Economic Diversification and Growth

71mK301zeG0

71mK301zeG0

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

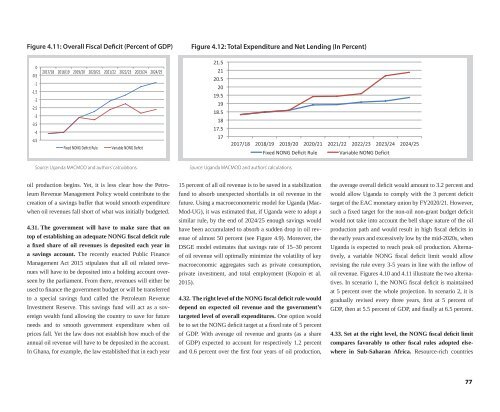

Figure 4.11: Overall Fiscal Deficit (Percent of GDP)<br />

Figure 4.12: Total Expenditure <strong>and</strong> Net Lending (In Percent)<br />

Source: Ug<strong>and</strong>a MACMOD <strong>and</strong> authors’ calculations.<br />

Source: Ug<strong>and</strong>a MACMOD <strong>and</strong> authors’ calculations.<br />

oil production begins. Yet, it is less clear how the Petroleum<br />

Revenue Management Policy would contribute to the<br />

creation of a savings buffer that would smooth expenditure<br />

when oil revenues fall short of what was initially budgeted.<br />

4.31. The government will have to make sure that on<br />

top of establishing an adequate NONG fiscal deficit rule<br />

a fixed share of oil revenues is deposited each year in<br />

a savings account. The recently enacted Public Finance<br />

Management Act 2015 stipulates that all oil related revenues<br />

will have to be deposited into a holding account overseen<br />

by the parliament. From there, revenues will either be<br />

used to finance the government budget or will be transferred<br />

to a special savings fund called the Petroleum Revenue<br />

Investment Reserve. This savings fund will act as a sovereign<br />

wealth fund allowing the country to save for future<br />

needs <strong>and</strong> to smooth government expenditure when oil<br />

prices fall. Yet the law does not establish how much of the<br />

annual oil revenue will have to be deposited in the account.<br />

In Ghana, for example, the law established that in each year<br />

15 percent of all oil revenue is to be saved in a stabilization<br />

fund to absorb unexpected shortfalls in oil revenue in the<br />

future. Using a macroeconometric model for Ug<strong>and</strong>a (Mac-<br />

Mod-UG), it was estimated that, if Ug<strong>and</strong>a were to adopt a<br />

similar rule, by the end of 2024/25 enough savings would<br />

have been accumulated to absorb a sudden drop in oil revenue<br />

of almost 50 percent (see Figure 4.9). Moreover, the<br />

DSGE model estimates that savings rate of 15–30 percent<br />

of oil revenue will optimally minimize the volatility of key<br />

macroeconomic aggregates such as private consumption,<br />

private investment, <strong>and</strong> total employment (Kopoin et al.<br />

2015).<br />

4.32. The right level of the NONG fiscal deficit rule would<br />

depend on expected oil revenue <strong>and</strong> the government’s<br />

targeted level of overall expenditures. One option would<br />

be to set the NONG deficit target at a fixed rate of 5 percent<br />

of GDP. With average oil revenue <strong>and</strong> grants (as a share<br />

of GDP) expected to account for respectively 1.2 percent<br />

<strong>and</strong> 0.6 percent over the first four years of oil production,<br />

the average overall deficit would amount to 3.2 percent <strong>and</strong><br />

would allow Ug<strong>and</strong>a to comply with the 3 percent deficit<br />

target of the EAC monetary union by FY2020/21. However,<br />

such a fixed target for the non-oil non-grant budget deficit<br />

would not take into account the bell shape nature of the oil<br />

production path <strong>and</strong> would result in high fiscal deficits in<br />

the early years <strong>and</strong> excessively low by the mid-2020s, when<br />

Ug<strong>and</strong>a is expected to reach peak oil production. Alternatively,<br />

a variable NONG fiscal deficit limit would allow<br />

revising the rule every 3-5 years in line with the inflow of<br />

oil revenue. Figures 4.10 <strong>and</strong> 4.11 illustrate the two alternatives.<br />

In scenario 1, the NONG fiscal deficit is maintained<br />

at 5 percent over the whole projection. In scenario 2, it is<br />

gradually revised every three years, first at 5 percent of<br />

GDP, then at 5.5 percent of GDP, <strong>and</strong> finally at 6.5 percent.<br />

4.33. Set at the right level, the NONG fiscal deficit limit<br />

compares favorably to other fiscal rules adopted elsewhere<br />

in Sub-Saharan Africa. Resource-rich countries<br />

77