Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

More fundamental threats to tobacco revenues come from more legitimate sources:<br />

<br />

<br />

Consumption trends are in decline with less people smoking and those who do<br />

smoking less. The Health agenda “A Tobacco Free Ireland” sets a target of less than 5%<br />

smoking prevalence in 2025, this figure has already fallen from 28.3% in 2003 to 19.5%<br />

in 2014. Additional Health-related initiatives, such as standardised packaging, are<br />

designed to encourage reduced consumption.<br />

The move towards alternative/novel products such as e-cigarettes, which is not<br />

currently subject to the Tobacco Products Tax, and heated tobacco products, which<br />

may fall under the definition of ‘other smoking tobacco’, thus attracting a lower rate<br />

of duty.<br />

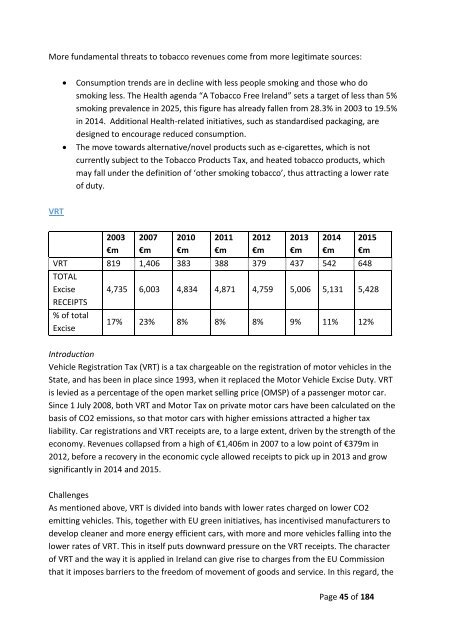

VRT<br />

2003<br />

€m<br />

2007<br />

€m<br />

2010<br />

€m<br />

2011<br />

€m<br />

2012<br />

€m<br />

2013<br />

€m<br />

2014<br />

€m<br />

2015<br />

€m<br />

VRT 819 1,406 383 388 379 437 542 648<br />

TOTAL<br />

Excise 4,735 6,003 4,834 4,871 4,759 5,006 5,131 5,428<br />

RECEIPTS<br />

% of total<br />

Excise<br />

17% 23% 8% 8% 8% 9% 11% 12%<br />

Introduction<br />

Vehicle Registration Tax (VRT) is a tax chargeable on the registration of motor vehicles in the<br />

State, and has been in place since 1993, when it replaced the Motor Vehicle Excise Duty. VRT<br />

is levied as a percentage of the open market selling price (OMSP) of a passenger motor car.<br />

Since 1 July 2008, both VRT and Motor Tax on private motor cars have been calculated on the<br />

basis of CO2 emissions, so that motor cars with higher emissions attracted a higher tax<br />

liability. Car registrations and VRT receipts are, to a large extent, driven by the strength of the<br />

economy. Revenues collapsed from a high of €1,406m in 2007 to a low point of €379m in<br />

2012, before a recovery in the economic cycle allowed receipts to pick up in 2013 and grow<br />

significantly in 2014 and 2015.<br />

Challenges<br />

As mentioned above, VRT is divided into bands with lower rates charged on lower CO2<br />

emitting vehicles. This, together with EU green initiatives, has incentivised manufacturers to<br />

develop cleaner and more energy efficient cars, with more and more vehicles falling into the<br />

lower rates of VRT. This in itself puts downward pressure on the VRT receipts. The character<br />

of VRT and the way it is applied in Ireland can give rise to charges from the EU Commission<br />

that it imposes barriers to the freedom of movement of goods and service. In this regard, the<br />

Page 45 of 184