Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.1.3 Tax Policy Division<br />

Description<br />

This Division is responsible for all aspects of tax policy, domestic and international. It works<br />

closely with the Office of the Revenue Commissioners, OECD and the EU on tax matters. It<br />

analyses policy proposals and drafts and prepares legislation, including the Finance Bill.<br />

Assistant Secretary - Gary Tobin<br />

Ireland’s Tax Burden and its Distribution<br />

The primary function of the tax system is to finance public expenditure. Taxation and public<br />

spending can also contribute to public policy objectives such as economic growth, equity and<br />

sustainable development. Taxes influence economic activity through their effects on<br />

decisions by households and firms on investment, savings, labour market participation and<br />

employment. These decisions are affected not only by the level of taxes but also by how taxes<br />

are designed and combined to generate revenues. Notwithstanding this economic role,<br />

financing the needs of the State remains the primary function of taxation.<br />

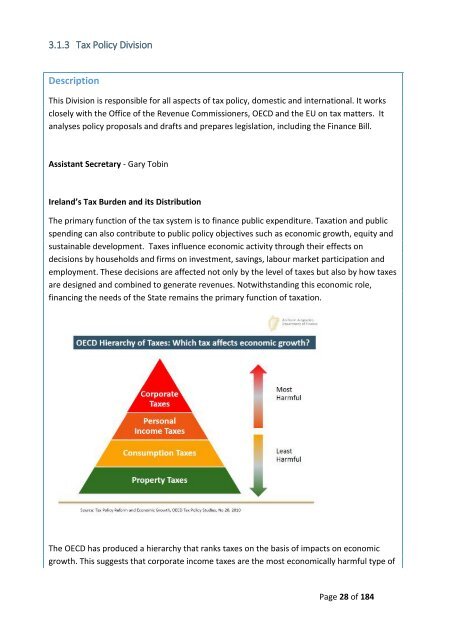

The OECD has produced a hierarchy that ranks taxes on the basis of impacts on economic<br />

growth. This suggests that corporate income taxes are the most economically harmful type of<br />

Page 28 of 184