International Trade Outlook for Latin America and the Caribbean: Recovery in an uncertain context

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>International</strong> <strong>Trade</strong> <strong>Outlook</strong> <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> • 2017<br />

Chapter I<br />

31<br />

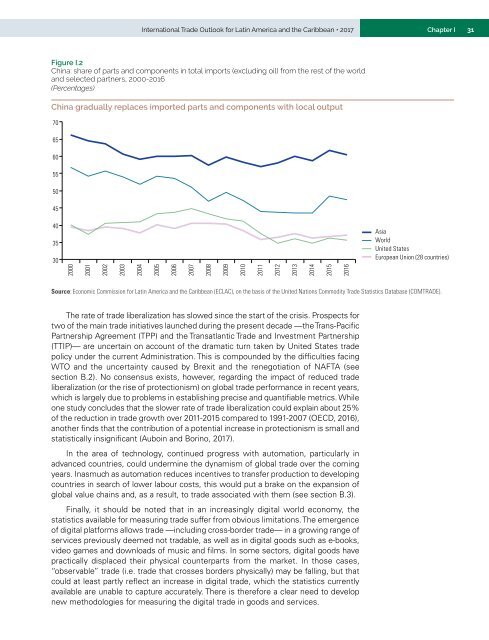

Figure I.2<br />

Ch<strong>in</strong>a: share of parts <strong><strong>an</strong>d</strong> components <strong>in</strong> total imports (exclud<strong>in</strong>g oil) from <strong>the</strong> rest of <strong>the</strong> world<br />

<strong><strong>an</strong>d</strong> selected partners, 2000-2016<br />

(Percentages)<br />

Ch<strong>in</strong>a gradually replaces imported parts <strong><strong>an</strong>d</strong> components with local output<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

Asia<br />

World<br />

United States<br />

Europe<strong>an</strong> Union (28 countries)<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

Source: Economic Commission <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (ECLAC), on <strong>the</strong> basis of <strong>the</strong> United Nations Commodity <strong>Trade</strong> Statistics Database (COMTRADE).<br />

The rate of trade liberalization has slowed s<strong>in</strong>ce <strong>the</strong> start of <strong>the</strong> crisis. Prospects <strong>for</strong><br />

two of <strong>the</strong> ma<strong>in</strong> trade <strong>in</strong>itiatives launched dur<strong>in</strong>g <strong>the</strong> present decade —<strong>the</strong> Tr<strong>an</strong>s-Pacific<br />

Partnership Agreement (TPP) <strong><strong>an</strong>d</strong> <strong>the</strong> Tr<strong>an</strong>satl<strong>an</strong>tic <strong>Trade</strong> <strong><strong>an</strong>d</strong> Investment Partnership<br />

(TTIP)— are uncerta<strong>in</strong> on account of <strong>the</strong> dramatic turn taken by United States trade<br />

policy under <strong>the</strong> current Adm<strong>in</strong>istration. This is compounded by <strong>the</strong> difficulties fac<strong>in</strong>g<br />

WTO <strong><strong>an</strong>d</strong> <strong>the</strong> uncerta<strong>in</strong>ty caused by Brexit <strong><strong>an</strong>d</strong> <strong>the</strong> renegotiation of NAFTA (see<br />

section B.2). No consensus exists, however, regard<strong>in</strong>g <strong>the</strong> impact of reduced trade<br />

liberalization (or <strong>the</strong> rise of protectionism) on global trade per<strong>for</strong>m<strong>an</strong>ce <strong>in</strong> recent years,<br />

which is largely due to problems <strong>in</strong> establish<strong>in</strong>g precise <strong><strong>an</strong>d</strong> qu<strong>an</strong>tifiable metrics. While<br />

one study concludes that <strong>the</strong> slower rate of trade liberalization could expla<strong>in</strong> about 25%<br />

of <strong>the</strong> reduction <strong>in</strong> trade growth over 2011-2015 compared to 1991-2007 (OECD, 2016),<br />

<strong>an</strong>o<strong>the</strong>r f<strong>in</strong>ds that <strong>the</strong> contribution of a potential <strong>in</strong>crease <strong>in</strong> protectionism is small <strong><strong>an</strong>d</strong><br />

statistically <strong>in</strong>signific<strong>an</strong>t (Aubo<strong>in</strong> <strong><strong>an</strong>d</strong> Bor<strong>in</strong>o, 2017).<br />

In <strong>the</strong> area of technology, cont<strong>in</strong>ued progress with automation, particularly <strong>in</strong><br />

adv<strong>an</strong>ced countries, could underm<strong>in</strong>e <strong>the</strong> dynamism of global trade over <strong>the</strong> com<strong>in</strong>g<br />

years. Inasmuch as automation reduces <strong>in</strong>centives to tr<strong>an</strong>sfer production to develop<strong>in</strong>g<br />

countries <strong>in</strong> search of lower labour costs, this would put a brake on <strong>the</strong> exp<strong>an</strong>sion of<br />

global value cha<strong>in</strong>s <strong><strong>an</strong>d</strong>, as a result, to trade associated with <strong>the</strong>m (see section B.3).<br />

F<strong>in</strong>ally, it should be noted that <strong>in</strong> <strong>an</strong> <strong>in</strong>creas<strong>in</strong>gly digital world economy, <strong>the</strong><br />

statistics available <strong>for</strong> measur<strong>in</strong>g trade suffer from obvious limitations. The emergence<br />

of digital plat<strong>for</strong>ms allows trade —<strong>in</strong>clud<strong>in</strong>g cross-border trade— <strong>in</strong> a grow<strong>in</strong>g r<strong>an</strong>ge of<br />

services previously deemed not tradable, as well as <strong>in</strong> digital goods such as e-books,<br />

video games <strong><strong>an</strong>d</strong> downloads of music <strong><strong>an</strong>d</strong> films. In some sectors, digital goods have<br />

practically displaced <strong>the</strong>ir physical counterparts from <strong>the</strong> market. In those cases,<br />

“observable” trade (i.e. trade that crosses borders physically) may be fall<strong>in</strong>g, but that<br />

could at least partly reflect <strong>an</strong> <strong>in</strong>crease <strong>in</strong> digital trade, which <strong>the</strong> statistics currently<br />

available are unable to capture accurately. There is <strong>the</strong>re<strong>for</strong>e a clear need to develop<br />

new methodologies <strong>for</strong> measur<strong>in</strong>g <strong>the</strong> digital trade <strong>in</strong> goods <strong><strong>an</strong>d</strong> services.