Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

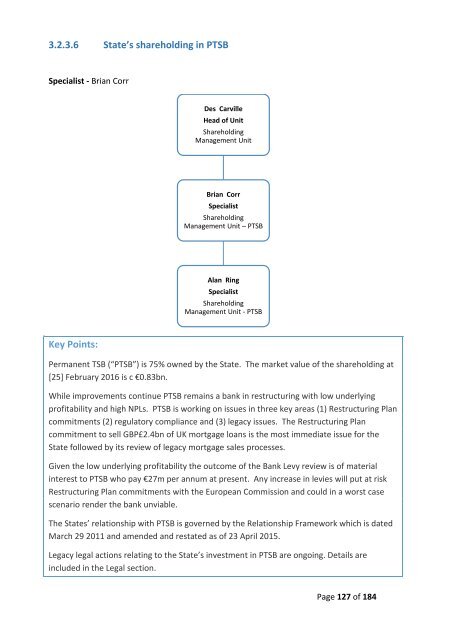

3.2.3.6 State’s shareholding in PTSB<br />

Specialist - Brian Corr<br />

Des Carville<br />

Head of Unit<br />

Shareholding<br />

Management Unit<br />

Brian Corr<br />

Specialist<br />

Shareholding<br />

Management Unit – PTSB<br />

Alan Ring<br />

Specialist<br />

Shareholding<br />

Management Unit - PTSB<br />

Key Points:<br />

Permanent TSB (“PTSB”) is 75% owned by the State. The market value of the shareholding at<br />

[25] February 2016 is c €0.83bn.<br />

While improvements continue PTSB remains a bank in restructuring with low underlying<br />

profitability and high NPLs. PTSB is working on issues in three key areas (1) Restructuring Plan<br />

commitments (2) regulatory compliance and (3) legacy issues. The Restructuring Plan<br />

commitment to sell GBP£2.4bn of UK mortgage loans is the most immediate issue for the<br />

State followed by its review of legacy mortgage sales processes.<br />

Given the low underlying profitability the outcome of the Bank Levy review is of material<br />

interest to PTSB who pay €27m per annum at present. Any increase in levies will put at risk<br />

Restructuring Plan commitments with the European Commission and could in a worst case<br />

scenario render the bank unviable.<br />

The States’ relationship with PTSB is governed by the Relationship Framework which is dated<br />

March 29 2011 and amended and restated as of 23 April 2015.<br />

Legacy legal actions relating to the State’s investment in PTSB are ongoing. Details are<br />

included in the Legal section.<br />

Page 127 of 184