk of not achieving<br />

its own st<strong><strong>an</strong>d</strong>ards of tr<strong>an</strong>sparency<br />

<strong><strong>an</strong>d</strong> credibility . Both characteristics<br />

are essen tial for this body since it is a<br />

private regulatory authority <strong><strong>an</strong>d</strong> consequently<br />

very much dependent on trust .<br />

The IASB h<strong>as</strong> been advised to ch<strong>an</strong>ge<br />

its mode of publishing the summary of<br />

comments received on proposals .<br />

The sub-field of enforcement is of<br />

particular relev<strong>an</strong>ce since there is a consistently<br />

high number of Germ<strong>an</strong> listed<br />

comp<strong>an</strong>ies publishing erroneous fin<strong>an</strong>cial<br />

statements . Germ<strong>an</strong> capital marketoriented<br />

comp<strong>an</strong>ies, i .e those which<br />

are either listed or have issued bonds<br />

that are traded on a stock exch<strong>an</strong>ge,<br />

are subject to accounting enforcement<br />

by the “accounting police” . This<br />

institution is formed by the Germ<strong>an</strong><br />

Fin<strong>an</strong>cial Reporting Enforcement P<strong>an</strong>el<br />

(DPR), <strong>as</strong> well <strong>as</strong> the Federal Fin<strong>an</strong>cial<br />

Supervisory Authority (BaFin) . Both<br />

dr. Seb<strong>as</strong>ti<strong>an</strong> Hoffm<strong>an</strong>n<br />

Assist<strong>an</strong>t Professor, Chair of Accounting<br />

<strong><strong>an</strong>d</strong> Auditing<br />

bodies investigate audited fin<strong>an</strong>cial<br />

statements of comp<strong>an</strong>ies, i .e . they perform<br />

a second review of the statements .<br />

Through its research, the Chair aims to<br />

inform comp<strong>an</strong>ies about procedures<br />

<strong><strong>an</strong>d</strong> problems which are inherent to the<br />

Germ<strong>an</strong> enforcement system . Moreover,<br />

policies <strong><strong>an</strong>d</strong> best practices are developed<br />

which may <strong>as</strong>sist comp<strong>an</strong>ies in<br />

avoiding erroneous fin<strong>an</strong>cial statements .<br />

In cooperation with Dr . Oliver Beyhs<br />

(KPMG Berlin) the Chair published <strong>an</strong><br />

“Enforcement Guide”, which not only<br />

familiarizes comp<strong>an</strong>ies with the procedural<br />

<strong><strong>an</strong>d</strong> legal <strong>as</strong>pects of the enforcement<br />

system, but also system atically<br />

discusses previous fin<strong>an</strong>cial statement<br />

errors identified by DPR <strong><strong>an</strong>d</strong> BaFin . The<br />

guide may thus help comp<strong>an</strong>ies avoid<br />

erroneous fin<strong>an</strong>cial reporting <strong><strong>an</strong>d</strong> not<br />

be punished <strong>as</strong> “accounting criminals”<br />

by public <strong>an</strong>nouncement .<br />

The findings suggest<br />

that comp<strong>an</strong>ies<br />

with underfunded<br />

pension<br />

obligations use<br />

discretion <strong>as</strong> a way<br />

to achieve posi<strong>tive</strong><br />

capital market<br />

reactions.