- Page 1 and 2:

PREMIER LEAGUE HANDBOOK Season 2015

- Page 4:

PREMIER LEAGUE CHAIRMEN’S CHARTER

- Page 8 and 9:

CLUB DIRECTORY CLUB DIRECTORY

- Page 10 and 11:

AFCB AFCB A F C B AFCB AFCB A F C B

- Page 12 and 13:

Head Groundsman Paul Ashcroft Quali

- Page 14 and 15:

Shirt Sponsor Intuit QuickBooks Kit

- Page 16 and 17:

Facilities Manager Chris Gleeson 02

- Page 18 and 19:

Content Editor Terry Byfield 020 87

- Page 20 and 21:

Head Groundsman Bob Lennon Qualific

- Page 22 and 23:

US UK EUR M M M 33 JP FR M SAMPLE U

- Page 24 and 25:

® ® ® Senior Physiotherapist Chr

- Page 26 and 27:

Head Groundsman Lee Jackson Qualifi

- Page 28 and 29:

Programme Editor Paul Davies Sir Ma

- Page 30 and 31:

Shirt Sponsor Wonga Kit Manufacture

- Page 32 and 33:

Shirt Sponsor Aviva Kit Manufacture

- Page 34 and 35:

Shirt Sponsor Veho Kit Manufacturer

- Page 36 and 37:

® ® ® ® Programme Editor Fraser

- Page 38 and 39:

Programme Editor Rob Mason Stadium

- Page 40 and 41:

Collegiate Navy 54F0 Intense Green

- Page 42 and 43:

Programme Editor Jon Rayner 020 354

- Page 44 and 45:

US UK EUR M M M 33 JP FR M Shirt Sp

- Page 46 and 47:

Programme Editor Dave Bowler The Ha

- Page 48 and 49:

Head Groundsman Dougie Robertson Qu

- Page 50 and 51:

FIXTURES FIXTURES

- Page 52 and 53:

BARCLAYS PREMIER LEAGUE Sunday 16 A

- Page 54 and 55:

BARCLAYS PREMIER LEAGUE Sunday 27 S

- Page 56 and 57:

BARCLAYS PREMIER LEAGUE Saturday 28

- Page 58 and 59:

BARCLAYS PREMIER LEAGUE Saturday 2

- Page 60 and 61:

BARCLAYS PREMIER LEAGUE Saturday 13

- Page 62 and 63:

BARCLAYS PREMIER LEAGUE Saturday 2

- Page 64 and 65:

BARCLAYS PREMIER LEAGUE Sunday 15 M

- Page 66 and 67:

EUROPEAN CLUB COMPETITION DATES 201

- Page 68 and 69:

