Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ausgrid – <strong>Annual</strong> <strong>Report</strong> 2014/15 65<br />

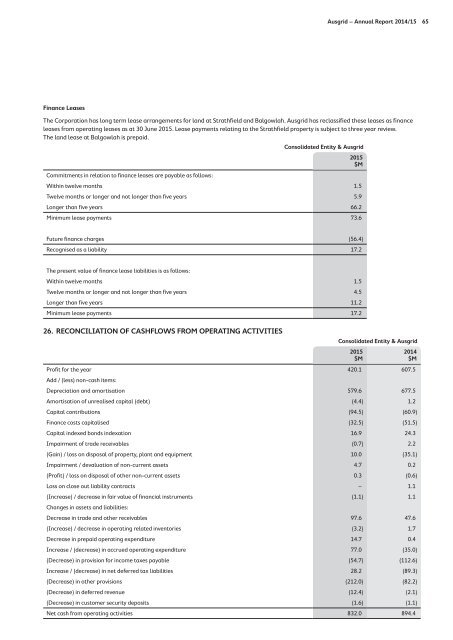

Finance Leases<br />

The Corporation has long term lease arrangements for land at Strathfield and Balgowlah. Ausgrid has reclassified these leases as finance<br />

leases from operating leases as at 30 June 2015. Lease payments relating to the Strathfield property is subject to three year review.<br />

The land lease at Balgowlah is prepaid.<br />

Commitments in relation to finance leases are payable as follows:<br />

Consolidated Entity & Ausgrid<br />

Within twelve months 1.5<br />

Twelve months or longer and not longer than five years 5.9<br />

Longer than five years 66.2<br />

Minimum lease payments 73.6<br />

2015<br />

$M<br />

Future finance charges (56.4)<br />

Recognised as a liability 17.2<br />

The present value of finance lease liabilities is as follows:<br />

Within twelve months 1.5<br />

Twelve months or longer and not longer than five years 4.5<br />

Longer than five years 11.2<br />

Minimum lease payments 17.2<br />

26. RECONCILIATION OF CASHFLOWS FROM OPERATING ACTIVITIES<br />

Consolidated Entity & Ausgrid<br />

Profit for the year 420.1 607.5<br />

Add / (less) non‐cash items:<br />

Depreciation and amortisation 579.6 677.5<br />

Amortisation of unrealised capital (debt) (4.4) 1.2<br />

Capital contributions (94.5) (60.9)<br />

Finance costs capitalised (32.5) (51.5)<br />

Capital indexed bonds indexation 16.9 24.3<br />

Impairment of trade receivables (0.7) 2.2<br />

(Gain) / loss on disposal of property, plant and equipment 10.0 (35.1)<br />

Impairment / devaluation of non‐current assets 4.7 0.2<br />

(Profit) / loss on disposal of other non‐current assets 0.3 (0.6)<br />

Loss on close out liability contracts – 1.1<br />

(Increase) / decrease in fair value of financial instruments (1.1) 1.1<br />

Changes in assets and liabilities:<br />

Decrease in trade and other receivables 97.6 47.6<br />

(Increase) / decrease in operating related inventories (3.2) 1.7<br />

Decrease in prepaid operating expenditure 14.7 0.4<br />

Increase / (decrease) in accrued operating expenditure 77.0 (35.0)<br />

(Decrease) in provision for income taxes payable (54.7) (112.6)<br />

Increase / (decrease) in net deferred tax liabilities 28.2 (89.3)<br />

(Decrease) in other provisions (212.0) (82.2)<br />

(Decrease) in deferred revenue (12.4) (2.1)<br />

(Decrease) in customer security deposits (1.6) (1.1)<br />

Net cash from operating activities 832.0 894.4<br />

2015<br />

$M<br />

2014<br />

$M