Annual Report 2007 in PDF - Cairn Energy PLC

Annual Report 2007 in PDF - Cairn Energy PLC

Annual Report 2007 in PDF - Cairn Energy PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE ACCOUNTS<br />

CONTINUED<br />

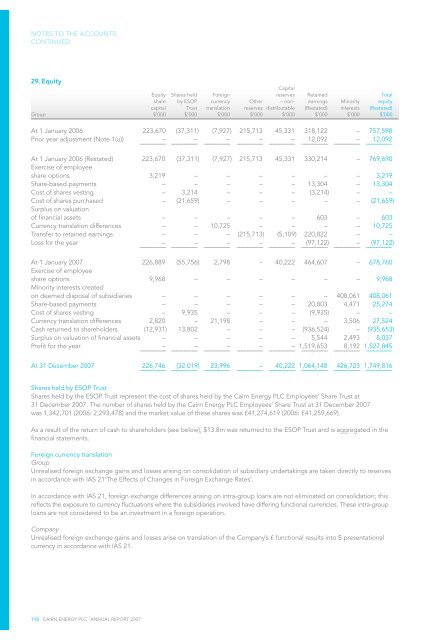

29. Equity<br />

Equity Shares held Foreign<br />

Capital<br />

reserves Reta<strong>in</strong>ed Total<br />

share by ESOP currency Other – non- earn<strong>in</strong>gs M<strong>in</strong>ority equity<br />

capital Trust translation reserves distributable (Restated) <strong>in</strong>terests (Restated)<br />

Group $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

At 1 January 2006 223,670 (37,311) (7,927) 215,713 45,331 318,122 – 757,598<br />

Prior year adjustment (Note 1(u)) – – – – – 12,092 – 12,092<br />

–––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– ––––––––––<br />

At 1 January 2006 (Restated) 223,670 (37,311) (7,927) 215,713 45,331 330,214 – 769,690<br />

Exercise of employee<br />

share options 3,219 – – – – – – 3,219<br />

Share-based payments – – – – – 13,304 – 13,304<br />

Cost of shares vest<strong>in</strong>g – 3,214 – – – (3,214) – –<br />

Cost of shares purchased – (21,659) – – – – – (21,659)<br />

Surplus on valuation<br />

of f<strong>in</strong>ancial assets – – – – – 603 – 603<br />

Currency translation differences – – 10,725 – – – – 10,725<br />

Transfer to reta<strong>in</strong>ed earn<strong>in</strong>gs – – – (215,713) (5,109) 220,822 – –<br />

Loss for the year – – – – – (97,122) – (97,122)<br />

–––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– ––––––––––<br />

At 1 January <strong>2007</strong> 226,889 (55,756) 2,798 – 40,222 464,607 – 678,760<br />

Exercise of employee<br />

share options 9,968 – – – – – – 9,968<br />

M<strong>in</strong>ority <strong>in</strong>terests created<br />

on deemed disposal of subsidiaries – – – – – – 408,061 408,061<br />

Share-based payments – – – – – 20,803 4,471 25,274<br />

Cost of shares vest<strong>in</strong>g – 9,935 – – – (9,935) – –<br />

Currency translation differences 2,820 – 21,198 – – – 3,506 27,524<br />

Cash returned to shareholders (12,931) 13,802 – – – (936,524) – (935,653)<br />

Surplus on valuation of f<strong>in</strong>ancial assets – – – – – 5,544 2,493 8,037<br />

Profit for the year – – – – – 1,519,653 8,192 1,527,845<br />

–––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– ––––––––––<br />

At 31 December <strong>2007</strong> 226,746 (32,019) 23,996 – 40,222 1,064,148 426,723 1,749,816<br />

–––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– –––––––––– ––––––––––<br />

Shares held by ESOP Trust<br />

Shares held by the ESOP Trust represent the cost of shares held by the <strong>Cairn</strong> <strong>Energy</strong> <strong>PLC</strong> Employees’ Share Trust at<br />

31 December <strong>2007</strong>. The number of shares held by the <strong>Cairn</strong> <strong>Energy</strong> <strong>PLC</strong> Employees’ Share Trust at 31 December <strong>2007</strong><br />

was 1,342,701 (2006: 2,293,478) and the market value of these shares was £41,274,619 (2006: £41,259,669).<br />

As a result of the return of cash to shareholders (see below), $13.8m was returned to the ESOP Trust and is aggregated <strong>in</strong> the<br />

f<strong>in</strong>ancial statements.<br />

Foreign currency translation<br />

Group<br />

Unrealised foreign exchange ga<strong>in</strong>s and losses aris<strong>in</strong>g on consolidation of subsidiary undertak<strong>in</strong>gs are taken directly to reserves<br />

<strong>in</strong> accordance with IAS 21‘The Effects of Changes <strong>in</strong> Foreign Exchange Rates’.<br />

In accordance with IAS 21, foreign exchange differences aris<strong>in</strong>g on <strong>in</strong>tra-group loans are not elim<strong>in</strong>ated on consolidation; this<br />

reflects the exposure to currency fluctuations where the subsidiaries <strong>in</strong>volved have differ<strong>in</strong>g functional currencies. These <strong>in</strong>tra-group<br />

loans are not considered to be an <strong>in</strong>vestment <strong>in</strong> a foreign operation.<br />

Company<br />

Unrealised foreign exchange ga<strong>in</strong>s and losses arise on translation of the Company’s £ functional results <strong>in</strong>to $ presentational<br />

currency <strong>in</strong> accordance with IAS 21.<br />

118 CAIRN ENERGY <strong>PLC</strong> ANNUAL REPORT <strong>2007</strong>