Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

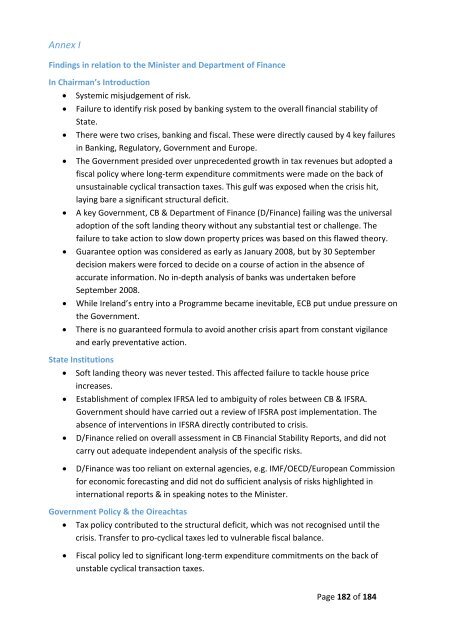

Annex I<br />

Findings in relation to the Minister and Department of Finance<br />

In Chairman’s Introduction<br />

Systemic misjudgement of risk.<br />

<br />

<br />

<br />

<br />

<br />

<br />

Failure to identify risk posed by banking system to the overall financial stability of<br />

State.<br />

There were two crises, banking and fiscal. These were directly caused by 4 key failures<br />

in Banking, Regulatory, Government and Europe.<br />

The Government presided over unprecedented growth in tax revenues but adopted a<br />

fiscal policy where long-term expenditure commitments were made on the back of<br />

unsustainable cyclical transaction taxes. This gulf was exposed when the crisis hit,<br />

laying bare a significant structural deficit.<br />

A key Government, CB & Department of Finance (D/Finance) failing was the universal<br />

adoption of the soft landing theory without any substantial test or challenge. The<br />

failure to take action to slow down property prices was based on this flawed theory.<br />

Guarantee option was considered as early as January 2008, but by 30 September<br />

decision makers were forced to decide on a course of action in the absence of<br />

accurate information. No in-depth analysis of banks was undertaken before<br />

September 2008.<br />

While Ireland’s entry into a Programme became inevitable, ECB put undue pressure on<br />

the Government.<br />

There is no guaranteed formula to avoid another crisis apart from constant vigilance<br />

and early preventative action.<br />

State Institutions<br />

Soft landing theory was never tested. This affected failure to tackle house price<br />

increases.<br />

<br />

<br />

Establishment of complex IFRSA led to ambiguity of roles between CB & IFSRA.<br />

Government should have carried out a review of IFSRA post implementation. The<br />

absence of interventions in IFSRA directly contributed to crisis.<br />

D/Finance relied on overall assessment in CB Financial Stability Reports, and did not<br />

carry out adequate independent analysis of the specific risks.<br />

<br />

D/Finance was too reliant on external agencies, e.g. IMF/OECD/European Commission<br />

for economic forecasting and did not do sufficient analysis of risks highlighted in<br />

international reports & in speaking notes to the Minister.<br />

Government Policy & the Oireachtas<br />

Tax policy contributed to the structural deficit, which was not recognised until the<br />

crisis. Transfer to pro-cyclical taxes led to vulnerable fiscal balance.<br />

<br />

Fiscal policy led to significant long-term expenditure commitments on the back of<br />

unstable cyclical transaction taxes.<br />

Page 182 of 184