Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44<br />

Ausgrid and Controlled Entity<br />

Notes to financial statements<br />

For the year ended 30 June 2015<br />

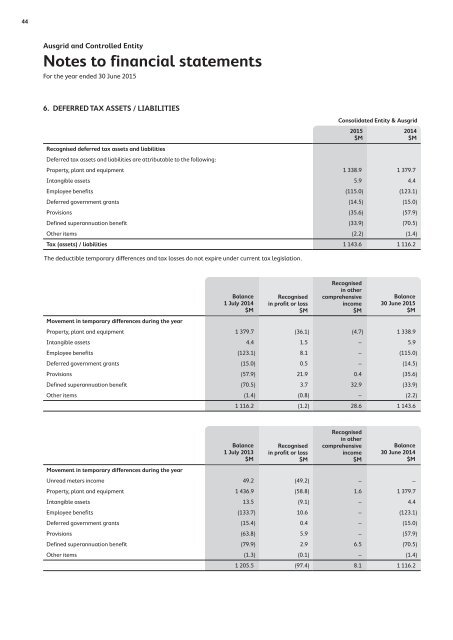

6. DEFERRED TAX ASSETS / LIABILITIES<br />

Recognised deferred tax assets and liabilities<br />

Deferred tax assets and liabilities are attributable to the following:<br />

Consolidated Entity & Ausgrid<br />

Property, plant and equipment 1 338.9 1 379.7<br />

Intangible assets 5.9 4.4<br />

Employee benefits (115.0) (123.1)<br />

Deferred government grants (14.5) (15.0)<br />

Provisions (35.6) (57.9)<br />

Defined superannuation benefit (33.9) (70.5)<br />

Other items (2.2) (1.4)<br />

Tax (assets) / liabilities 1 143.6 1 116.2<br />

The deductible temporary differences and tax losses do not expire under current tax legislation.<br />

2015<br />

$M<br />

2014<br />

$M<br />

Movement in temporary differences during the year<br />

Balance<br />

1 July 2014<br />

$M<br />

Recognised<br />

in profit or loss<br />

$M<br />

Recognised<br />

in other<br />

comprehensive<br />

income<br />

$M<br />

Balance<br />

30 June 2015<br />

$M<br />

Property, plant and equipment 1 379.7 (36.1) (4.7) 1 338.9<br />

Intangible assets 4.4 1.5 – 5.9<br />

Employee benefits (123.1) 8.1 – (115.0)<br />

Deferred government grants (15.0) 0.5 – (14.5)<br />

Provisions (57.9) 21.9 0.4 (35.6)<br />

Defined superannuation benefit (70.5) 3.7 32.9 (33.9)<br />

Other items (1.4) (0.8) – (2.2)<br />

1 116.2 (1.2) 28.6 1 143.6<br />

Movement in temporary differences during the year<br />

Balance<br />

1 July 2013<br />

$M<br />

Recognised<br />

in profit or loss<br />

$M<br />

Recognised<br />

in other<br />

comprehensive<br />

income<br />

$M<br />

Balance<br />

30 June 2014<br />

$M<br />

Unread meters income 49.2 (49.2) – –<br />

Property, plant and equipment 1 436.9 (58.8) 1.6 1 379.7<br />

Intangible assets 13.5 (9.1) – 4.4<br />

Employee benefits (133.7) 10.6 – (123.1)<br />

Deferred government grants (15.4) 0.4 – (15.0)<br />

Provisions (63.8) 5.9 – (57.9)<br />

Defined superannuation benefit (79.9) 2.9 6.5 (70.5)<br />

Other items (1.3) (0.1) – (1.4)<br />

1 205.5 (97.4) 8.1 1 116.2