KEY ISSUES FOR DIGITAL TRANSFORMATION IN THE G20

2jz0oUm

2jz0oUm

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In telecommunications, both fixed and wireless networks rely on passive infrastructure – such as ducts, cables,<br />

masts and tower sites – and on active equipment components used to implement the technology, e.g. routers<br />

and switches, control and management servers. Both fixed and wireless networks make use of fibre cables for<br />

backhaul and backbone segments of network infrastructures. To connect local and national facilities to other<br />

networks around the world, operators also need access to regional and international high-speed networks<br />

(submarine fibre optic or satellites). Alongside infrastructure, an essential asset in wireless communications is<br />

spectrum, which is needed for the delivery of wireless services. As spectrum is a scarce resource, government<br />

policies in this area can have a significant influence on financing.<br />

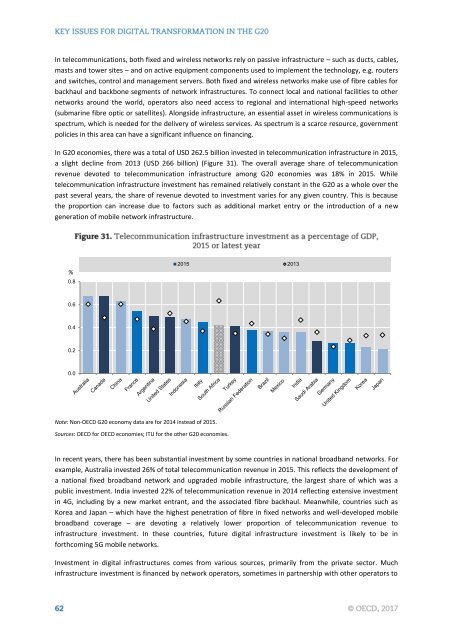

In <strong>G20</strong> economies, there was a total of USD 262.5 billion invested in telecommunication infrastructure in 2015,<br />

a slight decline from 2013 (USD 266 billion) (Figure 31). The overall average share of telecommunication<br />

revenue devoted to telecommunication infrastructure among <strong>G20</strong> economies was 18% in 2015. While<br />

telecommunication infrastructure investment has remained relatively constant in the <strong>G20</strong> as a whole over the<br />

past several years, the share of revenue devoted to investment varies for any given country. This is because<br />

the proportion can increase due to factors such as additional market entry or the introduction of a new<br />

generation of mobile network infrastructure.<br />

%<br />

0.8<br />

2015 2013<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

Note: Non-OECD <strong>G20</strong> economy data are for 2014 instead of 2015.<br />

Sources: OECD for OECD economies; ITU for the other <strong>G20</strong> economies.<br />

In recent years, there has been substantial investment by some countries in national broadband networks. For<br />

example, Australia invested 26% of total telecommunication revenue in 2015. This reflects the development of<br />

a national fixed broadband network and upgraded mobile infrastructure, the largest share of which was a<br />

public investment. India invested 22% of telecommunication revenue in 2014 reflecting extensive investment<br />

in 4G, including by a new market entrant, and the associated fibre backhaul. Meanwhile, countries such as<br />

Korea and Japan – which have the highest penetration of fibre in fixed networks and well-developed mobile<br />

broadband coverage – are devoting a relatively lower proportion of telecommunication revenue to<br />

infrastructure investment. In these countries, future digital infrastructure investment is likely to be in<br />

forthcoming 5G mobile networks.<br />

Investment in digital infrastructures comes from various sources, primarily from the private sector. Much<br />

infrastructure investment is financed by network operators, sometimes in partnership with other operators to