Registration Document - Pernod Ricard

Registration Document - Pernod Ricard

Registration Document - Pernod Ricard

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 Notes<br />

108<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS<br />

to the annual consolidated fi nancial statements<br />

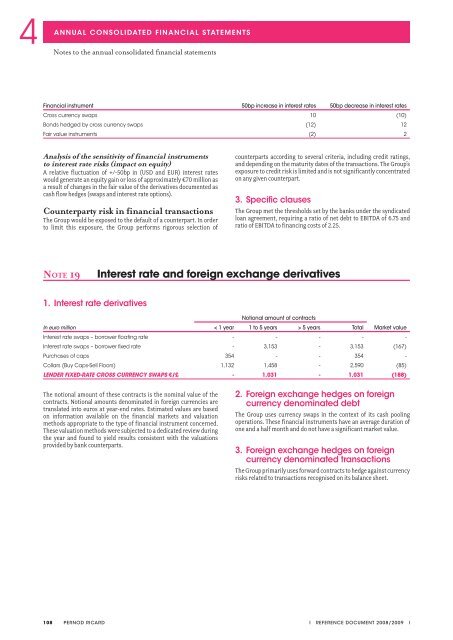

Financial instrument 50bp increase in interest rates 50bp decrease in interest rates<br />

Cross currency swaps 10 (10)<br />

Bonds hedged by cross currency swaps (12) 12<br />

Fair value instruments (2) 2<br />

Analysis of the sensitivity of financial instruments<br />

to interest rate risks (impact on equity)<br />

A relative fluctuation of +/-50bp in (USD and EUR) interest rates<br />

would generate an equity gain or loss of approximately €70 million as<br />

a result of changes in the fair value of the derivatives documented as<br />

cash flow hedges (swaps and interest rate options).<br />

Counterparty risk in financial transactions<br />

The Group would be exposed to the default of a counterpart. In order<br />

to limit this exposure, the Group performs rigorous selection of<br />

PERNOD RICARD<br />

counterparts according to several criteria, including credit ratings,<br />

and depending on the maturity dates of the transactions. The Group’s<br />

exposure to credit risk is limited and is not significantly concentrated<br />

on any given counterpart.<br />

3. Specific clauses<br />

The Group met the thresholds set by the banks under the syndicated<br />

loan agreement, requiring a ratio of net debt to EBITDA of 6.75 and<br />

ratio of EBITDA to financing costs of 2.25.<br />

NOTE 19 Interest rate and foreign exchange derivatives<br />

1. Interest rate derivatives<br />

In euro million<br />

Notional amount of contracts<br />

< 1 year 1 to 5 years > 5 years Total<br />

Market value<br />

Interest rate swaps – borrower floating rate - - - - -<br />

Interest rate swaps – borrower fixed rate - 3,153 - 3,153 (167)<br />

Purchases of caps 354 - - 354 -<br />

Collars (Buy Caps-Sell Floors) 1,132 1,458 - 2,590 (85)<br />

LENDER FIXED-RATE CROSS CURRENCY SWAPS €/£ - 1,031 - 1,031 (188)<br />

The notional amount of these contracts is the nominal value of the<br />

contracts. Notional amounts denominated in foreign currencies are<br />

translated into euros at year-end rates. Estimated values are based<br />

on information available on the financial markets and valuation<br />

methods appropriate to the type of financial instrument concerned.<br />

These valuation methods were subjected to a dedicated review during<br />

the year and found to yield results consistent with the valuations<br />

provided by bank counterparts.<br />

2. Foreign exchange hedges on foreign<br />

currency denominated debt<br />

The Group uses currency swaps in the context of its cash pooling<br />

operations. These financial instruments have an average duration of<br />

one and a half month and do not have a significant market value.<br />

3. Foreign exchange hedges on foreign<br />

currency denominated transactions<br />

The Group primarily uses forward contracts to hedge against currency<br />

risks related to transactions recognised on its balance sheet.<br />

I REFERENCE DOCUMENT 2008/2009 I