Minister’s Brief

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

20160229%20Minister%20for%20Finance%20Brief%20redacted%20web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

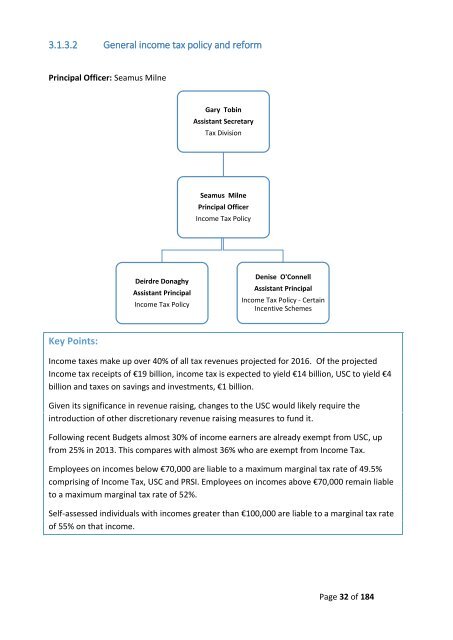

3.1.3.2 General income tax policy and reform<br />

Principal Officer: Seamus Milne<br />

Gary Tobin<br />

Assistant Secretary<br />

Tax Division<br />

Seamus Milne<br />

Principal Officer<br />

Income Tax Policy<br />

Deirdre Donaghy<br />

Assistant Principal<br />

Income Tax Policy<br />

Denise O'Connell<br />

Assistant Principal<br />

Income Tax Policy - Certain<br />

Incentive Schemes<br />

Key Points:<br />

Income taxes make up over 40% of all tax revenues projected for 2016. Of the projected<br />

Income tax receipts of €19 billion, income tax is expected to yield €14 billion, USC to yield €4<br />

billion and taxes on savings and investments, €1 billion.<br />

Given its significance in revenue raising, changes to the USC would likely require the<br />

introduction of other discretionary revenue raising measures to fund it.<br />

Following recent Budgets almost 30% of income earners are already exempt from USC, up<br />

from 25% in 2013. This compares with almost 36% who are exempt from Income Tax.<br />

Employees on incomes below €70,000 are liable to a maximum marginal tax rate of 49.5%<br />

comprising of Income Tax, USC and PRSI. Employees on incomes above €70,000 remain liable<br />

to a maximum marginal tax rate of 52%.<br />

Self-assessed individuals with incomes greater than €100,000 are liable to a marginal tax rate<br />

of 55% on that income.<br />

Page 32 of 184