AT&S World

AT&S World

AT&S World

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Healthy Finances<br />

36<br />

Healthy Finances<br />

A very healthy financial<br />

position: sufficient<br />

lines of credit available,<br />

agreed either<br />

in writing or orally<br />

Financing policy<br />

Subject to any local regulations, AT&S adopts a<br />

centralised treasury approach to finances, with<br />

external borrowing predominantly carried out<br />

by AT&S AG. A detailed summary of the various<br />

sources of finance, including the respective maturities,<br />

is given in Note 16, “Financial liabilities”<br />

in the Notes to Financial Statements (page 89).<br />

Net debt<br />

Capacity expansion in India and China and the<br />

capital investment that this necessarily entailed,<br />

combined with intensified research activities<br />

meant that in the financial year 2010/11 net debt<br />

increased by EUR 45.7m to EUR 193.7m. Last financial<br />

year also saw equity climb EUR 21.0m to<br />

EUR 229.8m, principally as a result of the improvement<br />

in consolidated net earnings and despite<br />

adverse currency effects of EUR 10.8m. The final<br />

outcome was that the gearing ratio rose from 70.9%<br />

to 84.3%.<br />

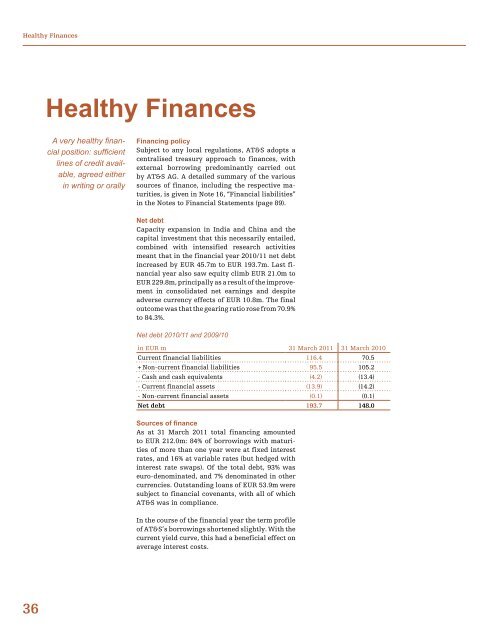

Net debt 2010/11 and 2009/10<br />

in EUR m 31 March 2011 31 March 2010<br />

Current financial liabilities 116.4 70.5<br />

+ Non-current financial liabilities 95.5 105.2<br />

- Cash and cash equivalents (4.2) (13.4)<br />

- Current financial assets (13.9) (14.2)<br />

- Non-current financial assets (0.1) (0.1)<br />

Net debt 193.7 148.0<br />

Sources of finance<br />

As at 31 March 2011 total financing amounted<br />

to EUR 212.0m: 84% of borrowings with maturities<br />

of more than one year were at fixed interest<br />

rates, and 16% at variable rates (but hedged with<br />

interest rate swaps). Of the total debt, 93% was<br />

euro-denominated, and 7% denominated in other<br />

currencies. Outstanding loans of EUR 53.9m were<br />

subject to financial covenants, with all of which<br />

AT&S was in compliance.<br />

In the course of the financial year the term profile<br />

of AT&S’s borrowings shortened slightly. With the<br />

current yield curve, this had a beneficial effect on<br />

average interest costs.