Shaftesbury AR 2017 LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRATEGIC REPORT OVERVIEW <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

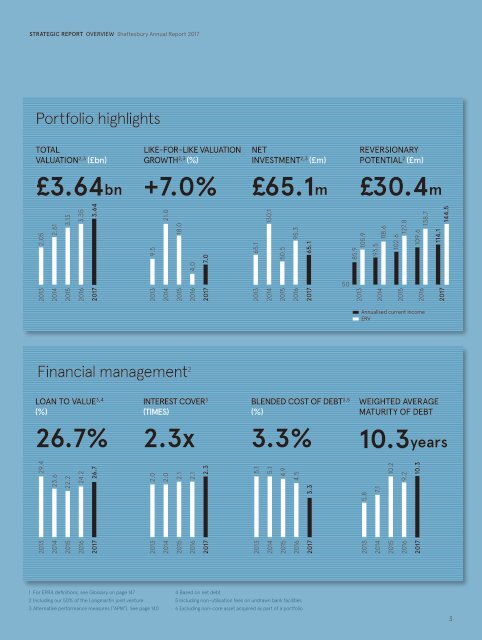

Portfolio highlights<br />

TOTAL<br />

VALUATION 2,3 (£bn)<br />

LIKE-FOR-LIKE VALUATION<br />

GROWTH 2,3 (%)<br />

NET<br />

INVESTMENT 2,3 (£m)<br />

REVERSION<strong>AR</strong>Y<br />

POTENTIAL 2 (£m)<br />

£3.64bn<br />

+7.0%<br />

£65.1m<br />

£30.4m<br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

29.4<br />

23.6<br />

22.2<br />

24.2<br />

26.7<br />

2.0<br />

2.0<br />

2.1<br />

2.1<br />

2.3<br />

5.1<br />

5.1<br />

4.9<br />

4.5<br />

3.3<br />

5.8<br />

7.1<br />

10.2<br />

9.2<br />

10.3<br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

2013<br />

2014<br />

2015<br />

2016<br />

<strong>2017</strong><br />

4.0<br />

2.05<br />

2.61<br />

3.13<br />

3.35<br />

3.64<br />

9.5<br />

21.0<br />

18.0<br />

7.0<br />

65.1<br />

130.1<br />

50.5<br />

95.3<br />

65.1<br />

85.9<br />

105.9<br />

93.5<br />

118.6<br />

102.6<br />

127.8<br />

109.6<br />

138.7<br />

114.1<br />

144.5<br />

50<br />

Annualised current income<br />

ERV<br />

Financial management 2<br />

LOAN TO VALUE 3,4<br />

(%)<br />

INTEREST COVER 3<br />

(TIMES)<br />

BLENDED COST OF DEBT 3,5<br />

(%)<br />

WEIGHTED AVERAGE<br />

MATURITY OF DEBT<br />

26.7%<br />

2.3x<br />

3.3%<br />

10.3years<br />

1 For EPRA definitions, see Glossary on page 147<br />

2 Including our 50% of the Longmartin joint venture<br />

3 Alternative performance measures (“APM”), See page 140<br />

4 Based on net debt<br />

5 Including non-utilisation fees on undrawn bank facilities<br />

6 Excluding non-core asset acquired as part of a portfolio<br />

3