RULES RULES

- Page 70 and 71: CONTENTS Short Term Cost Control 10

- Page 72 and 73: CONTENTS Media Conference Room 145

- Page 74 and 75: CONTENTS Merchandise 178 Relations

- Page 76 and 77: CONTENTS Legal Representation 215 P

- Page 78 and 79: CONTENTS Form 38: Appeal Against Co

- Page 80 and 81: CONTENTS Scholarships 382 Approache

- Page 82 and 83: PREMIER RULES LEAGUE RULES PREMIER

- Page 84 and 85: SECTION A: DEFINITIONS AND INTERPRE

- Page 86 and 87: SECTION A: DEFINITIONS AND INTERPRE

- Page 88 and 89: SECTION A: DEFINITIONS AND INTERPRE

- Page 90 and 91: SECTION A: DEFINITIONS AND INTERPRE

- Page 92 and 93: SECTION A: DEFINITIONS AND INTERPRE

- Page 94 and 95: SECTION A: DEFINITIONS AND INTERPRE

- Page 96 and 97: SECTION A: DEFINITIONS AND INTERPRE

- Page 98 and 99: SECTION A: DEFINITIONS AND INTERPRE

- Page 100 and 101: SECTION B: THE LEAGUE - GOVERNANCE

- Page 102 and 103: SECTION B: THE LEAGUE - GOVERNANCE

- Page 104 and 105: SECTION C: THE LEAGUE - COMPETITION

- Page 106 and 107: SECTION D: THE LEAGUE - FINANCE Acc

- Page 108 and 109: SECTION D: THE LEAGUE - FINANCE D.1

- Page 110 and 111: SECTION D: THE LEAGUE - FINANCE Ass

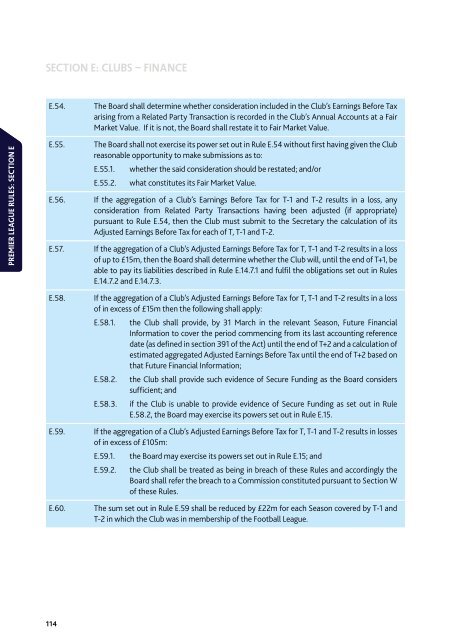

- Page 112 and 113: SECTION E: CLUBS - FINANCE E.8. E.9

- Page 114 and 115: SECTION E: CLUBS - FINANCE E.15. E.

- Page 116 and 117: SECTION E: CLUBS - FINANCE E.27. E.

- Page 118 and 119: SECTION E: CLUBS - FINANCE E.35. E.

- Page 122 and 123: SECTION E: CLUBS - FINANCE PREMIER

- Page 124 and 125: SECTION F: OWNERS’ AND DIRECTORS

- Page 126 and 127: SECTION F: OWNERS’ AND DIRECTORS

- Page 128 and 129: SECTION F: OWNERS’ AND DIRECTORS

- Page 130 and 131: SECTION G: DISCLOSURE OF OWNERSHIP

- Page 132 and 133: SECTION H: DIRECTORS’ REPORTS H.9

- Page 134 and 135: SECTION I: ASSOCIATIONS AND INFLUEN

- Page 136 and 137: SECTION J: MISCELLANEOUS J.6. No Cl

- Page 138 and 139: SECTION K: STADIUM CRITERIA AND BRO

- Page 140 and 141: SECTION K: STADIUM CRITERIA AND BRO

- Page 142 and 143: SECTION K: STADIUM CRITERIA AND BRO

- Page 144 and 145: SECTION K: STADIUM CRITERIA AND BRO

- Page 146 and 147: SECTION K: STADIUM CRITERIA AND BRO

- Page 148 and 149: SECTION K: STADIUM CRITERIA AND BRO

- Page 150 and 151: SECTION K: STADIUM CRITERIA AND BRO

- Page 152 and 153: SECTION K: STADIUM CRITERIA AND BRO

- Page 154 and 155: SECTION K: STADIUM CRITERIA AND BRO

- Page 156 and 157: SECTION K: STADIUM CRITERIA AND BRO

- Page 158 and 159: SECTION K: STADIUM CRITERIA AND BRO

- Page 160 and 161: SECTION K: STADIUM CRITERIA AND BRO

- Page 162 and 163: SECTION L: FIXTURES Other Competiti

- Page 164 and 165: SECTION L: FIXTURES L.23. L.24. L.2

- Page 166 and 167: SECTION L: FIXTURES PREMIER LEAGUE

- Page 168 and 169: SECTION M: PLAYERS’ IDENTIFICATIO

- Page 170 and 171:

SECTION M: PLAYERS’ IDENTIFICATIO

- Page 172 and 173:

SECTION N: MATCH OFFICIALS N.6.9. e

- Page 174 and 175:

SECTION O: MEDICAL Crowd Doctor O.8

- Page 176 and 177:

SECTION O: MEDICAL O.20. O.21. Head

- Page 178 and 179:

SECTION O: MEDICAL PREMIER LEAGUE R

- Page 180 and 181:

SECTION P: MANAGERS Broadcasters an

- Page 182 and 183:

SECTION Q: SCOUTS PREMIER LEAGUE RU

- Page 184 and 185:

SECTION R: CUSTOMER RELATIONS R.6.

