Economic Diversification and Growth

71mK301zeG0

71mK301zeG0

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 7<br />

IV. The Positive <strong>and</strong> Negative Impact of a<br />

Future Monetary Union<br />

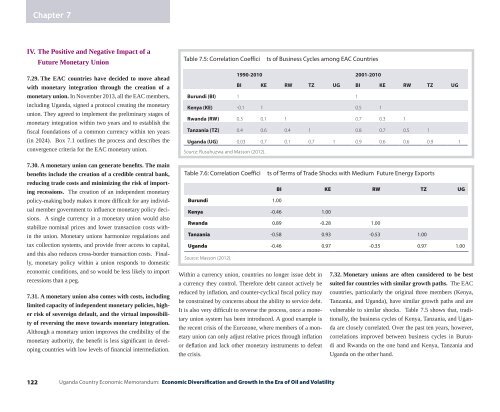

Table 7.5: Correlation Coeffici<br />

ts of Business Cycles among EAC Countries<br />

7.29. The EAC countries have decided to move ahead<br />

with monetary integration through the creation of a<br />

monetary union. In November 2013, all the EAC members,<br />

including Ug<strong>and</strong>a, signed a protocol creating the monetary<br />

union. They agreed to implement the preliminary stages of<br />

monetary integration within two years <strong>and</strong> to establish the<br />

fiscal foundations of a common currency within ten years<br />

(in 2024). Box 7.1 outlines the process <strong>and</strong> describes the<br />

convergence criteria for the EAC monetary union.<br />

7.30. A monetary union can generate benefits. The main<br />

benefits include the creation of a credible central bank,<br />

reducing trade costs <strong>and</strong> minimizing the risk of importing<br />

recessions. The creation of an independent monetary<br />

policy-making body makes it more difficult for any individual<br />

member government to influence monetary policy decisions.<br />

A single currency in a monetary union would also<br />

stabilize nominal prices <strong>and</strong> lower transaction costs within<br />

the union. Monetary unions harmonize regulations <strong>and</strong><br />

tax collection systems, <strong>and</strong> provide freer access to capital,<br />

<strong>and</strong> this also reduces cross-border transaction costs. Finally,<br />

monetary policy within a union responds to domestic<br />

economic conditions, <strong>and</strong> so would be less likely to import<br />

recessions than a peg.<br />

7.31. A monetary union also comes with costs, including<br />

limited capacity of independent monetary policies, higher<br />

risk of sovereign default, <strong>and</strong> the virtual impossibility<br />

of reversing the move towards monetary integration.<br />

Although a monetary union improves the credibility of the<br />

monetary authority, the benefit is less significant in developing<br />

countries with low levels of financial intermediation.<br />

1990-2010 2001-2010<br />

BI KE RW TZ UG BI KE RW TZ UG<br />

Burundi (BI) 1 1<br />

Kenya (KE) -0.1 1 0.5 1<br />

Rw<strong>and</strong>a (RW) 0.3 0.1 1 0.7 0.3 1<br />

Tanzania (TZ) 0.4 0.6 0.4 1 0.8 0.7 0.5 1<br />

Ug<strong>and</strong>a (UG) 0.03 0.7 0.1 0.7 1 0.9 0.6 0.6 0.9 1<br />

Source: Rusuhuzwa <strong>and</strong> Masson (2012).<br />

Table 7.6: Correlation Coeffici ts of Terms of Trade Shocks with Medium Future Energy Exports<br />

BI KE RW TZ UG<br />

Burundi 1.00<br />

Kenya -0.46 1.00<br />

Rw<strong>and</strong>a 0.89 -0.28 1.00<br />

Tanzania -0.58 0.93 -0.53 1.00<br />

Ug<strong>and</strong>a -0.46 0.97 -0.35 0.97 1.00<br />

Source: Masson (2012).<br />

Within a currency union, countries no longer issue debt in<br />

a currency they control. Therefore debt cannot actively be<br />

reduced by inflation, <strong>and</strong> counter-cyclical fiscal policy may<br />

be constrained by concerns about the ability to service debt.<br />

It is also very difficult to reverse the process, once a monetary<br />

union system has been introduced. A good example is<br />

the recent crisis of the Eurozone, where members of a monetary<br />

union can only adjust relative prices through inflation<br />

or deflation <strong>and</strong> lack other monetary instruments to defeat<br />

the crisis.<br />

7.32. Monetary unions are often considered to be best<br />

suited for countries with similar growth paths. The EAC<br />

countries, particularly the original three members (Kenya,<br />

Tanzania, <strong>and</strong> Ug<strong>and</strong>a), have similar growth paths <strong>and</strong> are<br />

vulnerable to similar shocks. Table 7.5 shows that, traditionally,<br />

the business cycles of Kenya, Tanzania, <strong>and</strong> Ug<strong>and</strong>a<br />

are closely correlated. Over the past ten years, however,<br />

correlations improved between business cycles in Burundi<br />

<strong>and</strong> Rw<strong>and</strong>a on the one h<strong>and</strong> <strong>and</strong> Kenya, Tanzania <strong>and</strong><br />

Ug<strong>and</strong>a on the other h<strong>and</strong>.<br />

122<br />

Ug<strong>and</strong>a Country <strong>Economic</strong> Memor<strong>and</strong>um: <strong>Economic</strong> <strong>Diversification</strong> <strong>and</strong> <strong>Growth</strong> in the Era of Oil <strong>and</strong> Volatility