Economic Diversification and Growth

71mK301zeG0

71mK301zeG0

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

nue will need to be accompanied by an equivalent reduction<br />

in expenditure. With a credible limit based on an enforced<br />

NONG fiscal deficit rule, the government would have to<br />

continue ongoing efforts to widen the tax base <strong>and</strong> improve<br />

the administrative efficiency of tax collection.<br />

D. Other issues: spending pressures<br />

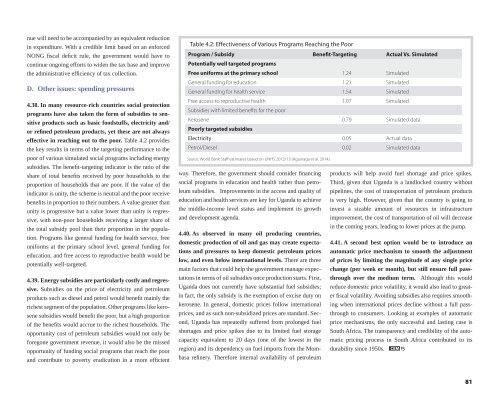

4.38. In many resource-rich countries social protection<br />

programs have also taken the form of subsidies to sensitive<br />

products such as basic foodstuffs, electricity <strong>and</strong>/<br />

or refined petroleum products, yet these are not always<br />

effective in reaching out to the poor. Table 4.2 provides<br />

the key results in terms of the targeting performance to the<br />

poor of various simulated social programs including energy<br />

subsidies. The benefit-targeting indicator is the ratio of the<br />

share of total benefits received by poor households to the<br />

proportion of households that are poor. If the value of the<br />

indicator is unity, the scheme is neutral <strong>and</strong> the poor receive<br />

benefits in proportion to their numbers. A value greater than<br />

unity is progressive but a value lower than unity is regressive,<br />

with non-poor households receiving a larger share of<br />

the total subsidy pool than their proportion in the population.<br />

Programs like general funding for health service, free<br />

uniforms at the primary school level, general funding for<br />

education, <strong>and</strong> free access to reproductive health would be<br />

potentially well-targeted.<br />

4.39. Energy subsidies are particularly costly <strong>and</strong> regressive.<br />

Subsidies on the price of electricity <strong>and</strong> petroleum<br />

products such as diesel <strong>and</strong> petrol would benefit mainly the<br />

richest segment of the population. Other programs like kerosene<br />

subsidies would benefit the poor, but a high proportion<br />

of the benefits would accrue to the richest households. The<br />

opportunity cost of petroleum subsidies would not only be<br />

foregone government revenue, it would also be the missed<br />

opportunity of funding social programs that reach the poor<br />

<strong>and</strong> contribute to poverty eradication in a more efficient<br />

Table 4.2: Effectiveness of Various Programs Reaching the Poor<br />

Program / Subsidy Benefit-Targeting Actual Vs. Simulated<br />

Potentially well targeted programs<br />

Free uniforms at the primary school 1.24 Simulated<br />

General funding for education 1.21 Simulated<br />

General funding for health service 1.54 Simulated<br />

Free access to reproductive health 1.07 Simulated<br />

Subsidies with limited benefits for the poor<br />

Kerosene 0.79 Simulated data<br />

Poorly targeted subsidies<br />

Electricity 0.05 Actual data<br />

Petrol/Diesel 0.02 Simulated data<br />

Source: World Bank Staff estimates based on UNHS 2012/13 (Aguinaga et al. 2014).<br />

way. Therefore, the government should consider financing<br />

social programs in education <strong>and</strong> health rather than petroleum<br />

subsidies. Improvements in the access <strong>and</strong> quality of<br />

education <strong>and</strong> health services are key for Ug<strong>and</strong>a to achieve<br />

the middle-income level status <strong>and</strong> implement its growth<br />

<strong>and</strong> development agenda.<br />

products will help avoid fuel shortage <strong>and</strong> price spikes.<br />

Third, given that Ug<strong>and</strong>a is a l<strong>and</strong>locked country without<br />

pipelines, the cost of transportation of petroleum products<br />

is very high. However, given that the country is going to<br />

invest a sizable amount of resources in infrastructure<br />

improvement, the cost of transportation of oil will decrease<br />

in the coming years, leading to lower prices at the pump.<br />

4.40. As observed in many oil producing countries,<br />

domestic production of oil <strong>and</strong> gas may create expectations<br />

<strong>and</strong> pressures to keep domestic petroleum prices<br />

low, <strong>and</strong> even below international levels. There are three<br />

main factors that could help the government manage expectations<br />

in terms of oil subsidies once production starts. First,<br />

Ug<strong>and</strong>a does not currently have substantial fuel subsidies;<br />

in fact, the only subsidy is the exemption of excise duty on<br />

kerosene. In general, domestic prices follow international<br />

prices, <strong>and</strong> as such non-subsidized prices are st<strong>and</strong>ard. Second,<br />

Ug<strong>and</strong>a has repeatedly suffered from prolonged fuel<br />

shortages <strong>and</strong> price spikes due to its limited fuel storage<br />

capacity equivalent to 20 days (one of the lowest in the<br />

region) <strong>and</strong> its dependency on fuel imports from the Mombasa<br />

4.41. A second best option would be to introduce an<br />

automatic price mechanism to smooth the adjustment<br />

of prices by limiting the magnitude of any single price<br />

change (per week or month), but still ensure full passthrough<br />

over the medium term. Although this would<br />

reduce domestic price volatility, it would also lead to greater<br />

fiscal volatility. Avoiding subsidies also requires smoothing<br />

when international prices decline without a full passthrough<br />

to consumers. Looking at examples of automatic<br />

price mechanisms, the only successful <strong>and</strong> lasting case is<br />

South Africa. The transparency <strong>and</strong> credibility of the automatic<br />

pricing process in South Africa contributed to its<br />

durability since 1950s.<br />

refinery. Therefore internal availability of<br />

petroleum<br />

81