- Page 186 and 187:

SECTION R: CUSTOMER RELATIONS R.19.

- Page 188 and 189:

SECTION S: THE SAFEGUARDING OF VULN

- Page 190 and 191:

SECTION S: THE SAFEGUARDING OF VULN

- Page 192 and 193:

SECTION S: THE SAFEGUARDING OF VULN

- Page 194 and 195:

SECTION S: THE SAFEGUARDING OF VULN

- Page 196 and 197:

SECTION T: PLAYERS - CONTRACTS Form

- Page 198 and 199:

SECTION T: PLAYERS - CONTRACTS Appe

- Page 200 and 201:

SECTION T: PLAYERS - CONTRACTS PREM

- Page 202 and 203:

SECTION U: PLAYERS - REGISTRATIONS

- Page 204 and 205:

SECTION U: PLAYERS - REGISTRATIONS

- Page 206 and 207:

SECTION U: PLAYERS - REGISTRATIONS

- Page 208 and 209:

SECTION V: PLAYERS - TRANSFERS OF R

- Page 210 and 211:

SECTION V: PLAYERS - TRANSFERS OF R

- Page 212 and 213:

SECTION V: PLAYERS - TRANSFERS OF R

- Page 214 and 215:

SECTION W: DISCIPLINARY W.9. W.10.

- Page 216 and 217:

SECTION W: DISCIPLINARY Commission

- Page 218 and 219:

SECTION W: DISCIPLINARY W.40. W.41.

- Page 220 and 221:

SECTION W: DISCIPLINARY W.58. W.59.

- Page 222 and 223:

SECTION W: DISCIPLINARY W.79. Subje

- Page 224 and 225:

SECTION X: ARBITRATION Standing X.6

- Page 226 and 227:

SECTION X: ARBITRATION X.21.2. X.21

- Page 228 and 229:

SECTION X: ARBITRATION X.37. Challe

- Page 230 and 231:

SECTION Y: MANAGERS’ ARBITRATION

- Page 232 and 233:

SECTION Z: PREMIER LEAGUE APPEALS C

- Page 234 and 235:

SECTION Z: PREMIER LEAGUE APPEALS C

- Page 236 and 237:

PREMIER LEAGUE FORMS PREMIER LEAGUE

- Page 238 and 239:

PREMIER LEAGUE Form 2 NOTIFICATION

- Page 240 and 241:

Form 3 PREMIER LEAGUE FORMS SALARY

- Page 242 and 243:

PREMIER LEAGUE Form 3 RETURN OF PLA

- Page 244 and 245:

Form 4A CALCULATION OF AGGREGATED A

- Page 246 and 247:

PREMIER LEAGUE Form 5 OWNERS’ AND

- Page 248 and 249:

PREMIER LEAGUE Form 7 DIRECTORS’

- Page 250 and 251:

PREMIER LEAGUE Form 8A ANNUAL FLOOD

- Page 252 and 253:

PREMIER LEAGUE Form 8A ANNUAL FLOOD

- Page 254 and 255:

PREMIER LEAGUE Form 8A ANNUAL FLOOD

- Page 256 and 257:

PREMIER LEAGUE Form 8A ANNUAL FLOOD

- Page 258 and 259:

PREMIER LEAGUE TEAM SHEET OF Form 9

- Page 260 and 261:

PREMIER LEAGUE Form 11 GATE STATEME

- Page 262 and 263:

PREMIER LEAGUE Form 13 REGISTRATION

- Page 264 and 265:

PREMIER LEAGUE Form 15 APPOINTMENT

- Page 266 and 267:

PREMIER LEAGUE Form 17 CANCELLATION

- Page 268 and 269:

PREMIER LEAGUE Form 19 STAFF REGIST

- Page 270 and 271:

PREMIER LEAGUE Form 21 STAFF REGIST

- Page 272 and 273:

