Shaftesbury AR 2017 LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRATEGIC REPORT ANNUAL REVIEW <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

Leasing<br />

and occupancy<br />

Sustained demand across our portfolio helped deliver strong leasing results.<br />

Our Thomas Neal’s Warehouse and Central Cross schemes completed in<br />

the year and letting is underway.<br />

Leasing<br />

During the year, we concluded leasing transactions in the wholly-owned<br />

portfolio with a rental value of £31.1 million (2016: £27.8 million). Of this,<br />

commercial transactions totalled £23.8 million (2016: £21.6 million) and<br />

residential lettings and renewals amounted to £7.3 million (2016: £6.2 million).<br />

Rents for commercial uses were, on average, 6.7% above ERV at 30<br />

September 2016.<br />

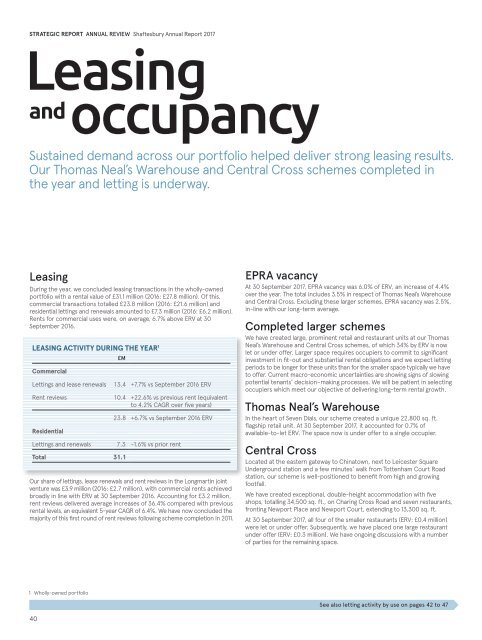

LEASING ACTIVITY DURING THE YE<strong>AR</strong> 1<br />

Commercial<br />

£M<br />

Lettings and lease renewals 13.4 +7.7% vs September 2016 ERV<br />

Rent reviews 10.4 +22.6% vs previous rent (equivalent<br />

to 4.2% CAGR over five years)<br />

Residential<br />

23.8 +6.7% vs September 2016 ERV<br />

Lettings and renewals 7.3 -1.6% vs prior rent<br />

Total 31.1<br />

Our share of lettings, lease renewals and rent reviews in the Longmartin joint<br />

venture was £3.9 million (2016: £2.7 million), with commercial rents achieved<br />

broadly in line with ERV at 30 September 2016. Accounting for £3.2 million,<br />

rent reviews delivered average increases of 36.4% compared with previous<br />

rental levels, an equivalent 5-year CAGR of 6.4%. We have now concluded the<br />

majority of this first round of rent reviews following scheme completion in 2011.<br />

EPRA vacancy<br />

At 30 September <strong>2017</strong>, EPRA vacancy was 6.0% of ERV, an increase of 4.4%<br />

over the year. The total includes 3.5% in respect of Thomas Neal’s Warehouse<br />

and Central Cross. Excluding these larger schemes, EPRA vacancy was 2.5%,<br />

in-line with our long-term average.<br />

Completed larger schemes<br />

We have created large, prominent retail and restaurant units at our Thomas<br />

Neal’s Warehouse and Central Cross schemes, of which 34% by ERV is now<br />

let or under offer. Larger space requires occupiers to commit to significant<br />

investment in fit-out and substantial rental obligations and we expect letting<br />

periods to be longer for these units than for the smaller space typically we have<br />

to offer. Current macro-economic uncertainties are showing signs of slowing<br />

potential tenants’ decision–making processes. We will be patient in selecting<br />

occupiers which meet our objective of delivering long-term rental growth.<br />

Thomas Neal’s Warehouse<br />

In the heart of Seven Dials, our scheme created a unique 22,800 sq. ft.<br />

flagship retail unit. At 30 September <strong>2017</strong>, it accounted for 0.7% of<br />

available-to-let ERV. The space now is under offer to a single occupier.<br />

Central Cross<br />

Located at the eastern gateway to Chinatown, next to Leicester Square<br />

Underground station and a few minutes’ walk from Tottenham Court Road<br />

station, our scheme is well-positioned to benefit from high and growing<br />

footfall.<br />

We have created exceptional, double-height accommodation with five<br />

shops, totalling 34,500 sq. ft., on Charing Cross Road and seven restaurants,<br />

fronting Newport Place and Newport Court, extending to 13,300 sq. ft.<br />

At 30 September <strong>2017</strong>, all four of the smaller restaurants (ERV: £0.4 million)<br />

were let or under offer. Subsequently, we have placed one large restaurant<br />

under offer (ERV: £0.3 million). We have ongoing discussions with a number<br />

of parties for the remaining space.<br />

1 Wholly-owned portfolio<br />

See also letting activity by use on pages 42 to 47<br />

40