Shaftesbury AR 2017 LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRATEGIC REPORT ANNUAL REVIEW <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

Financial<br />

results<br />

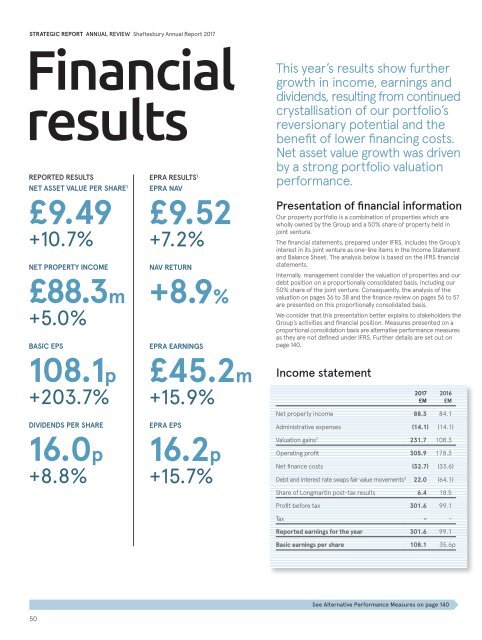

REPORTED RESULTS<br />

NET ASSET VALUE PER SH<strong>AR</strong>E 1<br />

£9.49<br />

+10.7%<br />

NET PROPERTY INCOME<br />

£88.3m<br />

+5.0%<br />

BASIC EPS<br />

EPRA RESULTS 1<br />

EPRA NAV<br />

£9.52<br />

+7.2%<br />

NAV RETURN<br />

+8.9%<br />

EPRA E<strong>AR</strong>NINGS<br />

This year’s results show further<br />

growth in income, earnings and<br />

dividends, resulting from continued<br />

crystallisation of our portfolio’s<br />

reversionary potential and the<br />

benefit of lower financing costs.<br />

Net asset value growth was driven<br />

by a strong portfolio valuation<br />

performance.<br />

Presentation of financial information<br />

Our property portfolio is a combination of properties which are<br />

wholly owned by the Group and a 50% share of property held in<br />

joint venture.<br />

The financial statements, prepared under IFRS, includes the Group’s<br />

interest in its joint venture as one-line items in the Income Statement<br />

and Balance Sheet. The analysis below is based on the IFRS financial<br />

statements.<br />

Internally, management consider the valuation of properties and our<br />

debt position on a proportionally consolidated basis, including our<br />

50% share of the joint venture. Consequently, the analysis of the<br />

valuation on pages 36 to 38 and the finance review on pages 56 to 57<br />

are presented on this proportionally consolidated basis.<br />

We consider that this presentation better explains to stakeholders the<br />

Group’s activities and financial position. Measures presented on a<br />

proportional consolidation basis are alternative performance measures<br />

as they are not defined under IFRS. Further details are set out on<br />

page 140.<br />

108.1p<br />

+203.7%<br />

DIVIDENDS PER SH<strong>AR</strong>E<br />

16.0p<br />

+8.8%<br />

£45.2m<br />

+15.9%<br />

EPRA EPS<br />

16.2p<br />

+15.7%<br />

Income statement<br />

<strong>2017</strong><br />

£M<br />

2016<br />

£M<br />

Net property income 88.3 84.1<br />

Administrative expenses (14.1) (14.1)<br />

Valuation gains 2 231.7 108.3<br />

Operating profit 305.9 178.3<br />

Net finance costs (32.7) (33.6)<br />

Debt and interest rate swaps fair value movements 3 22.0 (64.1)<br />

Share of Longmartin post-tax results 6.4 18.5<br />

Profit before tax 301.6 99.1<br />

Tax - -<br />

Reported earnings for the year 301.6 99.1<br />

Basic earnings per share 108.1 35.6p<br />

50<br />

See Alternative Performance Measures on page 140