PREMIER LEAGUE Form 23 NOTIFICATION

- Page 274 and 275:

PREMIER LEAGUE Form 25 THE FOOTBALL

- Page 276 and 277:

PREMIER LEAGUE Form 25 THE FOOTBALL

- Page 278 and 279:

PREMIER LEAGUE Form 25 THE FOOTBALL

- Page 280 and 281:

PREMIER LEAGUE PREMIER LEAGUE CONTR

- Page 282 and 283:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 284 and 285:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 286 and 287:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 288 and 289:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 290 and 291:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 292 and 293:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 294 and 295:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 296 and 297:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 298 and 299:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 300 and 301:

PREMIER LEAGUE Form 26 PREMIER LEAG

- Page 302 and 303:

PREMIER LEAGUE Form 27 PLAYER ETHNI

- Page 304 and 305:

PREMIER LEAGUE Form 29 TRANSFER AGR

- Page 306 and 307:

PREMIER LEAGUE Form 31 APPLICATION

- Page 308 and 309:

PREMIER LEAGUE Form 33 FIXED PENALT

- Page 310 and 311:

PREMIER LEAGUE Form 35 COMPLAINT (R

- Page 312 and 313:

PREMIER LEAGUE Form 37 APPEAL AGAIN

- Page 314 and 315:

PREMIER LEAGUE Form 39 REQUEST FOR

- Page 316 and 317:

PREMIER LEAGUE Form 41 APPOINTMENT

- Page 318 and 319:

311 PREMIER LEAGUE FORMS

- Page 320 and 321:

YOUTH DEVELOPMENT RULES YOUTH DEVEL

- Page 322 and 323:

GENERAL Clubs’ attention is drawn

- Page 324 and 325:

GENERAL 1.20. “Coaching Curriculu

- Page 326 and 327:

GENERAL 316 Team meeting room on si

- Page 328 and 329:

GENERAL (b) The Academy Player shal

- Page 330 and 331:

GENERAL 1.53. “Part Time” means

- Page 332 and 333:

GENERAL 1.76. “Tournament” mean

- Page 334 and 335:

GENERAL 15. Where a Club which wish

- Page 336 and 337:

GENERAL 24. Upon a Club making a fu

- Page 338 and 339:

STRATEGY, LEADERSHIP AND MANAGEMENT

- Page 340 and 341:

EFFECTIVE MEASUREMENT YOUTH DEVELOP

- Page 342 and 343:

PERFORMANCE MANAGEMENT, PLAYER DEVE

- Page 344 and 345:

STAFF Academy Management Team 57. E

- Page 346 and 347:

STAFF Guidance The Board will deem

- Page 348 and 349:

STAFF Goalkeeping Coaches 73. Each

- Page 350 and 351:

STAFF 85. The Club must record evid

- Page 352 and 353:

STAFF The Board will deem the curre

- Page 354 and 355:

STAFF Academy Doctor 103. Each Club

- Page 356 and 357:

STAFF 109.7. be Full Time in the ca

- Page 358 and 359:

COACHING 116. Save as otherwise per

- Page 360 and 361:

COACHING 124. Clubs which operate D

- Page 362 and 363:

GAMES PROGRAMME 135. Subject to a C

- Page 364 and 365:

GAMES PROGRAMME 140. Each Club shal

- Page 366 and 367:

GAMES PROGRAMME 151. The Football L

- Page 368 and 369:

GAMES PROGRAMME 160. Matches in the

- Page 370 and 371:

GAMES PROGRAMME Guidance The Board

- Page 372 and 373:

EDUCATION AND WELFARE Guidance Club

- Page 374 and 375:

EDUCATION AND WELFARE 197.3. obtain

- Page 376 and 377:

EDUCATION AND WELFARE 203. If a Clu

- Page 378 and 379:

EDUCATION AND WELFARE 209. Each Clu

- Page 380 and 381:

SPORTS SCIENCE AND MEDICINE 219. Ea

- Page 382 and 383:

TALENT IDENTIFICATION AND RECRUITME

- Page 384 and 385:

