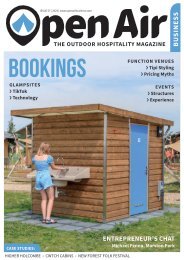

Open Air Business January 2018

The UK's outdoor hospitality business magazine for function venues, glamping, festivals and outdoor events

The UK's outdoor hospitality business magazine for function venues, glamping, festivals and outdoor events

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FUNCTION VENUES<br />

comprises four main cornerstones<br />

that can be taken independently<br />

of each other (in most cases), or<br />

combined to suit your needs, to give<br />

you the levels of cover that your<br />

event, or the users of your function<br />

venue, may need.<br />

› Public Liability Insurance. The<br />

foundation of any event insurance<br />

policy. There are four main cover<br />

levels ranging from £10m, down<br />

through £5m and £2m to the<br />

basic level of £1m of cover. Local<br />

authorities and larger stately homes<br />

are increasingly specifying that<br />

clients take out £10m of cover and I<br />

am seeing that trend spread out to<br />

other venue types as well.<br />

Premiums here can start from as<br />

little as £60, but will depend on the<br />

number of attendees at the event,<br />

as well as the length of the event<br />

itself.<br />

› Employers Liability Insurance.<br />

A legal essential for you to have in<br />

place, yet so often an overlooked<br />

level of cover. Employers liability is<br />

potentially relevant if you have any<br />

staff, volunteers or helpers working<br />

or assisting you at the event. This<br />

could range from stewards, catering<br />

staff, ticket collectors or marshalls.<br />

It doesn’t matter whether they are<br />

paid or unpaid, but they must be<br />

under your control and supervision<br />

at the time they sustain an injury.<br />

With cover starting from only<br />

around £53 for up to £5m of cover<br />

for up to 10 volunteers/employees,<br />

this is frequently taken out in<br />

conjunction with public liability.<br />

› Event Equipment Cover.<br />

This level of cover relates to items<br />

that your client may be bringing<br />

into, or hiring for, an event they<br />

are holding at your venue. So this<br />

excludes items which are already<br />

part of the fixtures and fittings at<br />

your venue. Our policy in particular<br />

would provide accidental damage,<br />

loss or theft cover for the event<br />

equipment that your client is legally<br />

responsible for, for the duration<br />

of their event. This cover can start<br />

from an additional premium as low<br />

as £34.<br />

› Cancellation Insurance. This<br />

is a big one, and yet as an optional<br />

cover many event organisers<br />

choose not to add it to their policy.<br />

Organising and hosting an event<br />

can be costly, and this cover looks<br />

to try and recover your costs if<br />

the event you are organising or<br />

attending was forced to cancel<br />

ABOUT THE<br />

AUTHOR<br />

Kerry Leighton-<br />

Bailey is the<br />

marketing<br />

director at Event<br />

Insurance Services.<br />

Established in 1996,<br />

Event Insurance<br />

Services provides<br />

affordable, reliable<br />

insurance, tailored<br />

to fit the scale and<br />

style of the occasion<br />

– from school<br />

fêtes and small<br />

ceremonies to high<br />

profile weddings<br />

and events. The<br />

team works with<br />

companies and<br />

individuals across<br />

the full spectrum of<br />

events, as well as<br />

supporting a broker<br />

network of over<br />

2,500 brokers and<br />

450 of the country’s<br />

top venues and<br />

hotels. www.eventsinsurance.co.uk<br />

for reasons beyond your control.<br />

There are also several extensions<br />

to cancellation cover, which are<br />

becoming increasingly common:<br />

• Adverse weather cover: With<br />

the unpredictability of the British<br />

weather, and the increasing<br />

number of outdoor events, this<br />

is one of the most common<br />

cancellation extensions<br />

• Terrorism cover: Sadly, a sign<br />

of the times. For an additional<br />

premium, we can offer terrorism<br />

cover for your event, limited to<br />

threats and acts of terrorism<br />

occurring within a specific<br />

number of days and miles of<br />

the event (usually 50 days and<br />

50 miles). There is an option to<br />

upgrade the cover to remove time<br />

and distance restrictions<br />

• Non-Appearance cover:<br />

Designed for events which are<br />

dependent upon a key individual<br />

or a group of performers.<br />

YOUR PREMIUM<br />

The median spend on event<br />

insurance last year was £2,500,<br />

according to a recent Eventbrite<br />

report. However, this figure has<br />

been pushed up by the increase in<br />

the number of very large events,<br />

such as Glastonbury, which have<br />

huge premiums.<br />

Whatever the size of the event<br />

you are organising, hosting or<br />

attending, there are several ways<br />

that you can look to reduce your<br />

insurance premium. The key is<br />

working with an insurance provider<br />

or broker that fully understands the<br />

needs of your event. By explaining<br />

the policies and procedures you<br />

have in place to help mitigate risk,<br />

you will give the insurer confidence<br />

that you are doing everything<br />

possible to reduce the risk of having<br />

to make a claim.<br />

If you are organising, hosting or<br />

attending multiple events per year<br />

then there are annual event policies<br />

available which generally offer a<br />

lower cost-per-event than insuring<br />

each event individually.<br />

If you work with an insurer for a<br />

period of time, it is likely they will<br />

be able to maintain your insurance<br />

premium, or in some cases reduce<br />

it, based on their long standing<br />

experience of your event or venue.<br />

Building a relationship with your<br />

insurer will stand you in good stead<br />

for the long term.<br />

By opening up your venue, or<br />

organising/exhibiting at an event,<br />

you want everyone involved to<br />

have an enjoyable, rewarding and<br />

profitable event. Ultimately, an<br />

insurance policy is a risk mitigation<br />

tool. Ensuring you have your<br />

own insurance in place to protect<br />

your negligence is important; by<br />

stipulating that your clients also<br />

have adequate insurance in place<br />

can give you peace of mind that<br />

they have financial security to cover<br />

any claims.<br />

GETTY IMAGES<br />

WWW.OPENAIRBUSINESS.COM 17