KEY ISSUES FOR DIGITAL TRANSFORMATION IN THE G20

2jz0oUm

2jz0oUm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

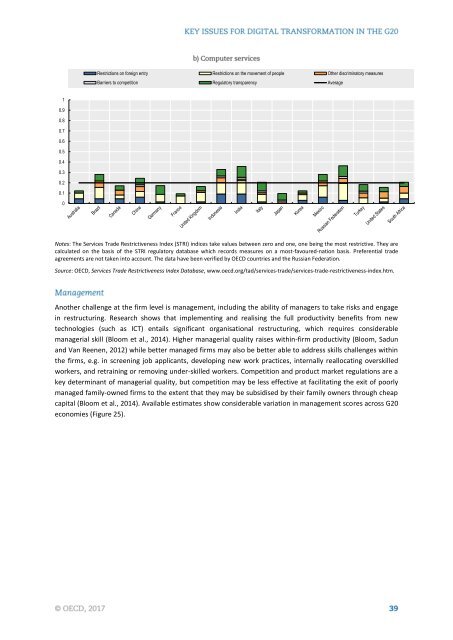

Restrictions on foreign entry Restrictions on the movement of people Other discriminatory measures<br />

Barriers to competition Regulatory transparency Average<br />

1<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

Notes: The Services Trade Restrictiveness Index (STRI) indices take values between zero and one, one being the most restrictive. They are<br />

calculated on the basis of the STRI regulatory database which records measures on a most-favoured-nation basis. Preferential trade<br />

agreements are not taken into account. The data have been verified by OECD countries and the Russian Federation.<br />

Source: OECD, Services Trade Restrictiveness Index Database, www.oecd.org/tad/services-trade/services-trade-restrictiveness-index.htm.<br />

Another challenge at the firm level is management, including the ability of managers to take risks and engage<br />

in restructuring. Research shows that implementing and realising the full productivity benefits from new<br />

technologies (such as ICT) entails significant organisational restructuring, which requires considerable<br />

managerial skill (Bloom et al., 2014). Higher managerial quality raises within-firm productivity (Bloom, Sadun<br />

and Van Reenen, 2012) while better managed firms may also be better able to address skills challenges within<br />

the firms, e.g. in screening job applicants, developing new work practices, internally reallocating overskilled<br />

workers, and retraining or removing under-skilled workers. Competition and product market regulations are a<br />

key determinant of managerial quality, but competition may be less effective at facilitating the exit of poorly<br />

managed family-owned firms to the extent that they may be subsidised by their family owners through cheap<br />

capital (Bloom et al., 2014). Available estimates show considerable variation in management scores across <strong>G20</strong><br />

economies (Figure 25).