Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

Achieve the financial plan<br />

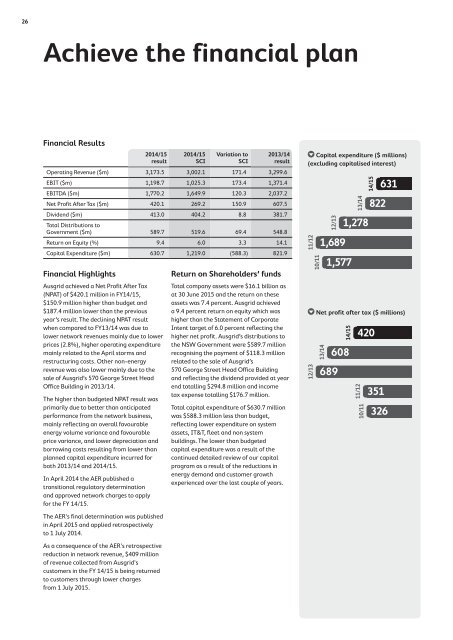

Financial Results<br />

2014/15<br />

result<br />

2014/15<br />

SCI<br />

Variation to<br />

SCI<br />

2013/14<br />

result<br />

Operating Revenue ($m) 3,173.5 3,002.1 171.4 3,299.6<br />

EBIT ($m) 1,198.7 1,025.3 173.4 1,371.4<br />

EBITDA ($m) 1,770.2 1,649.9 120.3 2,037.2<br />

Net Profit After Tax ($m) 420.1 269.2 150.9 607.5<br />

Dividend ($m) 413.0 404.2 8.8 381.7<br />

Total Distributions to<br />

Government ($m) 589.7 519.6 69.4 548.8<br />

Return on Equity (%) 9.4 6.0 3.3 14.1<br />

Capital Expenditure ($m) 630.7 1,219.0 (588.3) 821.9<br />

Financial Highlights<br />

Ausgrid achieved a Net Profit After Tax<br />

(NPAT) of $420.1 million in FY14/15,<br />

$150.9 million higher than budget and<br />

$187.4 million lower than the previous<br />

year’s result. The declining NPAT result<br />

when compared to FY13/14 was due to<br />

lower network revenues mainly due to lower<br />

prices (2.8%), higher operating expenditure<br />

mainly related to the April storms and<br />

restructuring costs. Other non-energy<br />

revenue was also lower mainly due to the<br />

sale of Ausgrid’s 570 George Street Head<br />

Office Building in 2013/14.<br />

The higher than budgeted NPAT result was<br />

primarily due to better than anticipated<br />

performance from the network business,<br />

mainly reflecting an overall favourable<br />

energy volume variance and favourable<br />

price variance, and lower depreciation and<br />

borrowing costs resulting from lower than<br />

planned capital expenditure incurred for<br />

both 2013/14 and 2014/15.<br />

In April 2014 the AER published a<br />

transitional regulatory determination<br />

and approved network charges to apply<br />

for the FY 14/15.<br />

The AER's final determination was published<br />

in April 2015 and applied retrospectively<br />

to 1 July 2014.<br />

As a consequence of the AER's retrospective<br />

reduction in network revenue, $409 million<br />

of revenue collected from Ausgrid's<br />

customers in the FY 14/15 is being returned<br />

to customers through lower charges<br />

from 1 July 2015.<br />

Return on Shareholders’ funds<br />

Total company assets were $16.1 billion as<br />

at 30 June 2015 and the return on these<br />

assets was 7.4 percent. Ausgrid achieved<br />

a 9.4 percent return on equity which was<br />

higher than the Statement of Corporate<br />

Intent target of 6.0 percent reflecting the<br />

higher net profit. Ausgrid’s distributions to<br />

the NSW Government were $589.7 million<br />

recognising the payment of $118.3 million<br />

related to the sale of Ausgrid’s<br />

570 George Street Head Office Building<br />

and reflecting the dividend provided at year<br />

end totalling $294.8 million and income<br />

tax expense totalling $176.7 million.<br />

Total capital expenditure of $630.7 million<br />

was $588.3 million less than budget,<br />

reflecting lower expenditure on system<br />

assets, IT&T, fleet and non system<br />

buildings. The lower than budgeted<br />

capital expenditure was a result of the<br />

continued detailed review of our capital<br />

program as a result of the reductions in<br />

energy demand and customer growth<br />

experienced over the last couple of years.<br />

Capital expenditure ($ millions)<br />

(excluding capitalised interest)<br />

11/12<br />

10/11<br />

12/13<br />

1,689<br />

13/14<br />

1,577<br />

689<br />

13/14<br />

1,278<br />

14/15<br />

608<br />

14/15<br />

420<br />

822<br />

631<br />

Net profit after tax ($ millions)<br />

10/11 11/12 12/13<br />

351<br />

326