You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INDUSTRY OVERVIEWS<br />

YP Loke<br />

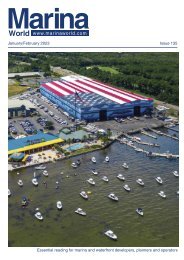

The Suntex <strong>Marina</strong> Investors portfolio, a constantly expanding US-based marina chain,<br />

purchased 600-slip Hurricane <strong>Marina</strong> in Silver Point, Tennessee earlier this year.<br />

marina business itself did not suffer<br />

as much and fell about 20% all over<br />

the continent and islands (Azores and<br />

Madeira).<br />

During the last two years we<br />

have seen incredible growth in the<br />

market, along with a boom in the<br />

country’s economy, mainly due to<br />

high performance in tourism and the<br />

property market.<br />

<strong>Marina</strong> occupancy levels are back<br />

to the record year of 2008 but this has<br />

only been possible as most customers<br />

come from outside Portugal. UK,<br />

German and Dutch boaters are pushing<br />

the Portuguese marinas back to high<br />

occupancy.<br />

All over the country there has been<br />

a phenomenal growth in what is called<br />

‘maritime-touristic activity’, which<br />

is basically the charter business of<br />

skippered daily trips. The beautiful<br />

coastal areas, natural sanctuaries<br />

and river estuaries are a must-see<br />

for tourists. This new market is now<br />

responsible for more than 10% of<br />

occupancy at most marinas in the<br />

country. At some locations it rises<br />

to 15-20% and marinas are already<br />

restricting the number of boats<br />

authorised for day trip activity.<br />

The outlook of the Portuguese<br />

market is now very positive but needs<br />

some ‘grow boating’ initiatives in order<br />

to bring the Portuguese back onto the<br />

ocean.<br />

Martinho Fortunato CMM<br />

SOUTH EAST ASIA<br />

The boating scene in South East<br />

Asia is relatively young. The first<br />

walk-on walk-off pontoon style<br />

marina, Raffles <strong>Marina</strong> in Singapore,<br />

opened for business barely 25<br />

years ago. Today, there is a network<br />

of over 50 marinas strewn across<br />

Southeast Asia. It has not all been<br />

smooth sailing. The Asia Financial<br />

Crisis (1997) and SARS epidemic<br />

(2003), two catastrophic upheavals,<br />

rocked the industry. The damage<br />

from the Indian Ocean Tsunami<br />

(2004), although costly in terms of<br />

lives lost, was more muted where<br />

infrastructure was concerned and<br />

felt mainly in the islands of Langkawi<br />

and Phuket.<br />

In spite of these setbacks, marinas<br />

and boating have flourished on the back<br />

of relatively strong economic growth in<br />

the region. But in common with most<br />

developing markets, the growth of the<br />

boating population has lagged behind<br />

berth supply and consequently the<br />

fortunes of marina developers have<br />

been mixed. The bright spots have<br />

always been Singapore and Phuket.<br />

Singapore because of its concentration<br />

of wealth, connectivity, infrastructure<br />

and security, and Phuket because of its<br />

cruising hinterland, laid back ambience<br />

and renowned Thai hospitality. The Gulf<br />

of Thailand on the eastern seaboard<br />

is a rising star. Ocean <strong>Marina</strong> close to<br />

Pattaya was the only marina for many<br />

years, but now several planned marina<br />

developments are in the offing.<br />

But the biggest rising star – a<br />

supernova in the making – is Indonesia.<br />

This archipelagic nation of 17,000+<br />

islands was difficult to access until a<br />

policy change instituted by the Jokowi<br />

Government that came into power<br />

in 2014. The so-called tilt towards<br />

a maritime axis focused national<br />

development on the maritime sector,<br />

of which recreational yachting is part.<br />

Legislation has been passed easing<br />

visa requirements and waiving the<br />

requirement for sailing permits or<br />

financial bonds. Boat taxation remains<br />

high and few Indonesians own boats.<br />

Whether yachting tourism alone<br />

can sustain marina development<br />

remains to be seen but several marina<br />

developments have been announced,<br />

mostly on the back of resorts and other<br />

real estate development.<br />

Although implementation of policy in<br />

a vast country like Indonesia will take<br />

time, it is a game changer not just for<br />

Indonesia but the region. Its awakening<br />

makes the region whole, and opens<br />

up the possibility to market the region<br />

as a single cruising destination (in the<br />

same way that the Mediterranean and<br />

Caribbean are single destinations).<br />

Malaysia has come through a political<br />

upheaval with Tun Mahathir upsetting<br />

the status quo with a return to power.<br />

Under his watch in the previous<br />

premiership, many marinas were<br />

developed (not all successful). Whether<br />

nautical tourism will feature in the new<br />

government’s economic agenda is left<br />

to be seen. In recent years a number of<br />

private marinas have been built close<br />

to the Singapore border, catering to the<br />

overspill from the city state.<br />

The Philippines has not been on the<br />

boating radar in spite of its appealing<br />

archipelagic geography (it has 7,000+<br />

islands). Boat taxation remains high. As<br />

38<br />

www.marinaworld.com - <strong>November</strong>/<strong>December</strong> <strong>2018</strong>