Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

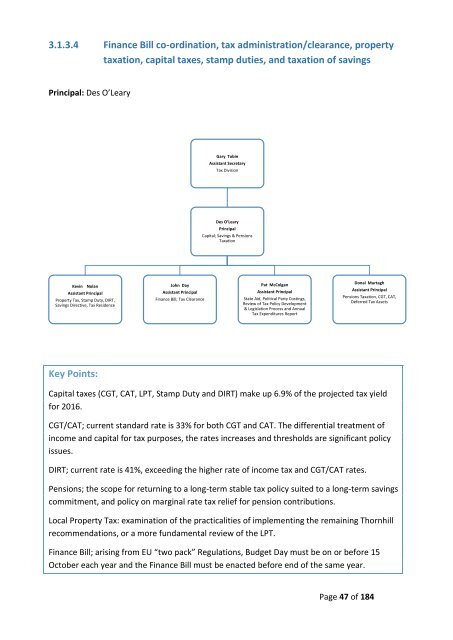

3.1.3.4 Finance Bill co-ordination, tax administration/clearance, property<br />

taxation, capital taxes, stamp duties, and taxation of savings<br />

Principal: Des O’Leary<br />

Gary Tobin<br />

Assistant Secretary<br />

Tax Division<br />

Des O’Leary<br />

Principal<br />

Capital; Savings & Pensions<br />

Taxation<br />

Kevin Nolan<br />

Assistant Principal<br />

Property Tax, Stamp Duty, DIRT,<br />

Savings Directive, Tax Residence<br />

John Day<br />

Assistant Principal<br />

Finance Bill; Tax Clearance<br />

Pat McColgan<br />

Assistant Principal<br />

State Aid, Political Party Costings,<br />

Review of Tax Policy Development<br />

& Legislation Process and Annual<br />

Tax Expenditures Report<br />

Donal Murtagh<br />

Assistant Principal<br />

Pensions Taxation, CGT, CAT,<br />

Deferred Tax Assets<br />

Key Points:<br />

Capital taxes (CGT, CAT, LPT, Stamp Duty and DIRT) make up 6.9% of the projected tax yield<br />

for 2016.<br />

CGT/CAT; current standard rate is 33% for both CGT and CAT. The differential treatment of<br />

income and capital for tax purposes, the rates increases and thresholds are significant policy<br />

issues.<br />

DIRT; current rate is 41%, exceeding the higher rate of income tax and CGT/CAT rates.<br />

Pensions; the scope for returning to a long-term stable tax policy suited to a long-term savings<br />

commitment, and policy on marginal rate tax relief for pension contributions.<br />

Local Property Tax: examination of the practicalities of implementing the remaining Thornhill<br />

recommendations, or a more fundamental review of the LPT.<br />

Finance Bill; arising from EU “two pack” Regulations, Budget Day must be on or before 15<br />

October each year and the Finance Bill must be enacted before end of the same year.<br />

Page 47 of 184