Shaftesbury AR 2017 LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS NOTES to the financial statements <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

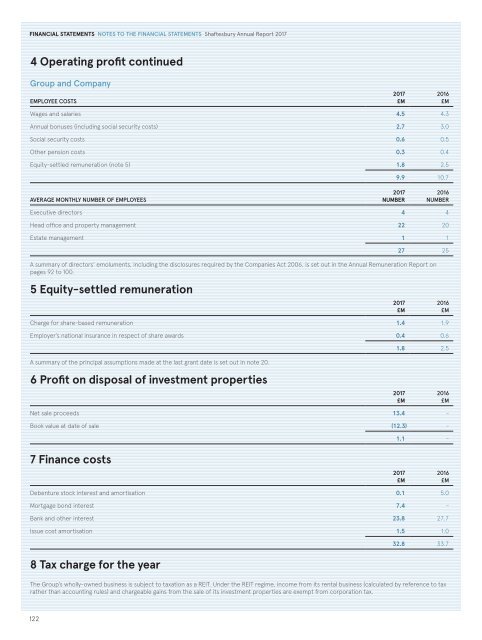

4 Operating profit continued<br />

Group and Company<br />

EMPLOYEE COSTS<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

Wages and salaries 4.5 4.3<br />

Annual bonuses (including social security costs) 2.7 3.0<br />

Social security costs 0.6 0.5<br />

Other pension costs 0.3 0.4<br />

Equity-settled remuneration (note 5) 1.8 2.5<br />

9.9 10.7<br />

AVERAGE MONTHLY NUMBER OF EMPLOYEES<br />

<strong>2017</strong><br />

NUMBER<br />

2016<br />

NUMBER<br />

Executive directors 4 4<br />

Head office and property management 22 20<br />

Estate management 1 1<br />

27 25<br />

A summary of directors’ emoluments, including the disclosures required by the Companies Act 2006, is set out in the Annual Remuneration Report on<br />

pages 92 to 100.<br />

5 Equity-settled remuneration<br />

Charge for share-based remuneration 1.4 1.9<br />

Employer’s national insurance in respect of share awards 0.4 0.6<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

1.8 2.5<br />

A summary of the principal assumptions made at the last grant date is set out in note 20.<br />

6 Profit on disposal of investment properties<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

Net sale proceeds 13.4 -<br />

Book value at date of sale (12.3) -<br />

1.1 -<br />

7 Finance costs<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

Debenture stock interest and amortisation 0.1 5.0<br />

Mortgage bond interest 7.4 -<br />

Bank and other interest 23.8 27.7<br />

Issue cost amortisation 1.5 1.0<br />

8 Tax charge for the year<br />

32.8 33.7<br />

The Group’s wholly-owned business is subject to taxation as a REIT. Under the REIT regime, income from its rental business (calculated by reference to tax<br />

rather than accounting rules) and chargeable gains from the sale of its investment properties are exempt from corporation tax.<br />

122