Annual Report

Ausgrid%20AR%202015

Ausgrid%20AR%202015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Ausgrid – <strong>Annual</strong> <strong>Report</strong> 2014/15 69<br />

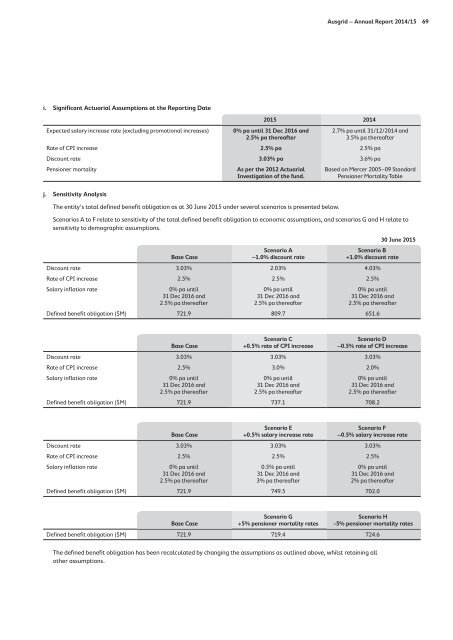

i. Significant Actuarial Assumptions at the <strong>Report</strong>ing Date<br />

Expected salary increase rate (excluding promotional increases)<br />

2015 2014<br />

0% pa until 31 Dec 2016 and<br />

2.5% pa thereafter<br />

2.7% pa until 31/12/2014 and<br />

3.5% pa thereafter<br />

Rate of CPI increase 2.5% pa 2.5% pa<br />

Discount rate 3.03% pa 3.6% pa<br />

Pensioner mortality<br />

As per the 2012 Actuarial<br />

Investigation of the fund.<br />

Based on Mercer 2005–09 Standard<br />

Pensioner Mortality Table<br />

j. Sensitivity Analysis<br />

The entity's total defined benefit obligation as at 30 June 2015 under several scenarios is presented below.<br />

Scenarios A to F relate to sensitivity of the total defined benefit obligation to economic assumptions, and scenarios G and H relate to<br />

sensitivity to demographic assumptions.<br />

Base Case<br />

Scenario A<br />

–1.0% discount rate<br />

30 June 2015<br />

Scenario B<br />

+1.0% discount rate<br />

Discount rate 3.03% 2.03% 4.03%<br />

Rate of CPI increase 2.5% 2.5% 2.5%<br />

Salary inflation rate<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

Defined benefit obligation ($M) 721.9 809.7 651.6<br />

Base Case<br />

Scenario C<br />

+0.5% rate of CPI increase<br />

Scenario D<br />

–0.5% rate of CPI increase<br />

Discount rate 3.03% 3.03% 3.03%<br />

Rate of CPI increase 2.5% 3.0% 2.0%<br />

Salary inflation rate<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

Defined benefit obligation ($M) 721.9 737.1 708.2<br />

Base Case<br />

Scenario E<br />

+0.5% salary increase rate<br />

Scenario F<br />

–0.5% salary increase rate<br />

Discount rate 3.03% 3.03% 3.03%<br />

Rate of CPI increase 2.5% 2.5% 2.5%<br />

Salary inflation rate<br />

0% pa until<br />

31 Dec 2016 and<br />

2.5% pa thereafter<br />

0.5% pa until<br />

31 Dec 2016 and<br />

3% pa thereafter<br />

0% pa until<br />

31 Dec 2016 and<br />

2% pa thereafter<br />

Defined benefit obligation ($M) 721.9 749.5 702.0<br />

Base Case<br />

Scenario G<br />

+5% pensioner mortality rates<br />

Scenario H<br />

-5% pensioner mortality rates<br />

Defined benefit obligation ($M) 721.9 719.4 724.6<br />

The defined benefit obligation has been recalculated by changing the assumptions as outlined above, whilst retaining all<br />

other assumptions.