Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

Ausgrid and Controlled Entity<br />

Notes to financial statements<br />

For the year ended 30 June 2015<br />

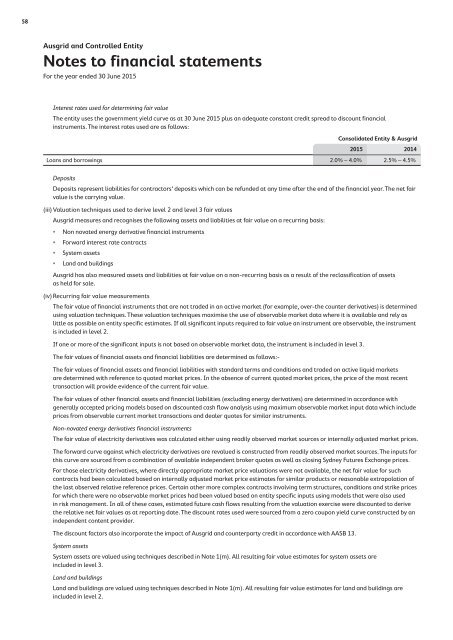

Interest rates used for determining fair value<br />

The entity uses the government yield curve as at 30 June 2015 plus an adequate constant credit spread to discount financial<br />

instruments. The interest rates used are as follows:<br />

Consolidated Entity & Ausgrid<br />

2015 2014<br />

Loans and borrowings 2.0% – 4.0% 2.5% – 4.5%<br />

Deposits<br />

Deposits represent liabilities for contractors’ deposits which can be refunded at any time after the end of the financial year. The net fair<br />

value is the carrying value.<br />

(iii) Valuation techniques used to derive level 2 and level 3 fair values<br />

Ausgrid measures and recognises the following assets and liabilities at fair value on a recurring basis:<br />

• Non novated energy derivative financial instruments<br />

• Forward interest rate contracts<br />

• System assets<br />

• Land and buildings<br />

Ausgrid has also measured assets and liabilities at fair value on a non‐recurring basis as a result of the reclassification of assets<br />

as held for sale.<br />

(iv) Recurring fair value measurements<br />

The fair value of financial instruments that are not traded in an active market (for example, over‐the counter derivatives) is determined<br />

using valuation techniques. These valuation techniques maximise the use of observable market data where it is available and rely as<br />

little as possible on entity specific estimates. If all significant inputs required to fair value an instrument are observable, the instrument<br />

is included in level 2.<br />

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.<br />

The fair values of financial assets and financial liabilities are determined as follows:‐<br />

The fair values of financial assets and financial liabilities with standard terms and conditions and traded on active liquid markets<br />

are determined with reference to quoted market prices. In the absence of current quoted market prices, the price of the most recent<br />

transaction will provide evidence of the current fair value.<br />

The fair values of other financial assets and financial liabilities (excluding energy derivatives) are determined in accordance with<br />

generally accepted pricing models based on discounted cash flow analysis using maximum observable market input data which include<br />

prices from observable current market transactions and dealer quotes for similar instruments.<br />

Non‐novated energy derivatives financial instruments<br />

The fair value of electricity derivatives was calculated either using readily observed market sources or internally adjusted market prices.<br />

The forward curve against which electricity derivatives are revalued is constructed from readily observed market sources. The inputs for<br />

this curve are sourced from a combination of available independent broker quotes as well as closing Sydney Futures Exchange prices.<br />

For those electricity derivatives, where directly appropriate market price valuations were not available, the net fair value for such<br />

contracts had been calculated based on internally adjusted market price estimates for similar products or reasonable extrapolation of<br />

the last observed relative reference prices. Certain other more complex contracts involving term structures, conditions and strike prices<br />

for which there were no observable market prices had been valued based on entity specific inputs using models that were also used<br />

in risk management. In all of these cases, estimated future cash flows resulting from the valuation exercise were discounted to derive<br />

the relative net fair values as at reporting date. The discount rates used were sourced from a zero coupon yield curve constructed by an<br />

independent content provider.<br />

The discount factors also incorporate the impact of Ausgrid and counterparty credit in accordance with AASB 13.<br />

System assets<br />

System assets are valued using techniques described in Note 1(m). All resulting fair value estimates for system assets are<br />

included in level 3.<br />

Land and buildings<br />

Land and buildings are valued using techniques described in Note 1(m). All resulting fair value estimates for land and buildings are<br />

included in level 2.