Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Detail:<br />

Finance Bill Process, Tax Administration, Capital Taxes<br />

Finance Bill process<br />

There is a statutory requirement that the Finance Bill is enacted 4 months from Budget day.<br />

However, under the EU regulations a common budgetary timeline was introduced for all Euro<br />

area Member States. Specifically:<br />

- the draft budget for central government and the main parameters of the draft budgets<br />

for all the other sub-sectors of the general government must be published by the 15th of<br />

October each year;<br />

- draft budgetary plans in a common format must be submitted by all Euro area Member<br />

States not in a programme of assistance; and<br />

- the budget for the central government must be adopted or fixed upon and published by<br />

the 31st of December each year.<br />

From 2013 onwards, Budget Day has been on or before the 15th of October. The Finance Bill<br />

also completes its passage through the Oireachtas by the 31st of December each year. This is<br />

in line with EU legal requirements.<br />

The Finance Bill, which is a Money Bill, addresses all tax measures included in the Budget<br />

which require legislative provision or amendment. It also addresses measures related to tax<br />

administration, Revenue powers and the statutory imposition of anti-avoidance measures.<br />

The Bill is drafted through close consultation between the Department, Revenue and the<br />

Attorney General’s Office, subject to approval of all measures by the Minister.<br />

Capital Taxes<br />

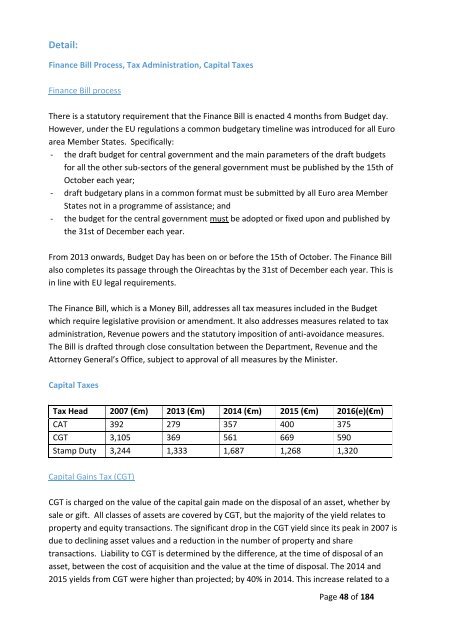

Tax Head 2007 (€m) 2013 (€m) 2014 (€m) 2015 (€m) 2016(e)(€m)<br />

CAT 392 279 357 400 375<br />

CGT 3,105 369 561 669 590<br />

Stamp Duty 3,244 1,333 1,687 1,268 1,320<br />

Capital Gains Tax (CGT)<br />

CGT is charged on the value of the capital gain made on the disposal of an asset, whether by<br />

sale or gift. All classes of assets are covered by CGT, but the majority of the yield relates to<br />

property and equity transactions. The significant drop in the CGT yield since its peak in 2007 is<br />

due to declining asset values and a reduction in the number of property and share<br />

transactions. Liability to CGT is determined by the difference, at the time of disposal of an<br />

asset, between the cost of acquisition and the value at the time of disposal. The 2014 and<br />

2015 yields from CGT were higher than projected; by 40% in 2014. This increase related to a<br />

Page 48 of 184