AT&S World

AT&S World

AT&S World

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investor Relations<br />

34<br />

Investor Relations<br />

AT&S secures<br />

coveted IVA-DAVID<br />

Award for IR activities<br />

Basis information<br />

AT&S share<br />

Security ID<br />

number 969985<br />

ISIN code AT0000969985<br />

Symbol ATS<br />

Reuters RIC ATSV.VI<br />

Bloomberg ATS AV<br />

Listing Vienna Stock<br />

Exchange<br />

Indexes ATX Prime,<br />

WBI SME<br />

The goal we pursue in our investor relations activities<br />

is to provide all capital market participants<br />

with up-to-date corporate information – transparently<br />

and simultaneously. This makes it all the<br />

more gratifying that our efforts have been recognised<br />

with the coveted IVA DAVID award. This<br />

accolade honours companies and individuals for<br />

significant contributions to the encouragement of<br />

broadly based capital markets and shareholderfriendly<br />

involvement. This award is testimony to<br />

the success of our efforts to retain and extend the<br />

trust of shareholders and the financial community<br />

in AT&S Group.<br />

Share price<br />

The share price recorded a steady increase until<br />

December 2010, reflecting the positive overall<br />

business performance during the period. The<br />

share reached a high of EUR 18.20 in mid-January,<br />

making it one of Austria’s best performing stocks<br />

in 2010. Reflecting the seasonal fluctuations in<br />

mobile phone sales and the disaster in Japan,<br />

which had the entire industry holding its breath,<br />

the share price fell back somewhat, closing the<br />

financial year on 31 March 2011 at EUR 15.84. An<br />

encouraging sign is the significantly increased<br />

liquidity of AT&S stock, with average daily traded<br />

volumes over the last 100 days amounting to<br />

around 6,000 shares, considerably higher than at<br />

the start of the year.<br />

At the end of September 2010, Landesbank Baden-<br />

Württemberg (LBWW) discontinued its coverage<br />

of AT&S stock because of internal restructuring<br />

measures. Fortunately, however, UniCredit,<br />

Deutsche Bank and Berenberg shortly afterwards<br />

all resumed their coverage, taking the total number<br />

of analysts covering AT&S from three at the<br />

start of the year to six.<br />

We made the most of these positive developments<br />

to raise awareness of AT&S stock among institutional<br />

investors in key European financial markets.<br />

Our autumn campaign centred on the Vienna,<br />

Frankfurt and Zürich financial markets, and on<br />

establishing close relationships with selected investors.<br />

In the spring the focus of our investor relations<br />

activities shifted to Asia, where we organised<br />

a non-deal roadshow in Hong Kong and Singapore<br />

in early March. Our Investors Day at the Shanghai<br />

site – the first of its kind – was well received by<br />

analysts and local media alike. The positive feedback<br />

and high levels of interest encountered in all<br />

three Asian financial centres were an encouraging<br />

start, and we now intend to continue our activities<br />

in these markets over the course of the next year.<br />

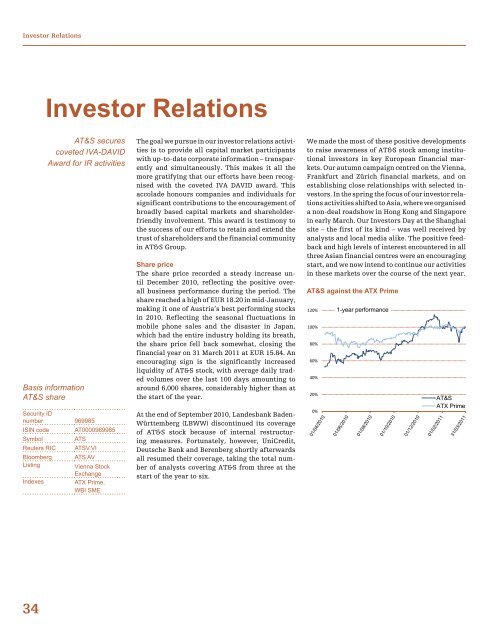

AT&S against the ATX Prime<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

01/04/2010<br />

1-year performance<br />

01/06/2010<br />

01/08/2010<br />

01/10/2010<br />

01/12/2010<br />

AT&S<br />

ATX Prime<br />

01/02/2011<br />

31/03/2011<br />

9.95%<br />

Treasury stock<br />

17.66%<br />

Dörflinger Private Foundation<br />

21.51%<br />

Androsch Private Foundation<br />

50.88%<br />

Free Float