Shaftesbury AR 2017 LR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS NOTES to the financial statements <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

1 Accounting policies continued<br />

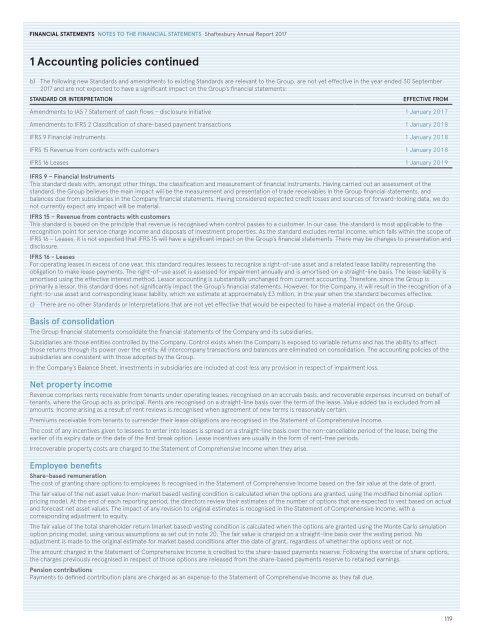

b) The following new Standards and amendments to existing Standards are relevant to the Group, are not yet effective in the year ended 30 September<br />

<strong>2017</strong> and are not expected to have a significant impact on the Group’s financial statements:<br />

STAND<strong>AR</strong>D OR INTERPRETATION<br />

EFFECTIVE FROM<br />

Amendments to IAS 7 Statement of cash flows - disclosure initiative 1 January <strong>2017</strong><br />

Amendments to IFRS 2 Classification of share-based payment transactions 1 January 2018<br />

IFRS 9 Financial instruments 1 January 2018<br />

IFRS 15 Revenue from contracts with customers 1 January 2018<br />

IFRS 16 Leases 1 January 2019<br />

IFRS 9 – Financial Instruments<br />

This standard deals with, amongst other things, the classification and measurement of financial instruments. Having carried out an assessment of the<br />

standard, the Group believes the main impact will be the measurement and presentation of trade receivables in the Group financial statements, and<br />

balances due from subsidiaries in the Company financial statements. Having considered expected credit losses and sources of forward-looking data, we do<br />

not currently expect any impact will be material.<br />

IFRS 15 – Revenue from contracts with customers<br />

This standard is based on the principle that revenue is recognised when control passes to a customer. In our case, the standard is most applicable to the<br />

recognition point for service charge income and disposals of investment properties. As the standard excludes rental income, which falls within the scope of<br />

IFRS 16 – Leases, it is not expected that IFRS 15 will have a significant impact on the Group’s financial statements. There may be changes to presentation and<br />

disclosure.<br />

IFRS 16 - Leases<br />

For operating leases in excess of one year, this standard requires lessees to recognise a right-of-use asset and a related lease liability representing the<br />

obligation to make lease payments. The right-of-use asset is assessed for impairment annually and is amortised on a straight-line basis. The lease liability is<br />

amortised using the effective interest method. Lessor accounting is substantially unchanged from current accounting. Therefore, since the Group is<br />

primarily a lessor, this standard does not significantly impact the Group’s financial statements. However, for the Company, it will result in the recognition of a<br />

right-to-use asset and corresponding lease liability, which we estimate at approximately £3 million, in the year when the standard becomes effective.<br />

c) There are no other Standards or Interpretations that are not yet effective that would be expected to have a material impact on the Group.<br />

Basis of consolidation<br />

The Group financial statements consolidate the financial statements of the Company and its subsidiaries.<br />

Subsidiaries are those entities controlled by the Company. Control exists when the Company is exposed to variable returns and has the ability to affect<br />

those returns through its power over the entity. All intercompany transactions and balances are eliminated on consolidation. The accounting policies of the<br />

subsidiaries are consistent with those adopted by the Group.<br />

In the Company’s Balance Sheet, investments in subsidiaries are included at cost less any provision in respect of impairment loss.<br />

Net property income<br />

Revenue comprises rents receivable from tenants under operating leases, recognised on an accruals basis, and recoverable expenses incurred on behalf of<br />

tenants, where the Group acts as principal. Rents are recognised on a straight-line basis over the term of the lease. Value added tax is excluded from all<br />

amounts. Income arising as a result of rent reviews is recognised when agreement of new terms is reasonably certain.<br />

Premiums receivable from tenants to surrender their lease obligations are recognised in the Statement of Comprehensive Income.<br />

The cost of any incentives given to lessees to enter into leases is spread on a straight-line basis over the non-cancellable period of the lease, being the<br />

earlier of its expiry date or the date of the first break option. Lease incentives are usually in the form of rent-free periods.<br />

Irrecoverable property costs are charged to the Statement of Comprehensive Income when they arise.<br />

Employee benefits<br />

Share-based remuneration<br />

The cost of granting share options to employees is recognised in the Statement of Comprehensive Income based on the fair value at the date of grant.<br />

The fair value of the net asset value (non-market based) vesting condition is calculated when the options are granted, using the modified binomial option<br />

pricing model. At the end of each reporting period, the directors review their estimates of the number of options that are expected to vest based on actual<br />

and forecast net asset values. The impact of any revision to original estimates is recognised in the Statement of Comprehensive Income, with a<br />

corresponding adjustment to equity.<br />

The fair value of the total shareholder return (market based) vesting condition is calculated when the options are granted using the Monte Carlo simulation<br />

option pricing model, using various assumptions as set out in note 20. The fair value is charged on a straight-line basis over the vesting period. No<br />

adjustment is made to the original estimate for market based conditions after the date of grant, regardless of whether the options vest or not.<br />

The amount charged in the Statement of Comprehensive Income is credited to the share-based payments reserve. Following the exercise of share options,<br />

the charges previously recognised in respect of those options are released from the share-based payments reserve to retained earnings.<br />

Pension contributions<br />

Payments to defined contribution plans are charged as an expense to the Statement of Comprehensive Income as they fall due.<br />

119