Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

68<br />

Ausgrid and Controlled Entity<br />

Notes to financial statements<br />

For the year ended 30 June 2015<br />

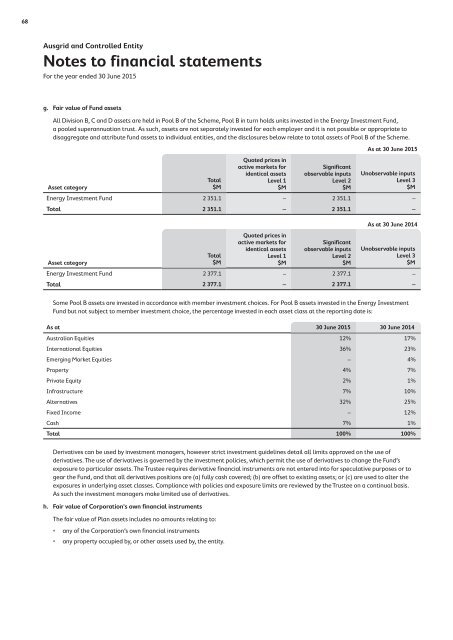

g. Fair value of Fund assets<br />

All Division B, C and D assets are held in Pool B of the Scheme, Pool B in turn holds units invested in the Energy Investment Fund,<br />

a pooled superannuation trust. As such, assets are not separately invested for each employer and it is not possible or appropriate to<br />

disaggregate and attribute fund assets to individual entities, and the disclosures below relate to total assets of Pool B of the Scheme.<br />

Asset category<br />

Total<br />

$M<br />

Quoted prices in<br />

active markets for<br />

identical assets<br />

Level 1<br />

$M<br />

Significant<br />

observable inputs<br />

Level 2<br />

$M<br />

As at 30 June 2015<br />

Unobservable inputs<br />

Level 3<br />

$M<br />

Energy Investment Fund 2 351.1 – 2 351.1 –<br />

Total 2 351.1 – 2 351.1 –<br />

Asset category<br />

Total<br />

$M<br />

Quoted prices in<br />

active markets for<br />

identical assets<br />

Level 1<br />

$M<br />

Significant<br />

observable inputs<br />

Level 2<br />

$M<br />

As at 30 June 2014<br />

Unobservable inputs<br />

Level 3<br />

$M<br />

Energy Investment Fund 2 377.1 – 2 377.1 –<br />

Total 2 377.1 – 2 377.1 –<br />

Some Pool B assets are invested in accordance with member investment choices. For Pool B assets invested in the Energy Investment<br />

Fund but not subject to member investment choice, the percentage invested in each asset class at the reporting date is:<br />

As at 30 June 2015 30 June 2014<br />

Australian Equities 12% 17%<br />

International Equities 36% 23%<br />

Emerging Market Equities – 4%<br />

Property 4% 7%<br />

Private Equity 2% 1%<br />

Infrastructure 7% 10%<br />

Alternatives 32% 25%<br />

Fixed Income – 12%<br />

Cash 7% 1%<br />

Total 100% 100%<br />

Derivatives can be used by investment managers, however strict investment guidelines detail all limits approved on the use of<br />

derivatives. The use of derivatives is governed by the investment policies, which permit the use of derivatives to change the Fund’s<br />

exposure to particular assets. The Trustee requires derivative financial instruments are not entered into for speculative purposes or to<br />

gear the Fund, and that all derivatives positions are (a) fully cash covered; (b) are offset to existing assets; or (c) are used to alter the<br />

exposures in underlying asset classes. Compliance with policies and exposure limits are reviewed by the Trustee on a continual basis.<br />

As such the investment managers make limited use of derivatives.<br />

h. Fair value of Corporation's own financial instruments<br />

The fair value of Plan assets includes no amounts relating to:<br />

• any of the Corporation’s own financial instruments<br />

• any property occupied by, or other assets used by, the entity.