Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Ausgrid – <strong>Annual</strong> <strong>Report</strong> 2014/15 57<br />

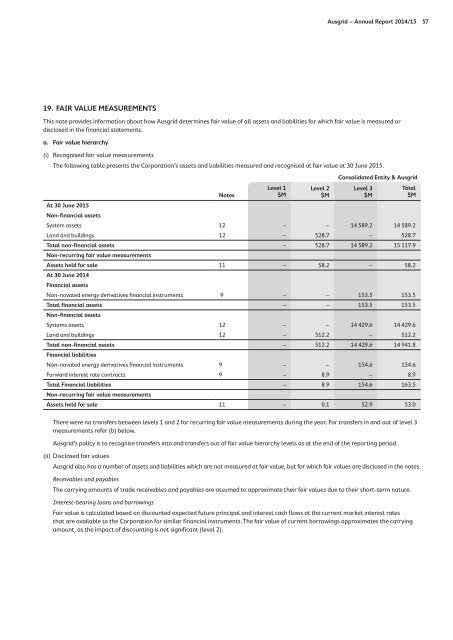

19. FAIR VALUE MEASUREMENTS<br />

This note provides information about how Ausgrid determines fair value of all assets and liabilities for which fair value is measured or<br />

disclosed in the financial statements.<br />

a. Fair value hierarchy<br />

(i) Recognised fair value measurements<br />

The following table presents the Corporation’s assets and liabilities measured and recognised at fair value at 30 June 2015.<br />

At 30 June 2015<br />

Non‐financial assets<br />

Notes<br />

Level 1<br />

$M<br />

Level 2<br />

$M<br />

Consolidated Entity & Ausgrid<br />

Level 3<br />

$M<br />

System assets 12 – – 14 589.2 14 589.2<br />

Land and buildings 12 – 528.7 – 528.7<br />

Total non‐financial assets – 528.7 14 589.2 15 117.9<br />

Non‐recurring fair value measurements<br />

Assets held for sale 11 – 58.2 – 58.2<br />

At 30 June 2014<br />

Financial assets<br />

Non‐novated energy derivatives financial instruments 9 – – 153.5 153.5<br />

Total financial assets – – 153.5 153.5<br />

Non‐financial assets<br />

Systems assets 12 – – 14 429.6 14 429.6<br />

Land and buildings 12 – 512.2 – 512.2<br />

Total non‐financial assets – 512.2 14 429.6 14 941.8<br />

Financial liabilities<br />

Non‐novated energy derivatives financial instruments 9 – – 154.6 154.6<br />

Forward interest rate contracts 9 – 8.9 – 8.9<br />

Total Financial liabilities – 8.9 154.6 163.5<br />

Non‐recurring fair value measurements<br />

Assets held for sale 11 – 0.1 52.9 53.0<br />

There were no transfers between levels 1 and 2 for recurring fair value measurements during the year. For transfers in and out of level 3<br />

measurements refer (b) below.<br />

Ausgrid’s policy is to recognise transfers into and transfers out of fair value hierarchy levels as at the end of the reporting period.<br />

(ii) Disclosed fair values<br />

Ausgrid also has a number of assets and liabilities which are not measured at fair value, but for which fair values are disclosed in the notes.<br />

Receivables and payables<br />

The carrying amounts of trade receivables and payables are assumed to approximate their fair values due to their short‐term nature.<br />

Interest‐bearing loans and borrowings<br />

Fair value is calculated based on discounted expected future principal and interest cash flows at the current market interest rates<br />

that are available to the Corporation for similar financial instruments. The fair value of current borrowings approximates the carrying<br />

amount, as the impact of discounting is not significant (level 2).<br />

Total<br />

$M