TALENT IDENTIFICATION AND RECRUITME

- Page 386 and 387:

TALENT IDENTIFICATION AND RECRUITME

- Page 388 and 389:

TALENT IDENTIFICATION AND RECRUITME

- Page 390 and 391:

TALENT IDENTIFICATION AND RECRUITME

- Page 392 and 393:

TALENT IDENTIFICATION AND RECRUITME

- Page 394 and 395:

FACILITIES Guidance Because of Rule

- Page 396 and 397:

FACILITIES 318. Match analysis suit

- Page 398 and 399:

FACILITIES YOUTH DEVELOPMENT RULES

- Page 400 and 401:

FINANCE YOUTH DEVELOPMENT RULES 393

- Page 402 and 403:

COMPENSATION 334. The initial fee r

- Page 404 and 405:

COMPENSATION 338. The appearance fe

- Page 406 and 407:

COMPENSATION 346. The amount of com

- Page 408 and 409:

YOUTH DEVELOPMENT FORMS YOUTH DEVEL

- Page 410 and 411:

SCHOLARSHIP AGREEMENT PLYD Form 1

- Page 412 and 413:

SCHOLARSHIP AGREEMENT PLYD Form 1 6

- Page 414 and 415:

SCHOLARSHIP AGREEMENT PLYD Form 1 1

- Page 416 and 417:

SCHEDULE TWO PLYD Form 1 DISCIPLINA

- Page 418 and 419:

PREMIER LEAGUE PLYD Form 2 NOTIFICA

- Page 420 and 421:

PREMIER LEAGUE PLYD Form 3 NOTICE O

- Page 422 and 423:

PREMIER LEAGUE PLYD Form 5 ACADEMY

- Page 424 and 425:

PREMIER LEAGUE PLYD Form 5A FULL TI

- Page 426 and 427:

PREMIER LEAGUE PLYD Form 5B HYBRID

- Page 428 and 429:

PREMIER LEAGUE PLYD Form 6 ACADEMY

- Page 430 and 431:

PREMIER LEAGUE PLYD Form 8 RETENTIO

- Page 432 and 433:

PREMIER LEAGUE PLYD Form 10 ACADEMY

- Page 434 and 435:

PREMIER LEAGUE PLYD Form 12 RESPONS

- Page 436 and 437:

APPENDICES TO THE RULES APPENDICES

- Page 438 and 439:

APPENDIX 2 INCLUSION AND ANTI-DISCR

- Page 440 and 441:

APPENDIX 3 (4) Close-Up Camera •

- Page 442 and 443:

APPENDIX 3 (3D-3) Steadicam • Wil

- Page 444 and 445:

APPENDIX 3 PLAN C UK Non-Live Camer

- Page 446 and 447:

APPENDIX 4 5. Vaccination Record of

- Page 448 and 449:

APPENDIX 4 F) ORTHOPAEDIC EXAMINATI

- Page 450 and 451:

APPENDIX 4A APPENDICES TO THE RULES

- Page 452 and 453:

APPENDIX 5 9. In all discussions, n

- Page 454 and 455:

APPENDIX 7 STANDARD CLAUSES for inc

- Page 456 and 457:

APPENDIX 9 STANDARD CLAUSES for inc

- Page 458 and 459:

APPENDIX 11 RULES GOVERNING APPLICA

- Page 460 and 461:

APPENDIX 11 13. Rule J.7 - Any Club

- Page 462 and 463:

APPENDIX 12 4.2 any other cost incu

- Page 464 and 465:

APPENDIX 12 Fees and Expenses 26. T

- Page 466 and 467:

APPENDIX 13 The Tours Co-ordinator

- Page 468 and 469:

APPENDIX 13 7. MEDICAL SUPPORT AND

- Page 470 and 471:

APPENDIX 13 11.4 In such accommodat

- Page 472 and 473:

APPENDIX 13 19. AFTER THE TOUR The

- Page 474 and 475:

ACADEMY TOURS Form T1 TOURS CO-ORDI

- Page 476 and 477:

TOUR NOTIFICATION Form T2 8. Accomm

- Page 478 and 479:

