International Trade Outlook for Latin America and the Caribbean: Recovery in an uncertain context

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20 Summary Economic Commission <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (ECLAC)<br />

The <strong>for</strong>ego<strong>in</strong>g <strong>an</strong>alysis concerned direct exports of services. However, m<strong>an</strong>y services<br />

traded <strong>in</strong>directly through <strong>the</strong>ir <strong>in</strong>corporation as <strong>in</strong>termediate <strong>in</strong>puts <strong>in</strong> exports of goods.<br />

M<strong>an</strong>y m<strong>an</strong>ufactur<strong>in</strong>g firms <strong>in</strong>corporate certa<strong>in</strong> types of “cost” services to improve efficiency<br />

<strong><strong>an</strong>d</strong> <strong>in</strong>crease productivity. Examples are tr<strong>an</strong>sport <strong><strong>an</strong>d</strong> logistics services, f<strong>in</strong><strong>an</strong>ces, ICT<br />

services, <strong>in</strong>sur<strong>an</strong>ce, m<strong>an</strong>agement, rent<strong>in</strong>g <strong><strong>an</strong>d</strong> leas<strong>in</strong>g of mach<strong>in</strong>ery, equipment <strong><strong>an</strong>d</strong><br />

build<strong>in</strong>gs, <strong><strong>an</strong>d</strong> <strong>in</strong>sur<strong>an</strong>ce. O<strong>the</strong>r m<strong>an</strong>ufacturers add “value” services to differentiate <strong>the</strong>ir<br />

products <strong><strong>an</strong>d</strong> make <strong>the</strong>m more attractive to clients <strong>in</strong> a highly competitive environment.<br />

M<strong>an</strong>ufacturers use wireless networks <strong><strong>an</strong>d</strong> digital technologies to build sensors <strong><strong>an</strong>d</strong><br />

microchips <strong>in</strong>to <strong>the</strong>ir goods to allow communication between <strong>the</strong>m (Internet of th<strong>in</strong>gs),<br />

to provide additional services <strong><strong>an</strong>d</strong> to collect <strong>in</strong><strong>for</strong>mation on consumer behaviour. These<br />

activities are concentrated <strong>in</strong> <strong>the</strong> category of bus<strong>in</strong>ess services.<br />

Us<strong>in</strong>g new statistics from <strong>the</strong> World <strong>Trade</strong> Org<strong>an</strong>ization (WTO) <strong><strong>an</strong>d</strong> <strong>the</strong> Org<strong>an</strong>ization<br />

<strong>for</strong> Economic Cooperation <strong><strong>an</strong>d</strong> Development (OECD) on <strong>in</strong>ternational value added exports,<br />

it was shown that <strong>the</strong> <strong>in</strong>directly exported services are similar <strong>in</strong> value to directly exported<br />

services. For <strong>the</strong> region’s larger economies, <strong>in</strong>direct exports represented between<br />

65% (<strong>in</strong> <strong>the</strong> case of Chile) <strong><strong>an</strong>d</strong> 160% (<strong>in</strong> <strong>the</strong> case of Mexico) of direct services exports<br />

<strong>in</strong> 2011. Chile’s low percentage has to do <strong>in</strong> part with its specialization <strong>in</strong> processed<br />

commodities such as ref<strong>in</strong>ed copper, which require relatively few services to compete<br />

<strong>in</strong>ternationally. Conversely, <strong>the</strong> high percentage <strong>in</strong> Mexico reflects its exports of<br />

medium- <strong><strong>an</strong>d</strong> high-tech <strong>in</strong>dustrial products such as automobiles <strong><strong>an</strong>d</strong> electronics, which<br />

<strong>in</strong>corporate m<strong>an</strong>y services <strong>for</strong> competitiveness.<br />

