Economic Diversification and Growth

71mK301zeG0

71mK301zeG0

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 4<br />

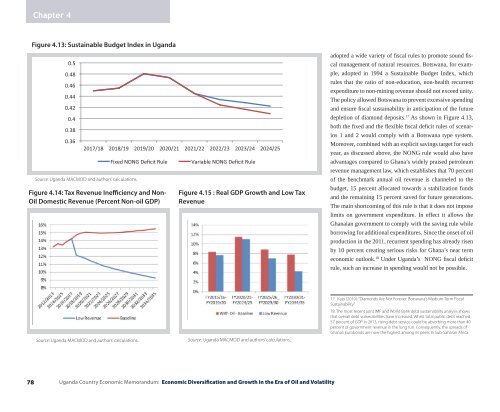

Figure 4.13: Sustainable Budget Index in Ug<strong>and</strong>a<br />

Source: Ug<strong>and</strong>a MACMOD <strong>and</strong> authors’ calculations.<br />

Figure 4.14: Tax Revenue Inefficiency <strong>and</strong> Non-<br />

Oil Domestic Revenue (Percent Non-oil GDP)<br />

Figure 4.15 : Real GDP <strong>Growth</strong> <strong>and</strong> low tax<br />

revenue<br />

adopted a wide variety of fiscal rules to promote sound fiscal<br />

management of natural resources. Botswana, for example,<br />

adopted in 1994 a Sustainable Budget Index, which<br />

rules that the ratio of non-education, non-health recurrent<br />

expenditure to non-mining revenue should not exceed unity.<br />

The policy allowed Botswana to prevent excessive spending<br />

<strong>and</strong> ensure fiscal sustainability in anticipation of the future<br />

depletion of diamond deposits. 17 As shown in Figure 4.13,<br />

both the fixed <strong>and</strong> the flexible fiscal deficit rules of scenarios<br />

1 <strong>and</strong> 2 would comply with a Botswana type system.<br />

Moreover, combined with an explicit savings target for each<br />

year, as discussed above, the NONG rule would also have<br />

advantages compared to Ghana’s widely praised petroleum<br />

revenue management law, which establishes that 70 percent<br />

of the benchmark annual oil revenue is channeled to the<br />

budget, 15 percent allocated towards a stabilization funds<br />

<strong>and</strong> the remaining 15 percent saved for future generations.<br />

The main shortcoming of this rule is that it does not impose<br />

limits on government expenditure. In effect it allows the<br />

Ghanaian government to comply with the saving rule while<br />

borrowing for additional expenditures. Since the onset of oil<br />

production in the 2011, recurrent spending has already risen<br />

by 10 percent creating serious risks for Ghana’s near term<br />

economic outlook. 18 Under Ug<strong>and</strong>a’s NONG fiscal deficit<br />

rule, such an increase in spending would not be possible.<br />

Source: Ug<strong>and</strong>a MACMOD <strong>and</strong> authors’ calculations.<br />

Source: Ug<strong>and</strong>a MACMOD <strong>and</strong> authors’ calculations.<br />

17. Kajo (2010): “Diamonds Are Not Forever: Botswana’s Medium-Term Fiscal<br />

Sustainability”.<br />

18. The most recent joint IMF <strong>and</strong> World Bank debt sustainability analysis shows<br />

that overall debt vulnerabilities have increased. Whilst total public debt reached<br />

57 percent of GDP in 2013, rising debt service could be absorbing more than 40<br />

percent of government revenue in the long run. Consequently, the spreads of<br />

Ghana’s Eurobonds are now the highest among its peers in Sub-Saharan Africa.<br />

78<br />

Ug<strong>and</strong>a Country <strong>Economic</strong> Memor<strong>and</strong>um: <strong>Economic</strong> <strong>Diversification</strong> <strong>and</strong> <strong>Growth</strong> in the Era of Oil <strong>and</strong> Volatility