Shaftesbury AR 2017 LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRATEGIC REPORT OVERVIEW <strong>Shaftesbury</strong> Annual Report <strong>2017</strong><br />

Focus<br />

on restaurants,<br />

leisure and retail<br />

Mix of uses, focussed on<br />

restaurants, leisure and retail<br />

over lower floors with offices<br />

and residential on upper floors.<br />

Restaurants,<br />

leisure and<br />

shops generate<br />

70% of current<br />

annualised<br />

New concepts and<br />

independents favoured<br />

Careful tenant selection is critical to ensure our areas remain<br />

popular and attract growing footfall. We favour new concepts,<br />

independent operators and international retailers making their<br />

UK debut and prefer mid-market, innovative formats. Our shops<br />

are neither luxury nor value-led and our restaurants typically are<br />

neither Michelin-starred nor low-end fast food.<br />

Long history of demand<br />

exceeding availability<br />

In the West End, there is a long history of occupier demand for<br />

restaurant, leisure and retail space exceeding availability, which is<br />

often restricted by planning policies.<br />

Consequently, rents for these uses, in our areas, have not<br />

demonstrated cyclical nor structural decline, even in times of<br />

major economic uncertainty. Over the past ten years, ERV for<br />

these uses has demonstrated like-for-like annualised growth of<br />

3.8%, despite rental levels remaining broadly flat during the global<br />

financial crisis. Vacancy levels for these uses over the same<br />

period have averaged 3.0% of ERV 1,2 .<br />

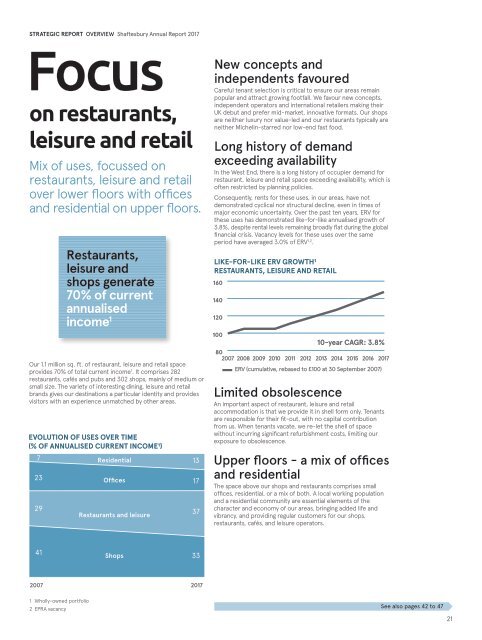

LIKE-FOR-LIKE ERV GROWTH¹<br />

RESTAURANTS, LEISURE AND RETAIL<br />

160<br />

140<br />

120<br />

income 1 ERV (cumulative, rebased to £100 at 30 September 2007)<br />

Our 1.1 million sq. ft. of restaurant, leisure and retail space<br />

provides 70% of total current income 1 . It comprises 282<br />

restaurants, cafés and pubs and 302 shops, mainly of medium or<br />

small size. The variety of interesting dining, leisure and retail<br />

brands gives our destinations a particular identity and provides<br />

visitors with an experience unmatched by other areas.<br />

EVOLUTION OF USES OVER TIME<br />

(% OF ANNUALISED CURRENT INCOME¹)<br />

7<br />

23<br />

29<br />

Residential<br />

Offices<br />

Restaurants and leisure<br />

13<br />

17<br />

37<br />

100<br />

10-year CAGR: 3.8%<br />

80<br />

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 <strong>2017</strong><br />

Limited obsolescence<br />

An important aspect of restaurant, leisure and retail<br />

accommodation is that we provide it in shell form only. Tenants<br />

are responsible for their fit-out, with no capital contribution<br />

from us. When tenants vacate, we re-let the shell of space<br />

without incurring significant refurbishment costs, limiting our<br />

exposure to obsolescence.<br />

Upper floors - a mix of offices<br />

and residential<br />

The space above our shops and restaurants comprises small<br />

offices, residential, or a mix of both. A local working population<br />

and a residential community are essential elements of the<br />

character and economy of our areas, bringing added life and<br />

vibrancy, and providing regular customers for our shops,<br />

restaurants, cafés, and leisure operators.<br />

41<br />

Shops<br />

33<br />

2007 <strong>2017</strong><br />

1 Wholly-owned portfolio<br />

2 EPRA vacancy<br />

See also pages 42 to 47<br />

21