Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

54<br />

Ausgrid and Controlled Entity<br />

Notes to financial statements<br />

For the year ended 30 June 2015<br />

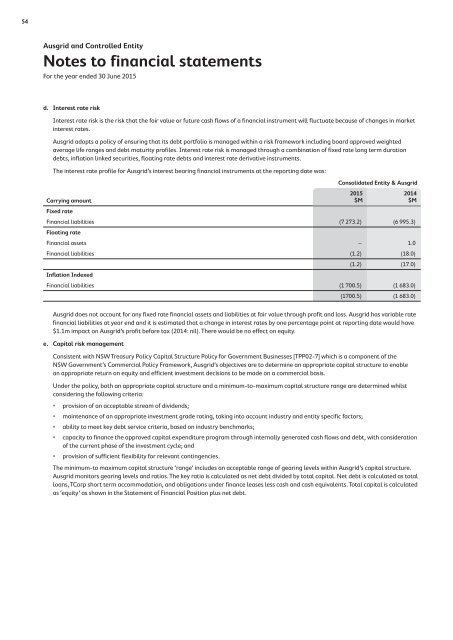

d. Interest rate risk<br />

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market<br />

interest rates.<br />

Ausgrid adopts a policy of ensuring that its debt portfolio is managed within a risk framework including board approved weighted<br />

average life ranges and debt maturity profiles. Interest rate risk is managed through a combination of fixed rate long term duration<br />

debts, inflation linked securities, floating rate debts and interest rate derivative instruments.<br />

The interest rate profile for Ausgrid’s interest bearing financial instruments at the reporting date was:<br />

Carrying amount<br />

Fixed rate<br />

Consolidated Entity & Ausgrid<br />

Financial liabilities (7 273.2) (6 995.3)<br />

Floating rate<br />

Financial assets – 1.0<br />

Financial liabilities (1.2) (18.0)<br />

Inflation Indexed<br />

2015<br />

$M<br />

2014<br />

$M<br />

(1.2) (17.0)<br />

Financial liabilities (1 700.5) (1 683.0)<br />

(1700.5) (1 683.0)<br />

Ausgrid does not account for any fixed rate financial assets and liabilities at fair value through profit and loss. Ausgrid has variable rate<br />

financial liabilities at year end and it is estimated that a change in interest rates by one percentage point at reporting date would have<br />

$1.1m impact on Ausgrid’s profit before tax (2014: nil). There would be no effect on equity.<br />

e. Capital risk management<br />

Consistent with NSW Treasury Policy Capital Structure Policy for Government Businesses [TPP02‐7] which is a component of the<br />

NSW Government’s Commercial Policy Framework, Ausgrid’s objectives are to determine an appropriate capital structure to enable<br />

an appropriate return on equity and efficient investment decisions to be made on a commercial basis.<br />

Under the policy, both an appropriate capital structure and a minimum‐to‐maximum capital structure range are determined whilst<br />

considering the following criteria:<br />

• provision of an acceptable stream of dividends;<br />

• maintenance of an appropriate investment grade rating, taking into account industry and entity specific factors;<br />

• ability to meet key debt service criteria, based on industry benchmarks;<br />

• capacity to finance the approved capital expenditure program through internally generated cash flows and debt, with consideration<br />

of the current phase of the investment cycle; and<br />

• provision of sufficient flexibility for relevant contingencies.<br />

The minimum‐to maximum capital structure ‘range’ includes an acceptable range of gearing levels within Ausgrid’s capital structure.<br />

Ausgrid monitors gearing levels and ratios. The key ratio is calculated as net debt divided by total capital. Net debt is calculated as total<br />

loans, TCorp short term accommodation, and obligations under finance leases less cash and cash equivalents. Total capital is calculated<br />

as ‘equity’ as shown in the Statement of Financial Position plus net debt.