Shaftesbury AR 2017 LR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS NOTES to the financial statements <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

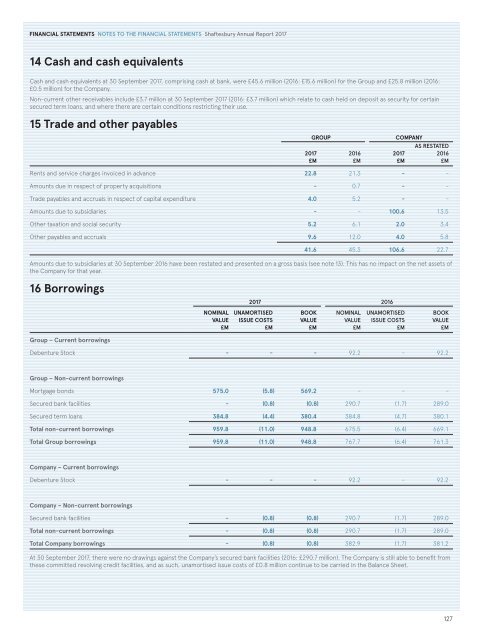

14 Cash and cash equivalents<br />

Cash and cash equivalents at 30 September <strong>2017</strong>, comprising cash at bank, were £45.6 million (2016: £15.6 million) for the Group and £25.8 million (2016:<br />

£0.5 million) for the Company.<br />

Non-current other receivables include £3.7 million at 30 September <strong>2017</strong> (2016: £3.7 million) which relate to cash held on deposit as security for certain<br />

secured term loans, and where there are certain conditions restricting their use.<br />

15 Trade and other payables<br />

GROUP<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

COMPANY<br />

<strong>2017</strong><br />

£M<br />

AS RESTATED<br />

2016<br />

£M<br />

Rents and service charges invoiced in advance 22.8 21.3 - -<br />

Amounts due in respect of property acquisitions - 0.7 - -<br />

Trade payables and accruals in respect of capital expenditure 4.0 5.2 - -<br />

Amounts due to subsidiaries - - 100.6 13.5<br />

Other taxation and social security 5.2 6.1 2.0 3.4<br />

Other payables and accruals 9.6 12.0 4.0 5.8<br />

41.6 45.3 106.6 22.7<br />

Amounts due to subsidiaries at 30 September 2016 have been restated and presented on a gross basis (see note 13). This has no impact on the net assets of<br />

the Company for that year.<br />

16 Borrowings<br />

<strong>2017</strong> 2016<br />

NOMINAL<br />

VALUE<br />

£M<br />

UNAMORTISED<br />

ISSUE COSTS<br />

£M<br />

BOOK<br />

VALUE<br />

£M<br />

NOMINAL<br />

VALUE<br />

£M<br />

UNAMORTISED<br />

ISSUE COSTS<br />

£M<br />

BOOK<br />

VALUE<br />

£M<br />

Group – Current borrowings<br />

Debenture Stock - - - 92.2 - 92.2<br />

Group – Non-current borrowings<br />

Mortgage bonds 575.0 (5.8) 569.2 - - -<br />

Secured bank facilities - (0.8) (0.8) 290.7 (1.7) 289.0<br />

Secured term loans 384.8 (4.4) 380.4 384.8 (4.7) 380.1<br />

Total non-current borrowings 959.8 (11.0) 948.8 675.5 (6.4) 669.1<br />

Total Group borrowings 959.8 (11.0) 948.8 767.7 (6.4) 761.3<br />

Company – Current borrowings<br />

Debenture Stock - - - 92.2 - 92.2<br />

Company – Non-current borrowings<br />

Secured bank facilities - (0.8) (0.8) 290.7 (1.7) 289.0<br />

Total non-current borrowings - (0.8) (0.8) 290.7 (1.7) 289.0<br />

Total Company borrowings - (0.8) (0.8) 382.9 (1.7) 381.2<br />

At 30 September <strong>2017</strong>, there were no drawings against the Company’s secured bank facilities (2016: £290.7 million). The Company is still able to benefit from<br />

these committed revolving credit facilities, and as such, unamortised issue costs of £0.8 million continue to be carried in the Balance Sheet.<br />

127