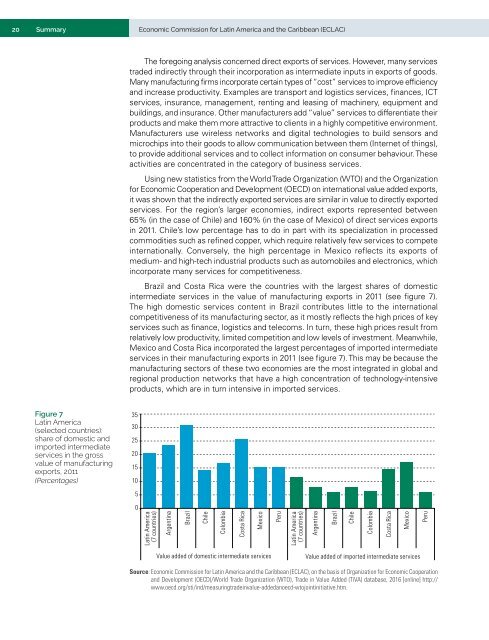

Brazil <strong><strong>an</strong>d</strong> Costa Rica were <strong>the</strong> countries with <strong>the</strong> largest shares of domestic<br />

<strong>in</strong>termediate services <strong>in</strong> <strong>the</strong> value of m<strong>an</strong>ufactur<strong>in</strong>g exports <strong>in</strong> 2011 (see figure 7).<br />

The high domestic services content <strong>in</strong> Brazil contributes little to <strong>the</strong> <strong>in</strong>ternational<br />

competitiveness of its m<strong>an</strong>ufactur<strong>in</strong>g sector, as it mostly reflects <strong>the</strong> high prices of key<br />

services such as f<strong>in</strong><strong>an</strong>ce, logistics <strong><strong>an</strong>d</strong> telecoms. In turn, <strong>the</strong>se high prices result from<br />

relatively low productivity, limited competition <strong><strong>an</strong>d</strong> low levels of <strong>in</strong>vestment. Me<strong>an</strong>while,<br />

Mexico <strong><strong>an</strong>d</strong> Costa Rica <strong>in</strong>corporated <strong>the</strong> largest percentages of imported <strong>in</strong>termediate<br />

services <strong>in</strong> <strong>the</strong>ir m<strong>an</strong>ufactur<strong>in</strong>g exports <strong>in</strong> 2011 (see figure 7). This may be because <strong>the</strong><br />

m<strong>an</strong>ufactur<strong>in</strong>g sectors of <strong>the</strong>se two economies are <strong>the</strong> most <strong>in</strong>tegrated <strong>in</strong> global <strong><strong>an</strong>d</strong><br />

regional production networks that have a high concentration of technology-<strong>in</strong>tensive<br />

products, which are <strong>in</strong> turn <strong>in</strong>tensive <strong>in</strong> imported services.<br />

Figure 7<br />

<strong>Lat<strong>in</strong></strong> <strong>America</strong><br />

(selected countries):<br />

share of domestic <strong><strong>an</strong>d</strong><br />

imported <strong>in</strong>termediate<br />

services <strong>in</strong> <strong>the</strong> gross<br />

value of m<strong>an</strong>ufactur<strong>in</strong>g<br />

exports, 2011<br />

(Percentages)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

<strong>Lat<strong>in</strong></strong> <strong>America</strong><br />

(7 countries)<br />

Argent<strong>in</strong>a<br />

Brazil<br />

Chile<br />

Colombia<br />

Costa Rica<br />

Mexico<br />

Peru<br />

<strong>Lat<strong>in</strong></strong> <strong>America</strong><br />

(7 countries)<br />

Argent<strong>in</strong>a<br />

Brazil<br />

Chile<br />

Colombia<br />

Costa Rica<br />

Mexico<br />

Peru<br />

Value added of domestic <strong>in</strong>termediate services<br />

Value added of imported <strong>in</strong>termediate services<br />

Source: Economic Commission <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (ECLAC), on <strong>the</strong> basis of Org<strong>an</strong>ization <strong>for</strong> Economic Cooperation<br />

<strong><strong>an</strong>d</strong> Development (OECD)/World <strong>Trade</strong> Org<strong>an</strong>ization (WTO), <strong>Trade</strong> <strong>in</strong> Value Added (TiVA) database, 2016 [onl<strong>in</strong>e] http://<br />

www.oecd.org/sti/<strong>in</strong>d/measur<strong>in</strong>gtrade<strong>in</strong>value-added<strong>an</strong>oecd-wtojo<strong>in</strong>t<strong>in</strong>itiative.htm.