Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

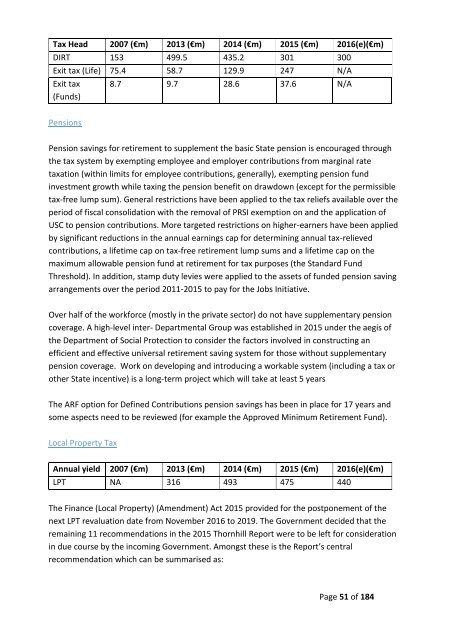

Tax Head 2007 (€m) 2013 (€m) 2014 (€m) 2015 (€m) 2016(e)(€m)<br />

DIRT 153 499.5 435.2 301 300<br />

Exit tax (Life) 75.4 58.7 129.9 247 N/A<br />

Exit tax<br />

(Funds)<br />

8.7 9.7 28.6 37.6 N/A<br />

Pensions<br />

Pension savings for retirement to supplement the basic State pension is encouraged through<br />

the tax system by exempting employee and employer contributions from marginal rate<br />

taxation (within limits for employee contributions, generally), exempting pension fund<br />

investment growth while taxing the pension benefit on drawdown (except for the permissible<br />

tax-free lump sum). General restrictions have been applied to the tax reliefs available over the<br />

period of fiscal consolidation with the removal of PRSI exemption on and the application of<br />

USC to pension contributions. More targeted restrictions on higher-earners have been applied<br />

by significant reductions in the annual earnings cap for determining annual tax-relieved<br />

contributions, a lifetime cap on tax-free retirement lump sums and a lifetime cap on the<br />

maximum allowable pension fund at retirement for tax purposes (the Standard Fund<br />

Threshold). In addition, stamp duty levies were applied to the assets of funded pension saving<br />

arrangements over the period 2011-2015 to pay for the Jobs Initiative.<br />

Over half of the workforce (mostly in the private sector) do not have supplementary pension<br />

coverage. A high-level inter- Departmental Group was established in 2015 under the aegis of<br />

the Department of Social Protection to consider the factors involved in constructing an<br />

efficient and effective universal retirement saving system for those without supplementary<br />

pension coverage. Work on developing and introducing a workable system (including a tax or<br />

other State incentive) is a long-term project which will take at least 5 years<br />

The ARF option for Defined Contributions pension savings has been in place for 17 years and<br />

some aspects need to be reviewed (for example the Approved Minimum Retirement Fund).<br />

Local Property Tax<br />

Annual yield 2007 (€m) 2013 (€m) 2014 (€m) 2015 (€m) 2016(e)(€m)<br />

LPT NA 316 493 475 440<br />

The Finance (Local Property) (Amendment) Act 2015 provided for the postponement of the<br />

next LPT revaluation date from November 2016 to 2019. The Government decided that the<br />

remaining 11 recommendations in the 2015 Thornhill Report were to be left for consideration<br />

in due course by the incoming Government. Amongst these is the Report’s central<br />

recommendation which can be summarised as:<br />

Page 51 of 184