CPT International 04/2014

The leading technical journal for the global foundry industry – Das führende Fachmagazin für die weltweite Gießerei-Industrie

The leading technical journal for the

global foundry industry – Das führende Fachmagazin für die

weltweite Gießerei-Industrie

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

force and drug gangs have been connected<br />

with their disappearance – the<br />

situation is thus extremely complex.<br />

From the economic point of view, Mexico<br />

profits from the growth effects resulting<br />

from the NAFTA free trade<br />

agreement. Upcoming liberalization of<br />

the energy sector could considerably<br />

reduce production costs, so Mexico<br />

could develop into Latin America’s economic<br />

star in the coming decade. Experts<br />

believe that electricity costs for<br />

Mexican producers might fall by 20 %<br />

in future – and foundries in this Central<br />

American country could also profit<br />

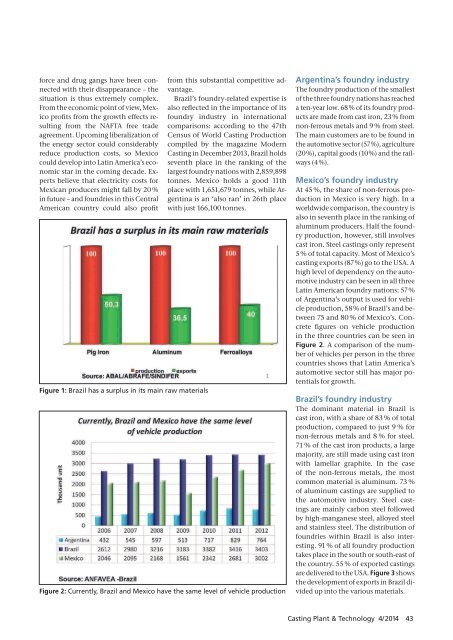

Figure 1: Brazil has a surplus in its main raw materials<br />

from this substantial competitive advantage.<br />

Brazil’s foundry-related expertise is<br />

also reflected in the importance of its<br />

foundry industry in international<br />

comparisons: according to the 47th<br />

Census of World Casting Production<br />

compiled by the magazine Modern<br />

Casting in December 2013, Brazil holds<br />

seventh place in the ranking of the<br />

largest foundry nations with 2,859,898<br />

tonnes. Mexico holds a good 11th<br />

place with 1,651,679 tonnes, while Argentina<br />

is an ‘also ran’ in 26th place<br />

with just 166,100 tonnes.<br />

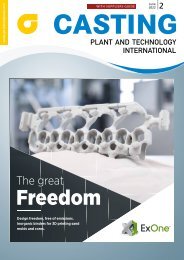

Figure 2: Currently, Brazil and Mexico have the same level of vehicle production<br />

Argentina’s foundry industry<br />

The foundry production of the smallest<br />

of the three foundry nations has reached<br />

a ten-year low. 68 % of its foundry products<br />

are made from cast iron, 23 % from<br />

non-ferrous metals and 9 % from steel.<br />

The main customers are to be found in<br />

the automotive sector (57 %), agriculture<br />

(20 %), capital goods (10 %) and the railways<br />

(4 %).<br />

Mexico’s foundry industry<br />

At 45 %, the share of non-ferrous production<br />

in Mexico is very high. In a<br />

worldwide comparison, the country is<br />

also in seventh place in the ranking of<br />

aluminum producers. Half the foundry<br />

production, however, still involves<br />

cast iron. Steel castings only represent<br />

5 % of total capacity. Most of Mexico’s<br />

casting exports (87 %) go to the USA. A<br />

high level of dependency on the automotive<br />

industry can be seen in all three<br />

Latin American foundry nations: 57 %<br />

of Argentina’s output is used for vehicle<br />

production, 58 % of Brazil’s and between<br />

75 and 80 % of Mexico’s. Concrete<br />

figures on vehicle production<br />

in the three countries can be seen in<br />

Figure 2. A comparison of the number<br />

of vehicles per person in the three<br />

countries shows that Latin America’s<br />

automotive sector still has major potentials<br />

for growth.<br />

Brazil’s foundry industry<br />

The dominant material in Brazil is<br />

cast iron, with a share of 83 % of total<br />

production, compared to just 9 % for<br />

non-ferrous metals and 8 % for steel.<br />

71 % of the cast iron products, a large<br />

majority, are still made using cast iron<br />

with lamellar graphite. In the case<br />

of the non-ferrous metals, the most<br />

common material is aluminum. 73 %<br />

of aluminum castings are supplied to<br />

the automotive industry. Steel castings<br />

are mainly carbon steel followed<br />

by high-manganese steel, alloyed steel<br />

and stainless steel. The distribution of<br />

foundries within Brazil is also interesting.<br />

91 % of all foundry production<br />

takes place in the south or south-east of<br />

the country. 55 % of exported castings<br />

are delivered to the USA. Figure 3 shows<br />

the development of exports in Brazil divided<br />

up into the various materials.<br />

Casting Plant & Technology 4/<strong>2014</strong> 43