ACADEMY TOURS Form T3 STAFF DECLARA

- Page 480 and 481:

ACADEMY TOURS Form T4 RISK ASSESSME

- Page 482 and 483:

ACADEMY TOURS Form T5 PARENTS’ CO

- Page 484 and 485:

PARENTS’ CONSENT: SCHOOL AGE ACAD

- Page 486 and 487:

ACADEMY TOURS Form T7 PARENTS’ CO

- Page 488 and 489:

EMERGENCY PROCEDURES CARD Form T8 6

- Page 490 and 491:

EMERGENCY PROCEDURES CARD Form T8 N

- Page 492 and 493:

TOUR REPORT Form T9 LIST OF PLAYERS

- Page 494 and 495:

TOUR REPORT Form T9 Food: Did you h

- Page 496 and 497:

APPENDIX 14 THE PARENTS AGREE TO

- Page 498 and 499:

491 APPENDICES TO THE RULES

- Page 500 and 501:

MATCH OFFICIALS MATCH OFFICIALS

- Page 502 and 503:

NATIONAL LIST OF ASSISTANT REFEREES

- Page 504 and 505:

NATIONAL LIST OF ASSISTANT REFEREES

- Page 506 and 507:

499 MATCH OFFICIALS

- Page 508 and 509:

MEMORANDUM & ARTICLES OF ASSOCIATIO

- Page 510 and 511:

(k) to lend or advance money and to

- Page 512 and 513:

No. 2719699 THE COMPANIES ACT 1985

- Page 514 and 515:

4. Subject as provided in Article 1

- Page 516 and 517:

9.3 The Board may also refuse to re

- Page 518 and 519:

Excess Shares 12.1 In the event tha

- Page 520 and 521:

19. The notice of a General Meeting

- Page 522 and 523:

several documents in the like form

- Page 524 and 525:

Number and Appointment of Directors

- Page 526 and 527:

Disqualification and Removal of Dir

- Page 528 and 529:

there was a defect in the appointme

- Page 530 and 531:

e confirmed by sending or deliverin

- Page 532 and 533:

MISCELLANEOUS MISCELLANEOUS

- Page 534 and 535:

POINTS BASED SYSTEM Continental Com

- Page 536 and 537:

POINTS BASED SYSTEM • for Nationa

- Page 538 and 539:

POINTS BASED SYSTEM 1.4. Internatio

- Page 540 and 541:

POINTS BASED SYSTEM • The Excepti

- Page 542 and 543:

POINTS BASED SYSTEM that a GBE shou

- Page 544 and 545:

POINTS BASED SYSTEM contract, for i

- Page 546 and 547:

POINTS BASED SYSTEM APPENDIX EXCEPT

- Page 548 and 549:

POINTS BASED SYSTEM Notes: * The a

- Page 550 and 551:

CONSTITUTION OF THE PROFESSIONAL FO

- Page 552 and 553:

CONSTITUTION OF THE PROFESSIONAL FO

- Page 554 and 555:

STATISTICS STATISTICS

- Page 556 and 557:

PREMIER LEAGUE TABLE SEASON 2014/15

- Page 558 and 559:

West Ham United 1-2 0-0 1-0 0-1 1-3

- Page 560 and 561:

PLAYER APPEARANCES AND GOALS SEASON

- Page 562 and 563:

PLAYER APPEARANCES AND GOALS SEASON

- Page 564 and 565:

PLAYER APPEARANCES AND GOALS SEASON

- Page 566 and 567:

PLAYER APPEARANCES AND GOALS SEASON

- Page 568 and 569:

PLAYER APPEARANCES AND GOALS SEASON

- Page 570 and 571:

PREMIER LEAGUE TABLES Premier Leagu

- Page 572 and 573:

PREMIER LEAGUE TABLES Premier Leagu

- Page 574 and 575:

PREMIER LEAGUE TABLES Premier Leagu

- Page 576 and 577:

PREMIER LEAGUE TABLES Premier Leagu

- Page 578 and 579:

PREMIER LEAGUE TABLES Premier Leagu

- Page 580:

573 STATISTICS