KEY ISSUES FOR DIGITAL TRANSFORMATION IN THE G20

2jz0oUm

2jz0oUm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

isks perceived by potential adopters, which is partly also the result of the increasing sophistication of digital<br />

security threats. In addition, increasing concerns have been raised with respect to whether privacy and IPRs<br />

are sufficiently protected (and enforced) in the digital economy. There are also additional risk factors<br />

associated with emerging practices in the use of personal data and intellectual property that risk deteriorating<br />

trust in the digital economy, and thus reducing incentives to ICT adoption. For instance, discrimination enabled<br />

by data analytics, for example, may result in greater efficiencies and innovation, but may also limit individuals’<br />

freedom (OECD, 2015f).<br />

SMEs also often face a deficit of knowledge and awareness of the chances and new business opportunities<br />

offered by digitised business and work, which then leads to a poor ability to change and competitive<br />

disadvantages. A 2014 survey among 1 000 SMEs in Germany revealed that for 70% of enterprises with annual<br />

revenue below EUR 500 million, the digitalisation of processes was still seen irrelevant. What is making the<br />

situation worse is that many of the currently available ICT products and information do not necessarily take<br />

the specific needs of SMEs into account. A study funded by the German Federal Ministry of Economic Affairs<br />

and Energy (2015), for instance, confirms that current research and projects on Industrie 4.0 are too often not<br />

presenting their results in a format and language that is appropriate to SMEs and skilled crafts.<br />

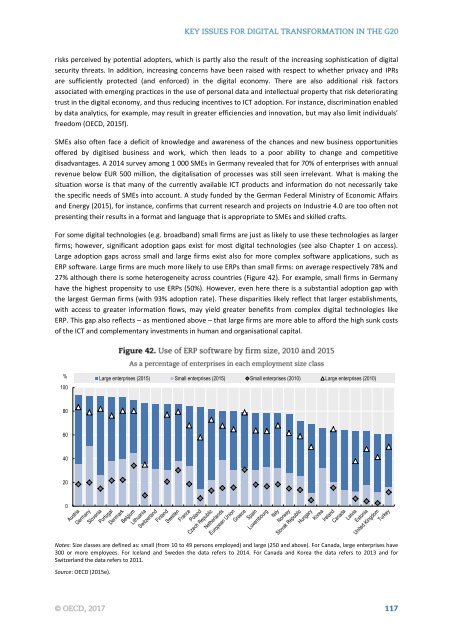

For some digital technologies (e.g. broadband) small firms are just as likely to use these technologies as larger<br />

firms; however, significant adoption gaps exist for most digital technologies (see also Chapter 1 on access).<br />

Large adoption gaps across small and large firms exist also for more complex software applications, such as<br />

ERP software. Large firms are much more likely to use ERPs than small firms: on average respectively 78% and<br />

27% although there is some heterogeneity across countries (Figure 42). For example, small firms in Germany<br />

have the highest propensity to use ERPs (50%). However, even here there is a substantial adoption gap with<br />

the largest German firms (with 93% adoption rate). These disparities likely reflect that larger establishments,<br />

with access to greater information flows, may yield greater benefits from complex digital technologies like<br />

ERP. This gap also reflects – as mentioned above – that large firms are more able to afford the high sunk costs<br />

of the ICT and complementary investments in human and organisational capital.<br />

% Large enterprises (2015) Small enterprises (2015) Small enterprises (2010) Large enterprises (2010)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Notes: Size classes are defined as: small (from 10 to 49 persons employed) and large (250 and above). For Canada, large enterprises have<br />

300 or more employees. For Iceland and Sweden the data refers to 2014. For Canada and Korea the data refers to 2013 and for<br />

Switzerland the data refers to 2011.<br />

Source: OECD (2015e).