International Trade Outlook for Latin America and the Caribbean: Recovery in an uncertain context

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

This first edition of International Trade Outlook for Latin America and the Caribbean, which is the continuation of Latin America and the Caribbean in the World Economy with a new title, covers 2017 and contains three chapters. The first chapter describes the current international context and the recovery of trade in the region. Chapter II reviews the region’s performance in global trade in services in general and in modern services in particular, since 2005. Chapter III provides an overview of Latin America and the Caribbean’s share of the world agricultural trade since 2000 and offers some policy recommendations for increasing the sector’s contribution to regional development.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>International</strong> <strong>Trade</strong> <strong>Outlook</strong> <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> • 2017<br />

Chapter I<br />

65<br />

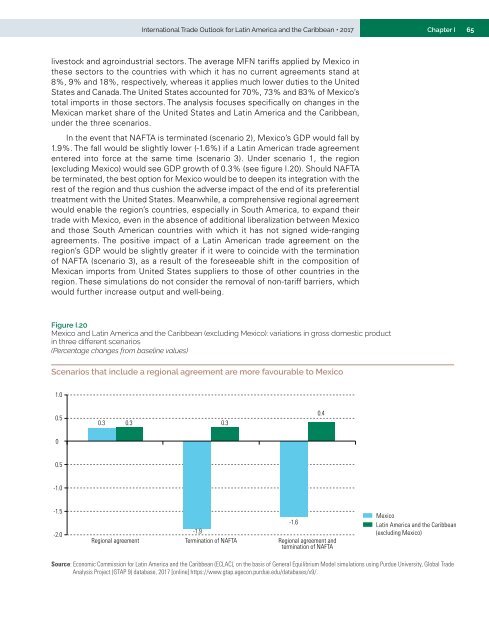

livestock <strong><strong>an</strong>d</strong> agro<strong>in</strong>dustrial sectors. The average MFN tariffs applied by Mexico <strong>in</strong><br />

<strong>the</strong>se sectors to <strong>the</strong> countries with which it has no current agreements st<strong><strong>an</strong>d</strong> at<br />

8%, 9% <strong><strong>an</strong>d</strong> 18%, respectively, whereas it applies much lower duties to <strong>the</strong> United<br />

States <strong><strong>an</strong>d</strong> C<strong>an</strong>ada. The United States accounted <strong>for</strong> 70%, 73% <strong><strong>an</strong>d</strong> 83% of Mexico’s<br />

total imports <strong>in</strong> those sectors. The <strong>an</strong>alysis focuses specifically on ch<strong>an</strong>ges <strong>in</strong> <strong>the</strong><br />

Mexic<strong>an</strong> market share of <strong>the</strong> United States <strong><strong>an</strong>d</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong>,<br />

under <strong>the</strong> three scenarios.<br />

In <strong>the</strong> event that NAFTA is term<strong>in</strong>ated (scenario 2), Mexico’s GDP would fall by<br />

1.9%. The fall would be slightly lower (-1.6%) if a <strong>Lat<strong>in</strong></strong> <strong>America</strong>n trade agreement<br />

entered <strong>in</strong>to <strong>for</strong>ce at <strong>the</strong> same time (scenario 3). Under scenario 1, <strong>the</strong> region<br />

(exclud<strong>in</strong>g Mexico) would see GDP growth of 0.3% (see figure I.20). Should NAFTA<br />

be term<strong>in</strong>ated, <strong>the</strong> best option <strong>for</strong> Mexico would be to deepen its <strong>in</strong>tegration with <strong>the</strong><br />

rest of <strong>the</strong> region <strong><strong>an</strong>d</strong> thus cushion <strong>the</strong> adverse impact of <strong>the</strong> end of its preferential<br />

treatment with <strong>the</strong> United States. Me<strong>an</strong>while, a comprehensive regional agreement<br />

would enable <strong>the</strong> region’s countries, especially <strong>in</strong> South <strong>America</strong>, to exp<strong><strong>an</strong>d</strong> <strong>the</strong>ir<br />

trade with Mexico, even <strong>in</strong> <strong>the</strong> absence of additional liberalization between Mexico<br />

<strong><strong>an</strong>d</strong> those South <strong>America</strong>n countries with which it has not signed wide-r<strong>an</strong>g<strong>in</strong>g<br />

agreements. The positive impact of a <strong>Lat<strong>in</strong></strong> <strong>America</strong>n trade agreement on <strong>the</strong><br />

region’s GDP would be slightly greater if it were to co<strong>in</strong>cide with <strong>the</strong> term<strong>in</strong>ation<br />

of NAFTA (scenario 3), as a result of <strong>the</strong> <strong>for</strong>eseeable shift <strong>in</strong> <strong>the</strong> composition of<br />

Mexic<strong>an</strong> imports from United States suppliers to those of o<strong>the</strong>r countries <strong>in</strong> <strong>the</strong><br />

region. These simulations do not consider <strong>the</strong> removal of non-tariff barriers, which<br />

would fur<strong>the</strong>r <strong>in</strong>crease output <strong><strong>an</strong>d</strong> well-be<strong>in</strong>g.<br />

Figure I.20<br />

Mexico <strong><strong>an</strong>d</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (exclud<strong>in</strong>g Mexico): variations <strong>in</strong> gross domestic product<br />

<strong>in</strong> three different scenarios<br />

(Percentage ch<strong>an</strong>ges from basel<strong>in</strong>e values)<br />

Scenarios that <strong>in</strong>clude a regional agreement are more favourable to Mexico<br />

1.0<br />

0.5<br />

0.3<br />

0.3 0.3<br />

0.4<br />

0<br />

0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-1.6<br />

-1.9<br />

Regional agreement Term<strong>in</strong>ation of NAFTA Regional agreement <strong><strong>an</strong>d</strong><br />

term<strong>in</strong>ation of NAFTA<br />

Mexico<br />

<strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong><br />

(exclud<strong>in</strong>g Mexico)<br />

Source: Economic Commission <strong>for</strong> <strong>Lat<strong>in</strong></strong> <strong>America</strong> <strong><strong>an</strong>d</strong> <strong>the</strong> <strong>Caribbe<strong>an</strong></strong> (ECLAC), on <strong>the</strong> basis of General Equilibrium Model simulations us<strong>in</strong>g Purdue University, Global <strong>Trade</strong><br />

Analysis Project (GTAP 9) database, 2017 [onl<strong>in</strong>e] https://www.gtap.agecon.purdue.edu/databases/v9/.