International Trade Outlook for Latin America and the Caribbean: Recovery in an uncertain context

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>International</strong> <strong>Trade</strong> <strong>Outlook</strong> <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> • 2017<br />

Summary<br />

15<br />

Figure 1<br />

<strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong>: year-on-year variation <strong>in</strong> <strong>the</strong> value of trade <strong>in</strong> goods <strong><strong>an</strong>d</strong> services<br />

by categories, J<strong>an</strong>uary-June 2017<br />

(Percentages)<br />

40<br />

30<br />

36.0<br />

31.1<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

1.9<br />

3.3<br />

-3.3<br />

9.8<br />

-12.0<br />

-2.6<br />

7.3 8.7<br />

-10.6 -11.2<br />

-30<br />

-40<br />

Agricultural<br />

products<br />

-28.8<br />

M<strong>in</strong><strong>in</strong>g<br />

<strong><strong>an</strong>d</strong> oil<br />

M<strong>an</strong>ufactur<strong>in</strong>g<br />

Capital<br />

goods<br />

Intermediate<br />

<strong>in</strong>puts<br />

Consumer<br />

goods<br />

-32.1<br />

Fuel<br />

J<strong>an</strong>uary-June 2016<br />

J<strong>an</strong>uary-June 2017<br />

Exports<br />

Imports<br />

Source: Economic Commission <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (ECLAC), on <strong>the</strong> basis of official <strong>in</strong><strong>for</strong>mation from central b<strong>an</strong>ks, customs offices <strong><strong>an</strong>d</strong> national<br />

statistics <strong>in</strong>stitutes.<br />

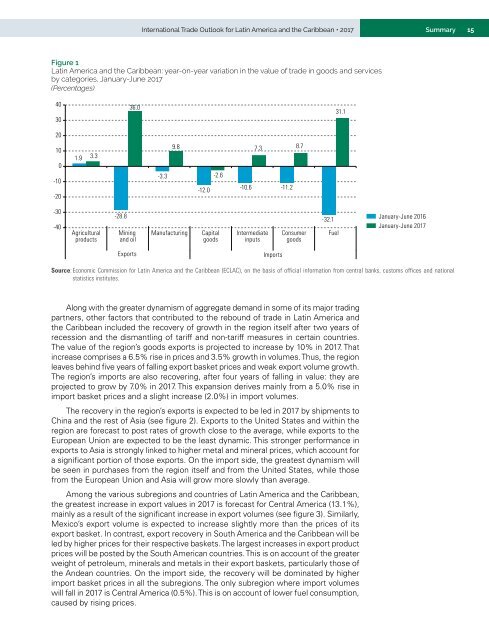

Along with <strong>the</strong> greater dynamism of aggregate dem<strong><strong>an</strong>d</strong> <strong>in</strong> some of its major trad<strong>in</strong>g<br />

partners, o<strong>the</strong>r factors that contributed to <strong>the</strong> rebound of trade <strong>in</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong><br />

<strong>the</strong> <strong>Caribbe<strong>an</strong></strong> <strong>in</strong>cluded <strong>the</strong> recovery of growth <strong>in</strong> <strong>the</strong> region itself after two years of<br />

recession <strong><strong>an</strong>d</strong> <strong>the</strong> dism<strong>an</strong>tl<strong>in</strong>g of tariff <strong><strong>an</strong>d</strong> non-tariff measures <strong>in</strong> certa<strong>in</strong> countries.<br />

The value of <strong>the</strong> region’s goods exports is projected to <strong>in</strong>crease by 10% <strong>in</strong> 2017. That<br />

<strong>in</strong>crease comprises a 6.5% rise <strong>in</strong> prices <strong><strong>an</strong>d</strong> 3.5% growth <strong>in</strong> volumes. Thus, <strong>the</strong> region<br />

leaves beh<strong>in</strong>d five years of fall<strong>in</strong>g export basket prices <strong><strong>an</strong>d</strong> weak export volume growth.<br />

The region’s imports are also recover<strong>in</strong>g, after four years of fall<strong>in</strong>g <strong>in</strong> value: <strong>the</strong>y are<br />

projected to grow by 7.0% <strong>in</strong> 2017. This exp<strong>an</strong>sion derives ma<strong>in</strong>ly from a 5.0% rise <strong>in</strong><br />

import basket prices <strong><strong>an</strong>d</strong> a slight <strong>in</strong>crease (2.0%) <strong>in</strong> import volumes.<br />

The recovery <strong>in</strong> <strong>the</strong> region’s exports is expected to be led <strong>in</strong> 2017 by shipments to<br />

Ch<strong>in</strong>a <strong><strong>an</strong>d</strong> <strong>the</strong> rest of Asia (see figure 2). Exports to <strong>the</strong> United States <strong><strong>an</strong>d</strong> with<strong>in</strong> <strong>the</strong><br />

region are <strong>for</strong>ecast to post rates of growth close to <strong>the</strong> average, while exports to <strong>the</strong><br />

Europe<strong>an</strong> Union are expected to be <strong>the</strong> least dynamic. This stronger per<strong>for</strong>m<strong>an</strong>ce <strong>in</strong><br />

exports to Asia is strongly l<strong>in</strong>ked to higher metal <strong><strong>an</strong>d</strong> m<strong>in</strong>eral prices, which account <strong>for</strong><br />

a signific<strong>an</strong>t portion of those exports. On <strong>the</strong> import side, <strong>the</strong> greatest dynamism will<br />

be seen <strong>in</strong> purchases from <strong>the</strong> region itself <strong><strong>an</strong>d</strong> from <strong>the</strong> United States, while those<br />

from <strong>the</strong> Europe<strong>an</strong> Union <strong><strong>an</strong>d</strong> Asia will grow more slowly th<strong>an</strong> average.<br />

Among <strong>the</strong> various subregions <strong><strong>an</strong>d</strong> countries of <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong>,<br />

<strong>the</strong> greatest <strong>in</strong>crease <strong>in</strong> export values <strong>in</strong> 2017 is <strong>for</strong>ecast <strong>for</strong> Central <strong>America</strong> (13.1%),<br />

ma<strong>in</strong>ly as a result of <strong>the</strong> signific<strong>an</strong>t <strong>in</strong>crease <strong>in</strong> export volumes (see figure 3). Similarly,<br />

Mexico’s export volume is expected to <strong>in</strong>crease slightly more th<strong>an</strong> <strong>the</strong> prices of its<br />

export basket. In contrast, export recovery <strong>in</strong> South <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> will be<br />

led by higher prices <strong>for</strong> <strong>the</strong>ir respective baskets. The largest <strong>in</strong>creases <strong>in</strong> export product<br />

prices will be posted by <strong>the</strong> South <strong>America</strong>n countries. This is on account of <strong>the</strong> greater<br />

weight of petroleum, m<strong>in</strong>erals <strong><strong>an</strong>d</strong> metals <strong>in</strong> <strong>the</strong>ir export baskets, particularly those of<br />

<strong>the</strong> Ande<strong>an</strong> countries. On <strong>the</strong> import side, <strong>the</strong> recovery will be dom<strong>in</strong>ated by higher<br />

import basket prices <strong>in</strong> all <strong>the</strong> subregions. The only subregion where import volumes<br />

will fall <strong>in</strong> 2017 is Central <strong>America</strong> (0.5%). This is on account of lower fuel consumption,<br />

caused by ris<strong>in</strong>g prices.